Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The amount of initial investment is $ 20,500 and estimated annual returns is 5000 each years totally 6 years. The cost of capital is 11%. Question 2 Let's define some variables to help us solve this problem: Let O be the event that Luffy receives an offer Let G be the event that Luffy has a good interview

Typology: Exercises

1 / 8

This page cannot be seen from the preview

Don't miss anything!

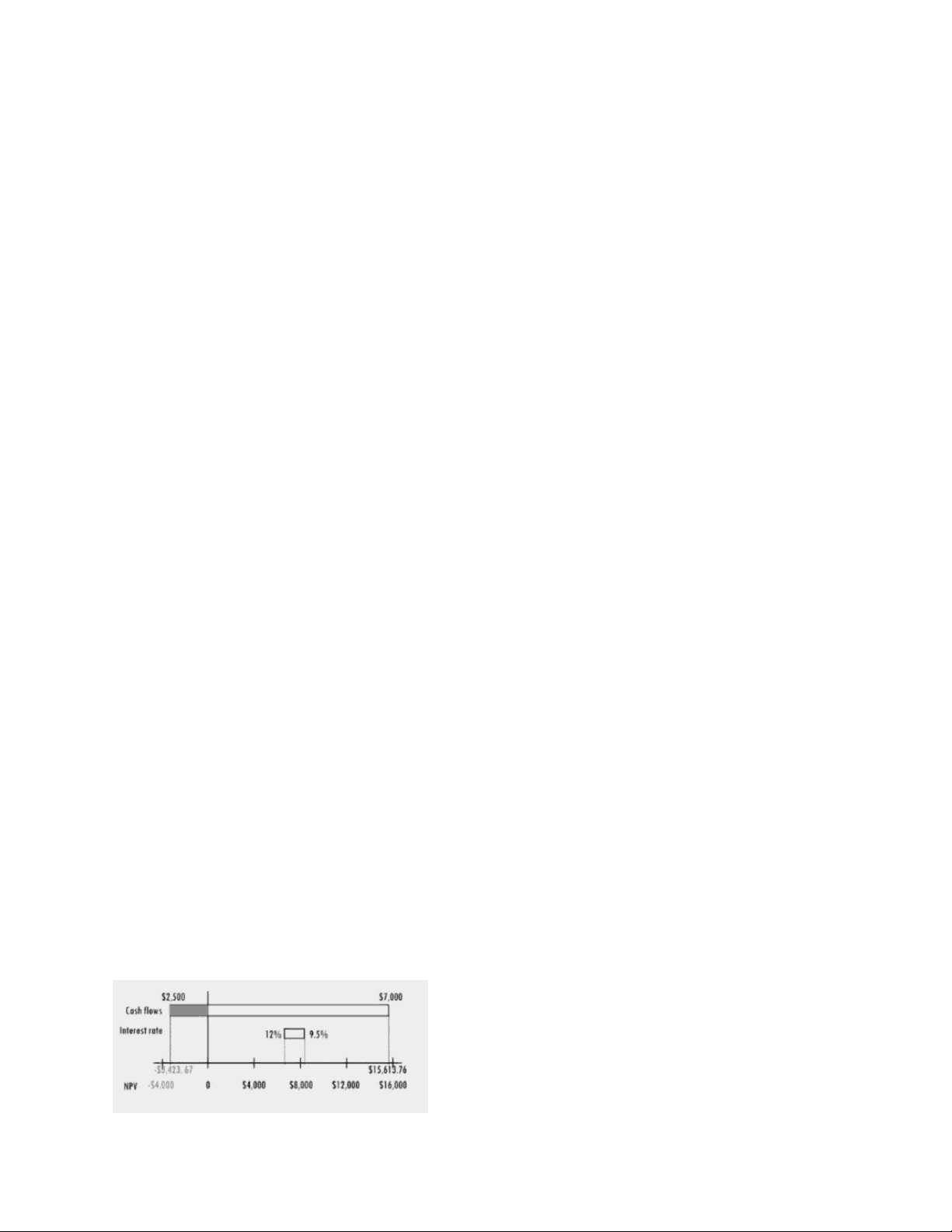

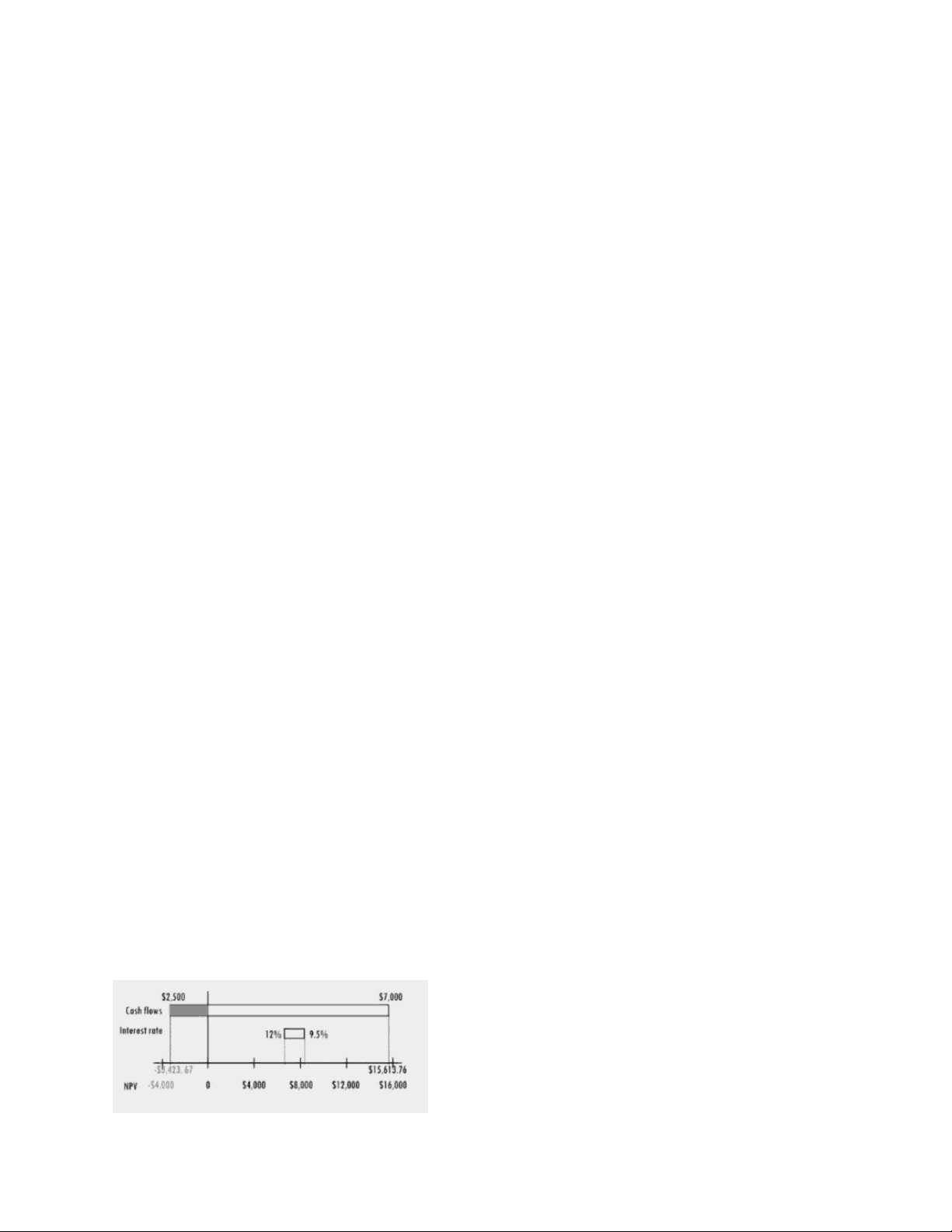

Question 1 a) The amount of initial investment is $ 20,500 and estimated annual returns is 5000 each years totally 6 years. The cost of capital is 11%. NPV is calculated below NPV = -P + A(P/A,I,n) =20,500 + 5000 ((1+i)n^ -1) /i(1+i)n = (^) 20,500 +5000 (1+0.1) 6 / 0.1 (1 + 0.1) 6 = 20,500 + 5000 (0.8704 / 0.2057) =7157. NPV = X0 + X1/(1+R)1 + X2 / (1+R)2 +....+X6/(1+R) X0 = -$14, VARIABLE BASE VALUE LOWER BOUND UPPER BOUND cash flow $5000 $2500 $ interest rate 11% 9.5% 12% X1 = X2 = .....X6= $5000 and r=11%, NPV =$7,152. X1 = X2 = .....X6= $2500 and r=11%, NPV =$-3423. X1 = X2 = .....X6= $7000 and r=11%, NPV =$15,613. X1 = X2 = .....X6= $5000 and r=9.5%, NPV =$8,099. X1 = X2 = .....X6= $5000 and r=12%, NPV =$6,557. In this project gives positive sense so it is highly acceptable Tornado Diagram

b) As we can see from the study above, interest rates are less sensitive than future cash flow changes, but these changes still have a fairly broad range, which lowers project NPV. In order to get a better and more precise estimate of NPV, research must be done on the probabilities of such verified future cash information. Question 2 Let's define some variables to help us solve this problem: Let O be the event that Luffy receives an offer Let G be the event that Luffy has a good interview From the information given, we can calculate the following probabilities: P(G|O) = 0.92 (the probability that a person has a good interview given that they received an offer) P(G|not O) = 0.62 (the probability that a person has a good interview given that they did not receive an offer) P(O) = 0.70 (Luffy's prior belief about the probability of receiving an offer) Using Bayes' Theorem, we can calculate the probability that Luffy has a good interview: P(G) = P(G|O) * P(O) + P(G|not O) * (1 - P(O)) And the probability that Luffy has a bad interview: P(not G) = 1 - P(G) The probability that Luffy receives an offer given that he had a good interview is: P(O|G) = P(G|O) * P(O) / P(G) And the probability that Luffy receives an offer given that he had a bad interview is: P(O|not G) = P(G|not O) * P(O) / P(not G) Using the values we found above: P(G) = 0.92 * 0.70 + 0.62 * (1 - 0.70) = 0. P(not G) = 1 - 0.764 = 0.

long-term financial aspirations. It is essential to get a mortgage that is both reliable and affordable in order to guarantee that one can continue to make payments over the course of a longer length of time. It is crucial to consider the likelihood of producing money over a longer period of time because this might significantly affect the acquisition's overall cost. In addition to considering financial aspects, it's critical to consider the lifestyle objectives you wish to attain. This entails looking for a property that, among other things, fits one's lifestyle in terms of the desired location, facilities, schools, and commuting possibilities. It is crucial to consider the sense of community that is connected to the purchase since this aspect might affect someone's overall degree of satisfaction with the decision. Once the fundamental objectives have been determined, means objectives can be identified. To get a mortgage that is both reliable and cheap, one must first determine their financial situation, weigh their mortgage possibilities, look into any potential tax benefits, and investigate the regional real estate market. To ensure that the desired lifestyle can be maintained, one must choose the ideal location, evaluate the facilities around, check into the local educational prospects, and consider the various transit alternatives. The methods objectives network and the basic objectives hierarchy are connected by the many goals that must be achieved. For instance, if someone wants to discover a place that suits their lifestyle, they should research the local schools, consider their alternatives for transportation, and evaluate the facilities. To get a mortgage that is both steady and cheap, one must compare the various mortgage kinds, investigate the numerous tax advantages and incentives that are available, and examine the situation of the real estate market right now. It is important to carefully analyses a variety of aspects and goals when deciding whether to buy a house or an apartment. In order to make sure that the best decision is made and that one is happy with the purchase they make, it might be good to establish a means objectives network and a hierarchy of primary objectives. By taking the time to think through every element of the purchase, one can ensure that they are making an informed choice that will be profitable to them in the long term. Long-term financial savings are possible thanks to this. Question 4 Omega Consulting, a consulting company, is thinking of providing a data analysis service. The company may make a net profit of $80,000 if there is a significant demand for the service (i.e., a healthy market). They might lose $35,000 if the market is unfavorable. Additionally, they are not required to continue, in which case there is no fee. The firm's best estimation assumes that there is a 70-30 possibility of substantial demand in the absence of any market data. a.

Option 2 3 6 (0.45) 5 (0.25) We would figure out the expected monetary value (EMV) for each chance node in order to solve the decision tree manually. The weighted average of the potential outcomes, where the weight reflects the likelihood that each scenario will occur, is used to get the expected maximum value (EMV) of a chance node. For instance, the following formula might be used to determine probability node 1's EMV: EMV = 0.7 * 14 + 0.3 * - = 9. The following formula would be used to determine probability node 2's EMV EMV = 0.3 * 6 + 0.3 * - = 0 The EMV of each decision node is then determined by adding the EMVs of its chance nodes. The EMV of decision node Opt 1, for instance, would be determined as follows: EMV = 0.85 * 8 + 0.15 * 9. Question 6 You may improve the model in Precision Tree by adding a new chance node for the sales value and linking it to the final decision node in order to do a one-way sensitivity analysis for the anticipated sales in the favourable market scenario. You may adjust the expected sales value from 350 to 950 in increments of 50 and recalculate the expected monetary value (EMV) for each scenario to examine the decision's sensitivity. For each circumstance, you may apply the following formula to get the EMV:

EMV = (Probability of Favorable Market * Expected Sales * Gross Margin) - (Fixed Cost + Cost of Research) where the cost of research is already known to be $100,000 and gross margin is equal to sales value less variable costs. B) You may include an additional chance node and connect it to the final choice node in the model to do a sensitivity analysis for the likelihood that the market will be favorable. Then, recalculate the EMV for each scenario by changing the chance of the favorable market from 20% to 90% in steps of 10%. The revised probability value for the advantageous market may be used in the same manner as above to get the EMV for each scenario. In order to test whether Allison Tate's choice is affected by the likelihood of a favorable market, sensitivity analysis will illustrate how the EMV varies as the probability of such a market changes.