Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The Accounting Equation; Rule of Debit and Credit; Business transactions.pdf

Typology: Lecture notes

1 / 3

This page cannot be seen from the preview

Don't miss anything!

Bachelor of Science in Office Administration Principles of Accounting I The Accounting Equation The accounting equation is the most basic tool of accounting. This equation represents the resources controlled by the enterprise, the present obligations of the enterprise and the residual interest in the assets. It states that assets must always equal liabilities and owner’s equity.

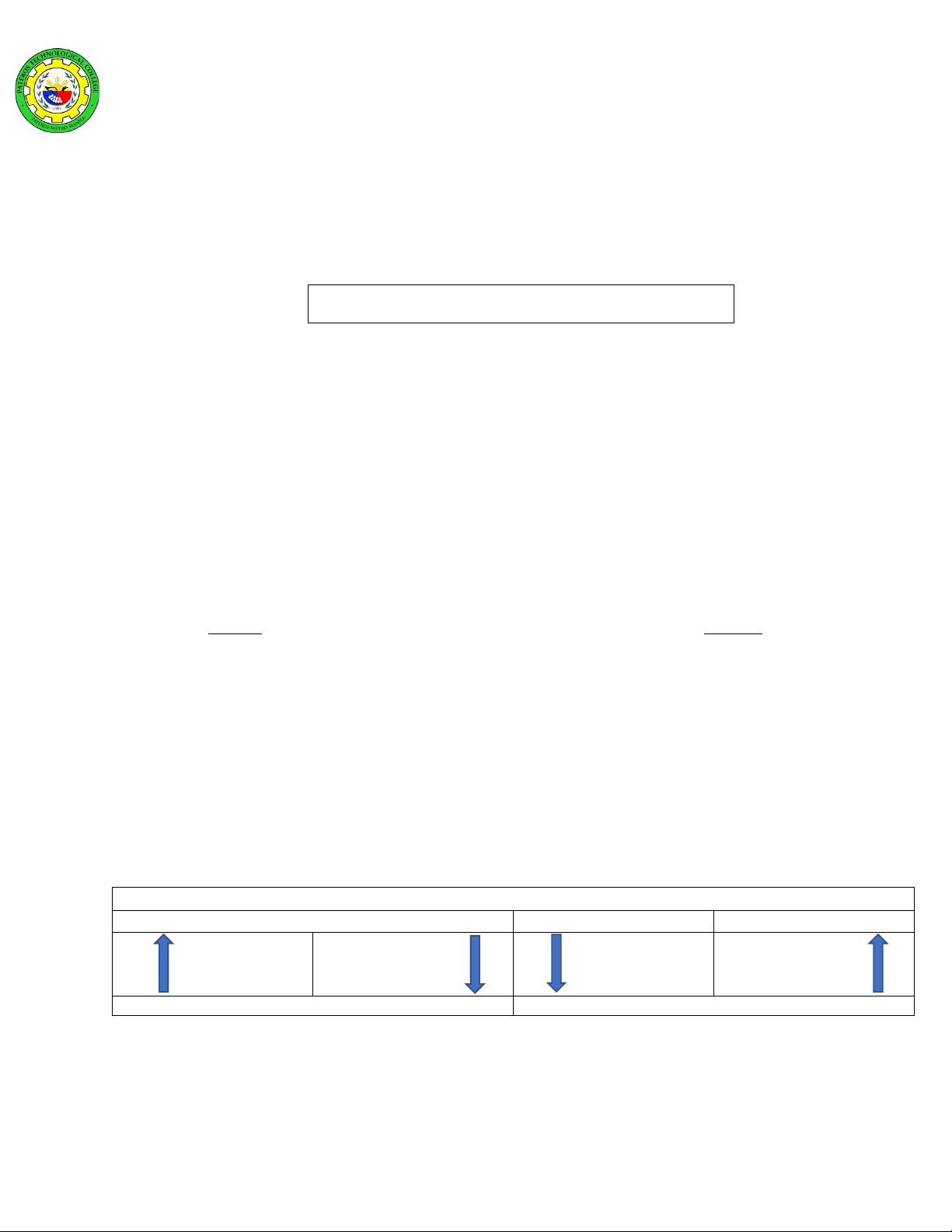

Note that the assets are on the left side of the equation opposite the liabilities and owner’s equity. This explains why increases and decreases in assets are recorded in the opposite manner (“mirror image”) as liabilities and owner’s equity are recorded. The equation also explains why liabilities and owner’s equity follow the same rules of debit and credit. The logic of debiting and crediting is related to the accounting equation. Transactions may require additions to both sides (left and right sides), subtractions from both sides, or an addition and subtraction on the same side, but in all cases the equality must be maintained. Debits and Credits – The Double-Entry System Accounting is based on a double-entry system which means that the dual effects of a business transaction is recorded. A debit side entry must have a corresponding credit side entry. An account is debited when an amount is entered on the left side of the account and credited when an amount is entered on the right side. The abbreviations for debit and credit are “Dr” from the Latin Debere and “Cr” from Latin Credere , respectively. The account type determines how increases or decreases in it are recorded. Increases in assets are recorded as debits while decreases in assets are recorded as credit. Conversely, increases in liabilities and owner’s equity are recorded by credits and decreases are entered as debits. The rules of debit and credit for income and expense accounts are based on the relationship of these accounts to owner’s equity. Income increases owner’s equity and expense decreases owner’s equity. Hence, increases in income are recorded as credits and decreases as debits. Increases in expenses are recorded as debits and decreases as credits. These are the rules of debit and credit.

Assets Liabilities Owner’s Equity Debit Credit Debit Credit (+) (-) (-) (+) Increases Decreases Decreases Increases Normal balance Normal balance

Bachelor of Science in Office Administration Principles of Accounting I Debits and Credits – The Double-Entry System (Continued)

Debit for decreases in owner’s equity Expenses Credit for increases in owner’s equity Income Debit Credit Debit Credit (+) (-) (-) (+) Increases Decreases Decreases Increases Normal balance Normal balance Normal Balance of Account The normal balance of any account refers to the side of the account- debit or credit- where increases are recorded. Assets, owner’s withdrawal and expense accounts normally have debit balances. Liabilities, owner’s equity and income accounts normally have credit balances. This result occurs because increases in an account are usually greater than or equal to decreases. Increases Recorded by Normal Balance Account Category Debit Credit Debit Credit Assets ∕ ∕ Liabilities ∕ ∕ Owner’s Equity: Owner’s Capital ∕ ∕ Withdrawals ∕ ∕ Income ∕ ∕ Expenses ∕ ∕ Accounting Events and Transactions An accounting event is an economic occurrence that causes changes in an enterprise’s assets, liabilities, and/or equity. Events may be internal actions such as the use of equipment for production of goods or services. It can also be external event such as the purchase of raw materials from supplier. A transaction is a particular kind of event that involves the transfer of something of value between two entities. Examples of transactions include acquiring assets from owner(s), borrowing funds from creditors, and purchasing or selling goods and services. Types and Effects of Transactions It will be beneficial to be able to understand a classification approach that emphasizes the effects of accounting events rather than the recording procedures involved. All transactions can be classified into one of four types, namely; a. Source of Assets (SA) – An asset account increases and the corresponding claims (liabilities or owner’s equity) account increases. Examples: Purchase of supplies on account; Sold of goods on cash on delivery basis. b. Exchange of Assets (EA) – One asset account increases and other asset account decreases. Example: Acquired equipment for cash.