Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Selcuk University - Neba Wais Alqorni - General Accounting (Week 1,2,3,4,5)

Typology: Assignments

1 / 22

This page cannot be seen from the preview

Don't miss anything!

2019 - 2020 SPRING SEMESTER Prof. Dr. Halim SÖZBİLİR Arş. Gör. Halenur Yılmaz

*9 APRIL Week of the Midterm Exam

We have already illustrated the effects of transactions on the basic accounting equation on the statement of financial position by considering particularly the two components of the equation; assets and liabilities. Here, we are going to take a closer look at the third component of the equation; OWNERS’ EQUITY. As stated previously, the owner’s interest in business, owners’ equity item is a residual amount (Assets- liabilities=Owners’ Equity) and thus it is also called net assets. Owners ’ equity is increased by owners’ investments and revenues. It is decreased by expenses. 2 APRIL 4

Revenues are the gross increase in owners’ equity resulting from business activities. Revenues and income are often mistakenly thought of as synonymous. Yet, expenses must be deducted from revenues to reach the net income. Revenues are the top line, which is gross amount of earnings, income is the bottom line. Expenses are the cost of assets consumed or services used in the process of earning revenue. When revenues exceed expenses, net income results, and as a matter of fact, owners’ equity increases. Conversely, a net loss occurs when expenses exceed revenues. Accordingly, owners’ equity decreases. This relationship is below: 5 Net Income (Net Loss) Revenues Expenses 2 APRIL

Paid-in capital is the amount the stockholders have invested in the corporation. The basic component of paid-in capital is common stock, which the corporation issues to the stockholders as evidence of their ownership. All corporations have common stock. Retained earnings is the amount earned by income-producing activities and kept for use in the business. Three major types of transactions affect retained earnings: revenues, expenses, and dividends. Dividends decrease retained earnings, because they are distributions to stockholders of assets (usually cash) generated by operating activities. A successful business may pay dividends to shareholders as a return on their investments. Remember: dividends are not expenses. Dividends never affect net income. Instead of being subtracted from revenues to compute net income, dividends are recorded as direct reductions of retained earnings.

Businesses strive for profits, the excess of revenues over expenses. When total revenues exceed total expenses, the result is called net income, net earnings, or net profit. When total expenses exceed total revenues, the result is a net loss. Net income or net loss is the “bottom line” on an income statement.

Revenues contribute to net income, and net income is added to retained earnings (don’t forget that it’s a part of owners equity). The basic accounting equation can be expanded as following. Like the basic equation, the expanded basic equation also always stays in balance. 10 Assets Liabilities Owners' Equity Revenues Expenses In summary, when revenues are earned, owners’ equity is increased. On the other hand, when the expenses incur, the owners’ equity is decreased.

Transaction 9. Let’s say, A) On June 19 , M. Karahan Co. earned 1 , 500 TL revenues from a customer, the company did work for a customer in exchange of cash (repair service). B) Later on the same day, the company paid its electricity bill for 500 TL. M. Karahan Company, The Statement of Financial Position June 1 9 , 2011 Assets Liabilities + Owners’ Equity Cash Banks Customers Merchandise Equipment

Liabilities:

Total Assets 52.000 Total L+OE 52. As you can get it easily from the transactions: Revenues=1.500 TL; Expenses=500 TL, Net Income=1,000 TL Let’s recall again that the equality of equation is never upset. Asset item cash is increased by the amount of 1,000 TL , and owners’ equity on the right side of the statement of financial position is also increased by the same amount. Total assets are still equal to total liabilities plus owners’ equity. The statement of financial position will be as follows: *: Owners ’ Equity is increased by owners’ investments and revenues. Accountants often use the term capital to designate owners’ investments in the business. As you see from the statement that the equality of the equation has never been disturbed by any transactions and events.

13

2 APRIL

2 APRIL

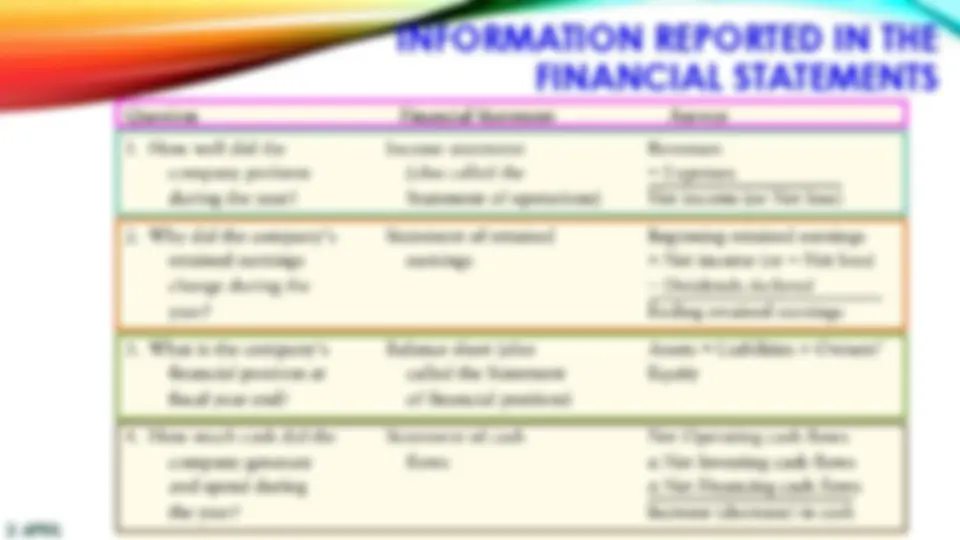

Income statement represents only the revenues and expenses in summary that incurred in the business during a period of time ( the accounting period). The decision makers particularly investors are interested in this financial statement because the profitability of the company attracts the investors. As mentioned previously, the difference between revenues generated and expenses incurred is identified as net income (or net loss). As long as the revenues exceed the expenses from profit seeking operations of the business net income is obtained; when the expenses exceed the revenues, net loss results in. 16 In accounting, the word net refers to an amount after a subtraction. Net income is the profit left over after subtracting expenses and losses from revenues and gains. Net income is the single most important item in the financial statements.

As we have learned earlier, statement of financial position (balance sheet) shows the impact of all transactions on business up to a specific point in time cumulatively. In other words, this statement indicates the financial position of a business as of a certain date of time (a specific date). Statement of financial position can be prepared in two formats: Account format lists the assets on left side, liabilities on right side (see the previous examples of it), and reporting format comprises of assets first, and then liabilities and owners’ equity at the end reported vertically in one column. 17 2 APRIL

Statement of cash flows gives the information to decision makers about cash flow in and out for the year. It reveals the cash generated and expended in business activities during a period of time. 19 2 APRIL

This statement consists of three sections: A) Operating Activities, B) Investing Activities, and C) Financing Activities.

Accountants must prepare the financial statements by behaving entirely in ethical fashion. Each one of the users of the financial statements has the right to expect accountants to behave in a completely trustworthy and ethical behavior in terms of their interests. 20 2 APRIL