Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

B. Short-term ib (unreasonable) (2cf)

Typology: Summaries

1 / 7

This page cannot be seen from the preview

Don't miss anything!

✓ ✓ ✓ ✓ ✓ ✓ ✓

SCI

(±) APPROPRiATED UNAPPROPRiATED RESTRiCTED UNRESTRiCTED

Balance sheet perspective

Cash received from customers xx Cash paid to suppliers (xx) Cash paid to operating expenses (xx) Separately presented: Interest paid (xx) Income tax paid (xx) Net cash provided (used) OA xx

Income before tax

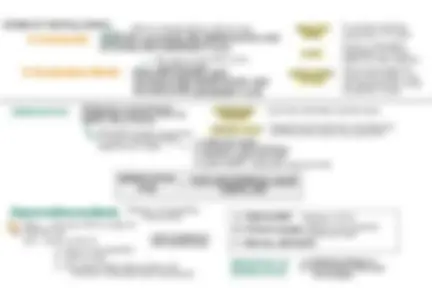

A. Cost model B. Revaluation Model REVALUED AMOUNT LESS

BASiS

ASSETS WiTHiN A CLASS

SYSTEMATiC ALLOCATiON OF DEPRECiABLE AMOUNT OVER THE USEFUL LiFE OF THE PPE DEPRECiABLE Cost less estimated residual value AMOUNT Expected proceeds from the disposal Expected number of periods^ RESiDUAL VALUE of PPE at the end of its useful life. or output that the PPE is usable by an entity.

B. TECHNiCAL OBSOLESCENCE C. PHYSiCAL WEAR AND TEAR D. LEGAL LiMiTS (^) Leasehold improvements

Depreciation methods (^) A. TiME-BASED Manner of computing depreciation

Start - when the PPE is ready for intended use End - earlier of the ff: a. Date of derecognition b. Held for sale c. Fully depreciated (depreciation will continue if Residual value decreases) LAND iS NORMALLY NON-DEPRECiABLE Passage of time Based on the quantity produced/used

B. CAPiTALiZED iN THE COST OF AN ASSET 0

Time-based (PASSAGE OF TiME)

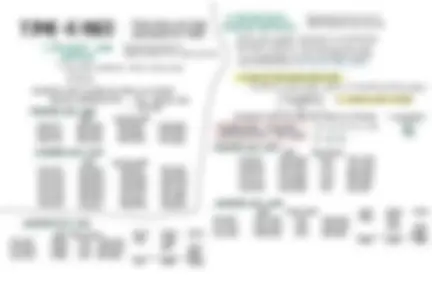

ANNUAL DEPRECiATiON = (1M - 100K)/5 YRS = 180, DEP ACCUM DEP 12/31/21 180,000 180,000 820, 12/31/22 180,000 360,000 640, 12/31/23 180,000 540,000 (^) 460, ACQUiRED JULY 1, 2021 DEP ACCUM DEP 12/31/21 90,000 90,000 910, 12/31/22 180,000 270,000 730, 12/31/23 180,000 450,000 550, 12/31/24 180,000 630,000 370, 12/31/25 180,000 810,000 190, 12/31/26 90,000 900,000 100,

ACQUiRED OCT 1, 2021

N = USEFUL LiFE iN YEARS EXAMPLE: COST 1M, RES VAL 100K, UL 5 YEARS = [ 5 X (5+1) ] 5 + 4 + 3 + 2 + 1 = 15 2 NUMERATOR > CHANGES DENOMiNATOR > THE SAME = 15 Y1 Y2 Y DEP FRACTiON 12/31/21 900,000 5/15 300, 12/31/22 900,000 4/15 240, 12/31/23 900,000 3/15 180, 12/31/24 900,000 2/15 120, 12/31/25 900,000 1/15 60, ACQUiRED JULY 1, 2021 ACQUiRED JAN 1, 2021 DEP FRACTiON 12/31/21 900,000 5/15 300, 12/31/22 900,000 4/15 240, 12/31/23 900,000 3/15 180,

DEP FRACTiON 12/31/21 900K 5/15 300, 12/31/22 900K 4/15 240, 12/31/23 900K 3/15 180,

ACQUiRED JAN 1, 2021 .

Special depreciation methods

E. ADDiTiONAL ASSET - REViSE THE DEPRECiATiON RATE F. COMPOSiTE LiFE - TOTAL DEPRECiABLE AMT ANNUAL DEPRECiATiON

SALE OF PPE C: NO GAiN OR LOSS

A. PER ASSET BASiS - COMPUTE FOR ANNUAL DEPRECiATiON B. TOTAL THE ANNUAL DEPRECiATiON COMPUTED iN A PER ASSET BASiS C. COMPUTE FOR THE DEPRECiATiON RATE: D. DEPRECiATiON CHARGE =

TOTAL ANNUAL DEPRECiATiON TOTAL COST OF ASSETS iN THE GROUP DEPRECiATiON RATE X TOTAL COST OF THE GROUP