Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

An analysis of the sugar industry in vietnam, focusing on the impact of anti-dumping duties on imported sugar from thailand and other asean countries. It discusses the changes in sugarcane cultivation area, domestic and imported sugar prices, and the company qns's strategies for future growth. The document also includes financial data, risk analysis, and a swot analysis.

Typology: Lab Reports

1 / 17

This page cannot be seen from the preview

Don't miss anything!

Ownership and material conflicts of interest The author(s), or a member of their household, of this report does not hold a financial interest in the securities of this company. The author(s), or a member of their household, of this report does not know of the existence of any conflicts of interest that might bias the content or publication of this report. Receipt of compensation Compensation of the author(s) of this report is not based on investment banking revenue. Position as an officer or a director The author(s), or a member of their household, does not serve as an officer, director, or advisory board member of the subject company. Market making The author(s) does not act as a market maker in the subject company’s securities. Disclaimer The information set forth herein has been obtained or derived from sources generally available to the public and believed by the author(s) to be reliable, but the author(s) does not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decisions by any person or entity. This information does not constitute investment advice, nor is it an offer or a solicitation of an offer to buy or sell any security. INVESTMENT SUMMARY REPORT AUTHOR: BUI PHU QUANG Class: English 02- High Quality Program for International Business Economics - K CFA Research Challenge: Team FTU Application

01 st September 2023. From our perspective, favorable conditions of Sugar sector and sustainable growth of Soy milk businesses hold the key to unlock QNS potentials.

Vietnam reduced the import tariff on sugar from ASEAN countries to merely 0 - 5 % ( 2020 ). This transformation in policy had a significant effect on the Vietnamese sugar market. With the influx of sugar at competitive prices, domestic sugar producers were thrust into a fierce competition. In 2020 , the total amount of sugar imported by Vietnam increased sharply, reaching 1 , 589 million tons, an increase of nearly 4. 4 times compared to the amount imported in 2019. (ii) This increased competition resulted in the closure of 17 of the country's 41 sugar factories , as they were unable to compete with sugar imported from Thailand and other ASEAN nations. The total area of sugarcane cultivation in the 2020 / 2021 crop is 152. 9 thousand hectares, - 16. 27 % compared to the 2019 / 2020 crop.

of dumping practices in the importation of sugar from Thailand and other ASEAN countries, the Ministry of Industry and Trade issued a formal decision to implement anti-dumping duties, ranging from 42. 55 - 47. 64 %, on sugar products imported from Thailand and other ASEAN members****. After the imposition of anti-dumping taxes, the price of sugar imported from Thailand and Thai-origin is notably higher than the average price of sugar in Vietnam, which ranges from 10 - 15 % lower. This measure began to have a protective effect on the domestic sugar industry from Q 3 / 2022 onwards. The total sugar import volume for the entire year of 2022 witnessed a substantial - 12. 6 % YoY. (ii) Opportunities persist for Sugar enterprises that have weathered challenges****. Currently, domestic sugar production only fulfills about 40 % of the nation's demand (VSSA). The author holds the belief that the near future will present a chance to raise the selling price and increase sugar output for QNS.

( 1 ) Pricing benefit from global sugar outlook. (i) The hot and dry weather, brought about by El Nino, has significantly diminished sugarcane yields for sugar-exporting countries in both Asia and Europe during the 2022 - 2023 crop year. The Indian government has decided to ban sugar exports for the next crop year, which starts from October 2023. USDA forecast sugar inventories worldwide will decrease 13 % YoY in the crop year 2022 / 2023 and put pressure on sugar prices to stay at high level. (ii) As the stockpile of affordable sugar in the first quarter of 2023 gradually depleted, the domestic sugar price began to respond to the fluctuations in global sugar prices during the second quarter of 2023. ( 2 ) Constantly developing sugarcane farming areas. (i) In the 2022 - 2023 crop year, QNS has seen a significant increase in its sugarcane cultivation area, surpassing 25 , 000 hectares , marking a 20 % year-on-year growth. This expansion can be attributed to favorable conditions for cultivation in Gia Lai province, resulting in robust profit projections for this year's sugar cane harvest, as reported by the forecasters. (ii) Positive outcome has prompted management to formulate plans to further expand the total sugarcane cultivation area across the region to 30 , 000 hectares by the 2024 - 2025 harvest. This strategic move positions QNS to capitalize on the forthcoming opportunities within the sugar industry.

The soy milk segment will remain a stable cornerstone in the company's business model. (i) Ongoing innovation and expansion of the product lines within the soy milk brand will contribute to QNS's ability to sustain its market position. (ii) QNS has a chance to expand its soy milk into the international market , being among the Top 5 soy milk producers worldwide. Table 1 : Market profile

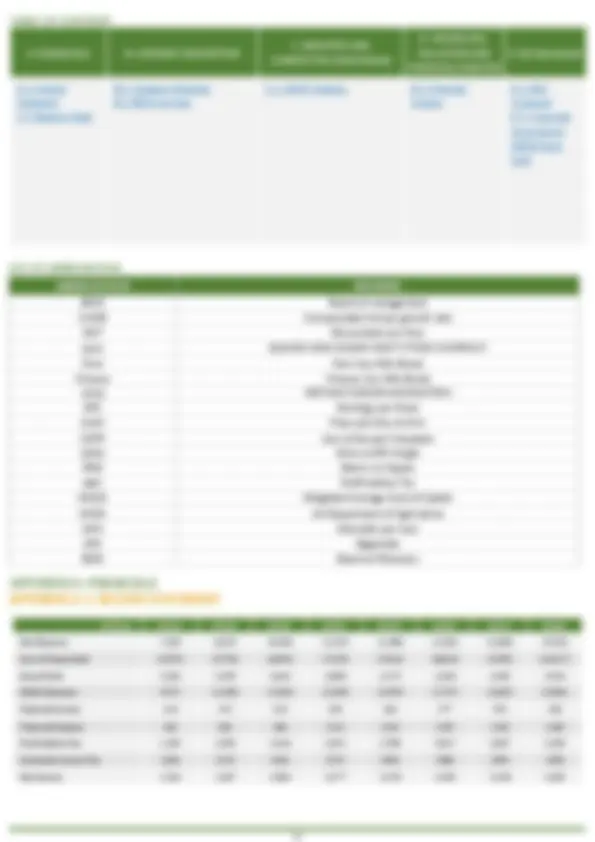

Table 2 : Key financial metrics MARKET PROFILE Date 01 /^09 /202 3 Current price (VND) 50, Sector (^) BeverageFood & Ticker QNS Stock Exchange UPCOM Market Cap (bil VND) 17, Share Outstanding (mn) 356. Free Float Shares (mn) 356. RECOMMENDATION: BUY Method Weight (^) (VND)Price DCF (FCFF) 50% 84, Multiple (Relative P/E) 50%^ 81, Target Price 83, Upside 66% Source: GEX, Team Estimates **40.

1150 1170 1190 1210 1230 1250** 7/31/2023 8/7/2023 8/14/2023 8/21/2023 8/28/ VNINDEX (LHS) Table 2: Valuation method Billion VND 2021A 2022A 2023F 2024F 2025F 2026F 2027F 2028F Revenue (VND bil) 7,335 8,255 11,050 12,342 12,638 14,018 14,711 16, EPS (VND/share) 3,512 3,605 5,839 6,379 6,659 6,749 6,802 7, EPS growth 19% 3% 62% 9% 4% 1% 1% 9% EBITDA margin (%) 24% 25% 28% 27% 28% 25% 24% 23% Net Profit Margin (%) 17% 16% 20% 20% 20% 18% 18% 17% ROE (%) 18% 18% 27% 27% 26% 25% 23% 24% Figure 1: Share price performance

While it's true that Vinasoy is actively cultivating material areas in four regions across the country, namely the North, Central, Central Highlands, and Mekong Delta, the business still relies on approximately 10 - 15 % of imported soybeans from Canada. Recognizing the inherent risks associated with a product prone to genetic mutations like soybeans, QNS acknowledges the significance of achieving complete self-sufficiency in domestic input materials to mitigate potential input-related risks. Consequently, QNS has proactively engaged in comprehensive collaboration with farmers. This entails providing quality seeds, offering agricultural technical support, and ensuring the entire product range meets stringent quality standards while maintaining competitive prices, thereby guaranteeing profitability for farmers.

Following the completion of the investment project to expand the An Khe sugar factory's capacity to 18 , 000 tons per day, securing an adequate supply of raw sugarcane material becomes a pivotal concern for QNS's sugar business. Although QNS is granted a quota to buy imported raw sugar, the vision of management team will still focus on developing QNS's sugarcane growing area to 40 , 000 - 50 , 000 hectares to have the ability to be autonomous in raw material sources in the future. In the writer's opinion, this is possible thanks to (i) The Gia Lai region offers ample land resources to accommodate QNS's ambitious expansion plans. (ii) The enterprise has consistently raised the purchase price of sugarcane, fostering trust and confidence among farmers. During the 2022 / 2023 crop, QNS made a commitment to buy sugarcane from farmers at a price of 1. 05 billion VND/ton.

With an impressive market share of nearly 90 % in the domestic soy milk market, QNS's growth in the soy milk segment faces unique challenges due to the relatively saturated nature of the Vietnamese dairy market. Recognizing this, the company's leadership has been proactive in taking steps to introduce the Fami and Vinasoy brands to the international arena. The journey for Vinasoy to "venture into the vast sea" began in 2020 when the brand made its debut on 11 prominent e-commerce platforms in China. In 2021 , Vinasoy's soy milk made its way into Chinese and Japanese supermarkets, achieving extensive coverage across Japan, with nearly 1 , 000 Asian stores and supermarkets spanning 45 out of 47 provinces and cities.

As mentioned, the majority of An Khe factory's finished sugar products are distributed to manufacturing enterprises through B 2 B channels. However, QNS has recently undertaken a strategic expansion into the B 2 C retail channel by introducing convenient sugar bag product lines aimed at consumers. The retail initiative commenced in March 2023 , with QNS launching its packaged sugar under the "An Khe Sugar" brand through the Bach Hoa Xanh retail chain, which encompasses modern trade channels. Subsequently, in May 2023 , the company entered into collaborations with prominent retail chains including BigC, Coop, and Winmart to further promote and sell its sugar products through Vinasoy’s extensive distribution network. Source: Writer’s research Source: QNS

Figure 6 : Sugarcane harvest of QNS (thoundsand tons) Source: QNS, writer’s research

Figure 8 : Market share of canned soy milk products in Viet Nam

( 1 ) According to research conducted by AC Nielsen, Vietnam holds the distinction of having the 3 rd^ highest soy milk consumption rate in the world. (i) In Vietnam, soybeans have long enjoyed a special place in the hearts of consumers due to their nutritional value and health benefits. ( 2 ) While the demand for soy milk is substantial , it's worth noting that nearly 60 % of the soy milk production in the market is supplied by small-scale caterers****. (i) Only around 40 % of the canned soy milk products are offered by well-known brands such as Vinasoy, Vinamilk, and Nutifood , among others. (ii) Vinasoy, in particular, currently dominates the canned soy milk market in Vietnam with a market share of approximately 90 %. Quang Ngai Sugar (QNS) is following its own unique path in this market, diverging from the competition that exists among major players in the dairy industry, such as Vinamilk, TH True Milk, Dutch Lady, Friesland Campina, and Nutifood, who primarily focus on liquid and powdered milk products. (iii) In the realm of soy milk, Vinamilk and Nutifood are the primary contenders of Vinasoy , with each holding around 5 % of the market share per company. Figure 7 : Retail product of An Khe Sugar Factory Table 3: Soy milk production capacity of Vinasoy Factory Location Years of operation Capacity Vinasoy Quang Ngai 26 years 120 mil litres/year Vinasoy Bac Ninh 12 years 180 mil litres/year Vinasoy Binh Duong 07 years 90 mil litres/year Total capacity 390 mil litres/year 1600 0 200 400 600 800 1000 1200 1400 1600 1800 87% 4.70% 4.70% (^) 3.60% Vinasoy Vinamilk Nutifood Others Source: Euromonitor

( 1 ) The soy milk market is characterized by intense competition, with a significant presence of both regional small to medium-sized players and prominent global industry leaders. (i) Key players in this sector encompass Eden Food, The Hershey Company, Campbell Soup, Vitasoy International Holdings, and Kikkoman Pearl Soy Milk. (ii) Evolving consumer preferences are motivating manufacturers to introduce an array of new flavors to the market. This trend is fueling the growth of flavored soy milk varieties and, in turn, boosting overall consumption. ( 2 ) According to Persistence Market Research, the soy milk market is projected to achieve a Compound Annual Growth Rate (CAGR) of 9. 1 % between 2023 and 2033. (i) The Asia-Pacific region stands out as a rapidly expanding market, with countries like China, India, Japan, Korea, and Hong Kong emerging as significant consumers of soy milk. The availability of ample soybean resources in these nations is further propelling soy milk consumption in the region.

( 1 ) In Asia-Pacific, consumers are showing a growing interest in health-conscious, lactose- free, plant-based milk alternatives (Source: Mordor Intelligence). (i) The increasing prevalence of lactose intolerance and allergies is a primary driver behind the shift away from dairy products, especially in infants and young children, as indicated by food allergy statistics. (ii) Consumers are increasingly favoring products that are low in calories, devoid of artificial additives, and rich in protein, which is fueling the growth of the soy beverage market. Plant- based beverages containing various plant proteins or protein combinations are meeting the surging demand for a healthier lifestyle. SUGAR INDUSTRY

( 1 ) In 2023 , the global sugar supply is at risk of falling short due to various factors, including adverse weather conditions, the Russia-Ukraine conflict, and the increasing trend in ethanol production. production is predicted to experience a slight deficit of approximately - 0. 1 million tons in the 2023 / 2024 crop, with global supply estimated at around 178. 8 million tons compared to global consumption of approximately 178. 9 million tons (USDA). (i) Brazil, the world's largest su Global sugar gar producer, is actively encouraging greater ethanol production from sugarcane, especially given the rising oil prices due to OPEC's decision to reduce production. (ii) India, the second-largest sugar producer , is expected to see a nearly 3 % reduction in production for the period from October 2022 to September 2023 due to the impact of unseasonal rainfall. (iii) Thailand, the fourth-largest sugar producer in the world, is anticipated to experience a supply reduction of 2. 8 million tons compared to the same period, as farmers shift to cultivating cassava for ethanol production in response to the increasing oil prices. (iv) The Russia-Ukraine conflict has affected the sugar beet exports from these two nations, leading to a decrease in the forecasted sugar beet production. ( 2 ) As a result, in the short term, the sugar supply is expected to face shortages , keeping sugar prices high, approximately at $ 520 /ton in 2023 , marking a 25 % increase compared to the end of 2022. However, this supply deficit is considered temporary, and it is anticipated that sugar prices will decrease as global sugar supplies return to normal levels.

( 1 ) Vietnam's sugar industry has faced significant competitive pressures following the immediate tariff reductions under the ATIGA agreement , which came into effect on January 1 , 2020. ( i) In particular, during 2020 , the total sugar imports into Vietnam increased by + 34 % YoY, while domestically produced sugar decreased by - 24 % YoY. This decline can be attributed to the lower competitiveness of Vietnam's sugar industry compared to major sugarcane-producing countries worldwide. (ii) According to VSSA, Vietnamese sugar cane incurs higher production, processing, and management costs , which are 30 %, 183 %, and 52. 9 % respectively, compared to those in Thailand. Consequently, the price of imported sugar is typically lower than that of domestic sugar by approximately 200 - 300 VND/kg. (iii) Additionally, the sugar industry in Vietnam has faced challenges in securing adequate inputs due to the shrinking sugarcane cultivation area in the country. Farmers have been shifting to crops with higher economic value, such as cassava and corn, especially in the Southeast region, where these crops offer economic returns that are 10 - 30 times higher than sugarcane. As a result, Vietnam's sugarcane cultivation area has decreased significantly, declining from 310 , 000 hectares in 2013 to 127 , 000 hectares in 2022 , representing a 59 % reduction. This trend has further impacted domestic sugar production. ( 2 ) In 2023 , domestic sugar industry enterprises are expected to make a recovery and regain their competitiveness, primarily due to the implementation of anti-dumping and import taxes. Figure 9 : Global Soy milk market value (forecast) Source: Pesistence Market Research Figure 11 : Global sugar price from 2000 to 2023 Figure 10 : Lactose Intolerance rate in Asia Source: Lancet Research (2020) Source: Macro Trends Figure 13 : Sugarcane harvest area of Viet Nam Source: Writer’s research Figure 12 : Sugarcane harvest area of Thailand Source: USDA, FSA-Thailand 5. 13. 0 2 4 6 8 10 12 14 2023 2033 Billion USD

0

1/3/2000 1/3/2002 1/3/2004 1/3/2006 1/3/2008 1/3/2010 1/3/2012 1/3/2014 1/3/2016 1/3/2018 1/3/2020 1/3/ million hectares 0

1

2 0 50000 100000 150000 200000 250000 300000 350000 400000

with the revival of sugarcane raw material areas, there are expectations for an uptick in electricity output from the company.

The Center for Environment and Clean Water is dedicated to providing clean water and managing waste, boasting a daily capacity of 3 , 000 m³ for water treatment and waste treatment. The workshop's smoke treatment system ensures compliance with prescribed environmental standards. In 2022 , the Center for MT & NS delivered 565 , 000 m³ of clean water to various units and treated 410 , 000 m³ of wastewater from these units. For units equipped with boilers exceeding a steam capacity of 20 tons per hour and wastewater flows exceeding 1 , 000 m³ per day, the company has installed emission monitoring stations and online wastewater monitoring. To date, the company has successfully deployed and installed three boiler emission monitoring stations at An Khe Sugar Factory and An Khe Biomass Power Plant, along with one online wastewater monitoring station for the An Khe Street Plant. This initiative required an investment of nearly 10 billion VND. SOCIAL

The primary construction company rewards individuals and groups for exceptional achievements that contribute to improving overall production and business efficiency. Additionally, it imposes penalties on individuals and groups who breach the collective labor agreement or internal company regulations, resulting in detrimental effects on the company's operations. The average income for workers in 2022 was 12. 8 million VND per person per month, marking an 11 % increase compared to 2021. Furthermore, the company implements an Employee Stock Ownership Program (ESOP) to incentivize, motivate, and empower workers while recognizing their roles and responsibilities. In 2022 , the company diligently and promptly executed a comprehensive labor protection and occupational safety program, investing over VND 7. 6 billion, which represented a 76 % increase from 2021. Ensuring employee well-being remains a yearly commitment. The company excels in providing primary healthcare to its workforce, conducting periodic health check-ups for 2 , 865 employees and offering outpatient care for 1 , 226 cases.

Vietnam Soymilk Education Promotion Fund - established in 2016 , was inspired by the humanitarian program "Education on Hygiene and Nutrition in Schools" initiated by the Ministry of Agriculture in collaboration with the American Industry and American Red Cross Funding through the Vietnam Red Cross Association. Since its inception in 2016 , the Vietnam Soy Milk Study Promotion Fund has distributed over

The Board of Directors in QNS consists of 6 members, holds lead management positions in the company. Five out of six BOD members held bachelor's degrees in Finance, Economics, and Business Administration. Mentioning GELEX governance, we could not overlook the contribution of Mr. Vo Thanh Danh - former General Director and member of Board of Directors. He has been with the company for more than 40 years, and is one of the people who has been with the company since its inception. With board members who possess extensive experience and a deep commitment to the company, they are well-equipped to steer the company's continued growth in the future. They will persist in driving core production and business activities and navigating the increasingly dynamic landscape of the integrated economy. 2. Figure 16 : QNS's average salary of employees Figure 17 : Vietnam Soymilk Education Fund Donation Source: QNS Source: QNS Categories 2021 2022 Water (m3) 448, 800 560, Water treatment 314,10^0 410, Treatment Percentage 70%^ 73% Table 6 : Water usage & Water treatment of QNS Source: QNS Category Criteria Score Environmental Emission Innovation 0. Resource use Social Community

Human right Product responsibility Workforce Governance CSR Strategy Management 0. 65 Shareholders ESG Score 0. 71 Table 7: ESG Score Source: Writer Estimates 0% 2% 4% 6% 8% 10% 12% 14%

2018 2019 2020 2021 2022 million VND growth rate 0 1 2 3 4 5 6 7 8 9 10 2018 2019 2020 2021 2022

( 1 ) Control the majority of input soybeans. (i) Wide cultivation area of soybean. Vinasoy has identified four key cultivation regions throughout the country: Central Vietnam, Tay Nguyen, the Red River Delta, and the Mekong Delta, with the potential to expand to 9 , 000 ha. Currently, Vinasoy can effectively manage 85 - 90 % of its annual soybean raw material supply from domestic cultivation regions. Therefore, the writer believes that Vinasoy will not face shortages in its soy milk product category. (ii) The proficiency of QNS to manage non- genetically modified (non-GMO) soybean seed varieties. Over a decade of research, Vinasoy’s professionals now possesses a remarkable collection of 1 , 533 invaluable soybean genes, which ensure suitable seeds for different growing regions. VSAC is also strongly confident in soybean import’s management from Canada. ( 2 ) Earning the trust of the people of Gia Lai with sugarcane cultivation. (i) QNS supports farmers in Gia Lai by providing sugarcane varieties, promoting mechanization in cultivation and harvesting, leading to superior economic efficiency compared to other crops. Therefore, the sugarcane cultivation area in Gia Lai has been consistently increasing in recent years. In the 2021 - 2022 , the overall sugarcane production in the region reached 1. 34 million tons. Among this, the quantity of sugarcane purchased by the company for production and breeding purposes was 1. 2 million tons. (ii) According to writer’s research, the minimum sugarcane purchase price that QNS guarantees for farmers will remain at 1 , 050 , 000 VND/ton for the next 02 years , ensuring that farmers' sugarcane cultivation activities will not be disrupted.

( 1 ) The Fami & Vinasoy brands in the soy mlk segment have built a reputation in the hearts of consumers with high-quality and diverse products. (i) QNS therefore has an apparent advantage in the competition against small, less-branded peers in the soy milk market. As previously mentioned, approximately 60 % of Vietnam's soy milk market is dominated by vendors offering freshly made soy milk to the public. Nevertheless, considering the potential risks associated with a product like soy milk, which can be susceptible to "genetic mutation“, the writer anticipates that consumers will place growing trust in products with transparent packaging and clearly traceable origins, such as those offered by Vinasoy. This trend is likely to intensify as people become increasingly health-conscious. (ii) Fami & Vinasoy soy milk brand currently accounts for 90 % of the country's canned soy milk market share , far surpassing competitors in the same market such as Vinamilk ( 5 %) and Nutifood ( 5 %). ( 2 ) In addition, the canned soy milk market is not expected to face fierce competition in the future. (i) Vinasoy's two main competitors, Vinamilk and Nutifood , do not currently have plans to heavily invest in the soy milk sector in the future. Their primary focus remains on their core businesses, which revolve around cow's milk, fresh milk, and flavored yogurts. (ii) Over the years, foreign companies have shifted their focus away from the soy milk market , as consumer trust in Vinasoy's dairy products has become quite substantial. Certain foreign brands like Lactasoy (Thailand), Vitasoy (Hong Kong), and Vegemil (South Korea) have indeed been present in the Vietnamese market for quite some time. However, despite their presence, these brands have not managed to establish significant market recognition.

Given that sugarcane serves as the primary input for sugar production, QNS has repurposed bagasse from the sugar production process as fuel for the An Khe biomass power plant. ( 1 ) Using bagasse to produce electricity. Over the past three years, QNS has procured a substantial amount of sugarcane, ranging from 870 , 000 to 1. 1 million tons, to support its sugar production operations. The scale of sugar production results in a significant quantity of bagasse left after each annual sugarcane pressing, posing a waste management challenge. Consequently, the establishment of a biomass power plant has proven instrumental for QNS. It enables the company to optimize its raw material resources by preventing wastage of sugarcane materials and minimizing environmental impact. ( 2 ) Energy generated is returned to supply the sugarcane production. By establishing a production cluster comprising sugar production and electricity generation, the An Khe biomass power plant supplies all the energy required for sugar production operations in Gia Lai province, as well as supporting agricultural activities necessary for servicing the company's sugar production needs. Besides achieving self-sufficiency in electricity for sugarcane production, the plant also contributes electricity to the national power grid at a rate of 7. 03 U.S. cents per kilowatt-hour. Figure 19: Sugarcane purchase price of QNS for farmers Figure 22 : Sugar production Value chain of QNS Figure 18: Record of VSAC Development Source: QNS Source: Writer’s research Figure 20 : Vinasoy Brand Source: Vinasoy 1,533non-GMO soybean genes 850, 950, 1,050, 1,150,

200, 400, 600, 800, 1,000, 1,200, 1,400, VND/tons Figure 21 : Fami Brand Sugar Biomass Electric Sugarcane

the end of 2023 driven by valuation model based on Discounted cash flow (DCF) and Multiple method. With the current market price of 50 , 100 VND, our fair value implies 66 % upside potential. As a diversified businesses, QNS's intrinsic value can be perceived as the Free cash flow to firm (FCFF) values. In light of this perspective, the find the Multiple method also appropriate for estimating QNS's intrinsic worth. Therefore, the writer combines these two valuation methods with 50 % weighted each. The writer divides QNS businesses into four sectors: Soy milk, Sugar, Commercial, and Others. In which, Soy milk comprises operations of Fami & Vinasoy brands. The Commercial segment is related to QNS's finished product distribution and circulation activities classified based on the company's financial statements. Other sectors include Biomass Electricity and non-soybean F&B productions. BUSINESS OUTCOMES

- 5. 39 % YoY due to unsatisfactory business performance in first two Quarter of 2023. However, the writer expects Vinasoy’s revenue will grow at 4. 34 % CAGR in the 2024 F- 2028 F period owing to the positive future development of Vietnam's economy and rising demand for canned soy milk production.

details: Quantity: According to the writer's research, QNS's sugar segment in the 2022 - 2023 sugarcane season has successfully procured 1. 6 million tons of sugarcane , marking the highest for the company since 2019. With this promising sugarcane crop, the company anticipates producing 160 , 000 tons of refined sugar. Additionally, the writer addresses a opstimistic view that the company can continue to participate in successful bids for importing raw sugar from abroad to produce RE sugar domestically, with a cautious scenario in which the company could produce 25 , 000 tons of RE sugar. Price: According to the analysis, the prices of RS and RE sugar in the domestic market are currently at approximately 21 , 500 and 21 , 800 VND , respectively, for sugar from the An Khe factory sold through wholesale channels. Based on this, the writer assumes that the prices of RS and RE sugar will continue to remain favorable until the end of 2024 , at around 21 , 000 and 22 , 500 VND , respectively. This assumption is based on the fact that domestic demand remains significantly higher than the actual supply.

subsidiary, Thanh Phat Company. Since the commercial segment is closely related to QNS's sugar segment, its revenue is expected to benefit from the domestic sugar market. It is projected that the revenue of the commercial segment in 2023 will reach 2 , 104 billion VND, representing a + 33 % YoY increase.

remain stable, with a readily available consumer market in Quang Ngai and neighboring Southern provinces. Thach Bich mineral water is expected to have higher growth potential (+ 4 - 6 %) according to the company's strategy.

Although Soy milk’s price has decreased, Vinasoy has purchased the majority of soybean’s inventory for 2023 from last year. In the long-term, the writer expects the Vinasoy's gross margin can remain at above ~ 40 %, aligning with the power to increase production prices of QNS in 2023 (+ 5 %)

VND/ton for the next 2 years. Although this price is about 10 % higher than previous seasons, the profit margin of the sugar segment is still predicted to grow at a rate of ( 24. 79 %) as the price of RS sugar in 2023 remains high at 21 , 000 VND. In the future, the writer anticipates that sugarcane prices will reach 1 , 150 , 000 VND/ton, about 10 % higher than QNS' insurance price, to reflect the actual market conditions. Therefore, the gross profit margin is expected to decline (approximately 22 %) in the following years, but this is still a very promising profit margin for the sugar industry.

Commercials & Others: Since there haven't been significant changes in the business operations of these segments, the writer is maintaining the gross profit margin at a level similar to previous years, reflecting the current situation. Figure 27: Soy Milk sector’s Revenue forecast

Source: Writer Forecasts Figure 28 : Sugar sector projected revenue Figure 29 : GPM by sector Source: Writer Forecasts

Method Weight (^) (VND)Price DCF (FCFF) 50% 84, Multiple (Relative P/E) 50%^ 81, Target Price 83, Upside 66% 0 500 1000 1500 2000 2500 3000 3500 Billion VND 2023F, 3923 0 1000 2000 3000 4000 5000 6000 7000 8000 Billion VND 10% 15% 20% 25% 30% 35% 40% 45% Soy Milk Sugar

Valuation Breakdown

the end of 2023 driven by 50 % Discounted cash flow to firm (FCFF) model of VND 84 900 and 50 % Multiple valuation (Relative P/E) of VND 81 700. With the current market price of 50 , 100 VND, fair value implies 66 % upside potential. The writer acknowledges that both methods are essential as the DCF method gives a better understanding of ’s cash flow generating ability. In contrast, P/E method could better evaluate the detail of financial performance and profitability compare to national peers.

WACC estimation The writer employs the Capital Asset Pricing Model to calculate WACC for QNS. In which, Equity risk premium of 8. 13 % was taken from Prof. Damodaran in 2023 and our survey results. The risk-free rate at 3. 00 % is the Vietnamese 15 - year government bond yield which have a highest winning rate. After calculating the cost of equity and cost of debt are 13. 84 % and 6. 7 %, respectively, the total WACC is 11. 21 %. Terminal growth rate The writer projects the terminal growth rate of QNS to stand at 3 % in long term based on following reasons: (i) Prosperous Viet Nam's Economy outlook (ii) The increasingly refined value chain of QNS will aid its sectors' development in the future. From above estimation, the fair value for QNS implied by FCFF method is 84 , 900 VND.

For Multiple method, the writer decides to use relative P/E of national peers to valuate the fair value for QNS. The chosen peers are closely related to QNS’s business operations, working in F&B sector, Milk sector and Sugar sector. The writer has chosen 06 nation peers of QNS base on these criterias. After estimation, the relative P/E used for QNS is 13. 81 , which is 38 % higher than its 01 year trailing. With the calculated profit of 2 , 084 billion VND, the end-of- 2023 target price for QNS is 81 , 700 VND/share. Source: Writer Estimates FCFF Input QNS WACC 11.21% In which Cost of equity 13.84% Cost of Debt 6.7% Debt/Assets Ratio ~31% Terminal Growth rate 3% Table 9 : FCFF Input of QNS 5 0, 100 (1 Sep, 2023) Bull: 95 , 700 Base: 83 , 300 Bear: 69 , 100 1 - year Target

Bear case: In bear case, the writer assumes that ( 1 ) Global economy will fall into recession from 2023 to 2024 , causing decline in consumption, reducing the demand for F&B industry as well as Sugar sector of QNS ( 2 ) Global sugar price will decrease, affecting the domestic market ( 3 ) The possibility of smuggled sugar from Thailand returning to the Vietnamese market, thereby reducing domestic sugar prices ( 4 ) Vinasoy's international market expansion plan does not meet expectations Bull case: In bull case, the writer assumes that ( 1 ) Declining interest rate and lower inflation encourage consumption, boosting demand for F&B sector and Sugar sector. ( 2 ) Global sugar market enjoy upward pricing movement in the remaining 2 quarters of this year ( 3 ) The Ministry of Industry and Trade's regulations for controlling imported sugar products originating from Thailand will be closely monitored to combat smuggling. Domestic peers (Ticker) Sector P/E VNM F&B 19. IDP F&B 16. MCM F&B 11. MCH F&B 9. SBT Sugar 21. SLS Sugar 3. Relative P/E for QNS (Average) 13. Source: Writer Research` Table 10 : Relative P/E chosen for QNS

7/31/2023^ 8/1/2023^ 8/2/2023^ 8/3/2023^ 8/4/2023^ 8/5/2023^ 8/6/2023^ 8/7/2023^ 8/8/2023^ 8/9/2023 8/10/2023 8/11/2023 8/12/2023 8/13/2023 8/14/2023 8/15/2023 8/16/2023 8/17/2023 8/18/2023 8/19/2023 8/20/2023 8/21/2023 8/22/2023 8/23/2023 8/24/2023 8/25/2023 8/26/2023 8/27/2023 8/28/2023 8/29/2023 8/30/ SCENARIO ANALYSIS As valuation is subject to a variety of assumptions, the writer have conducted scenario analysis to flex the key drivers of QNS’s share price in different scenarios.

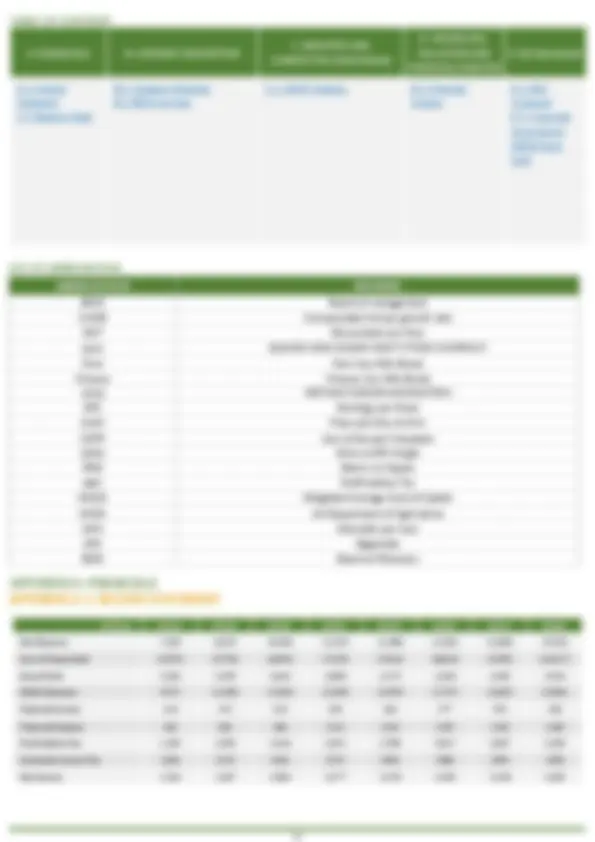

A. FINANCIALS B. COMPANY DESCRPTION C. INDUSTRY AND COMPETITIVE POSITIONING D. MODELLING, VALUATION AND FINANCIAL ANALYSIS E. ESG Becnhmark A-1: Income Statement A-2: Balance Sheet B-1: Company Structure B-2: BOD overview C- 1 : SWOT Analysis D- 1 : Financial Analysis E-1: ESG Scorecard E-2: Corporate Governance’s OECD Score Card ABBREVIATION MEANING BOM Board of management CAGR Compounded Annual growth rate DCF Discounted cash flow QNS QUANG NGAI SUGAR JOINT STOCK COMPANY Fami Fami Soy Milk Brand Vinasoy Vinasoy Soy Milk Brand VSSA VIETNAM SUGAR ASSOCIATION EPS Earnings per Share FCFF Free cash flow to firm SOTP Sum of the part Valuation GPM Gross profit margin ROE Return on Equity PBT Profit before Tax WACC Weighted Average Cost of Capital USDA US Department of Agriculture kWh Kilowatts per hour GW Gigawatts BOD Board of Directors APPENDIX A: FINANCIALS APPENDIX A-1: INCOME STATEMENT (VND bn) 2021A 2022A 2023F 2024F 2025F 2026F 2027F 2028F Net Revenue 7,335 8,255 10,556 11,670 11,988 13,204 13,850 15, Cost of Goods Sold (5,073) (5,796) (6,894) (7,670) (7,813) (8,844) (9,395) (10,617) Gross Profit 2,262 2,459 3,662 4,000 4,175 4,360 4,455 4, SG&A Expenses (947) (1,100) (1,404) (1,540) (1,595) (1,757) (1,842) (2,066) Financial Income 143 191 222 245 264 277 291 326 Financial Expense (66) (84) (86) (112) (124) (129) (136) (148) Profit before Tax 1,439 1,505 2,446 2,651 2,780 2,817 2,837 3, Corporate Income Tax (186) (219) (362) (374) (403) (408) (409) (450) Net Income 1,254 1,287 2.084 2,277 2,378 2,409 2,428 2,

APPENDIX A-2: BALANCE SHEET (VND bn) 2021A 2022A 2023F 2024F 2025F 2026F 2027F 2028F CURRENT ASSETS 5,323 6,090 7,687 9,100 9,898 10,938 11,801 13, Cash and Cash Equivalents 179 203 350 509 559 613 817 956 Short-term Investments 3,923 4,296 4,803 5,602 6,234 6,866 7,341 8, Accounts Receivable 386 587 771 923 863 990 1,053 1, Inventories 816 947 1,689 1,984 2,158 2,377 2,493 2, Other Current Assets 19 57 74 82 84 92 97 109 NON-CURRENT ASSETS 4,553 4,176 4,078 3,997 3,887 3,852 3,843 3, Long-term Receivables 1 1 1 1 1 1 1 1 Tangible Assets 4,274 3,906 3,741 3,597 3,487 3,417 3,387 3, Intangible Assets 12 8 17 18 16 15 14 15 Construction in Progress 0 0 0 0 0 0 0 0 Long-term Investments 0 0 0 0 0 0 0 0 Other Non-current Assets 220 229 296 362 360 396 416 466 Goodwill 0 0 0 0 0 0 0 0 TOTAL ASSETS 9,876 10,267 11,765 13,097 13,785 14,790 15,644 16, TOTAL LIABILITIES 2,781 2,802 3,589 4,226 4,352 4,674 4,890 5, Current Liabilities 2,710 2,750 3,525 4,156 4,268 4,595 4,807 5, Short-term Debt 2,032 1,896 2,428 2,918 2,997 3,169 3,324 3, Accounts Payable 364 479 612 654 671 753 776 870 Avances and Other Payables 27 43 53 47 48 53 55 62 Non-current Liabilities 71 52 64 70 84 79 83 93 Long-term Borrowings 0 0 0 0 0 0 0 0 Long-term Accounts Payable 0 0 0 0 0 0 0 0 Other Non-current Payables 71 52 64 70 84 79 83 93 TOTAL EQUITY 7,095 7,465 8,176 8,871 9,433 10,116 10,754 11, Share capital 3,569 3,569 3,569 3,569 3,569 3,569 3,569 3, Capital surplus 354 354 354 354 354 354 354 354 Retained Earnings 3,368 3,701 4,222 4,791 5,314 5,892 6,475 7, Other 0 0 0 0 0 0 0 0 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 9,876^ 10,267^ 11,765^ 13,097^ 13,785^ 14,790^ 15,644^ 16, APPENDIX B-1: COMPANY STRUCTURE APPENDIX B: COMPANY DESCRPTION Source: GEX

FINANCIAL ANALYSIS TABLE 2021A 2022A 2023F 2024F 2025F 2026F 2027F 2028F LIQUIDITY RATIO Current Ratio 1.66 1.87 1.70 1.71 1.81 1.86 1.94 1. Quick Ratio 1.96 2.21 2.18 2.19 2.32 2.38 2.45 2. CAPITAL STRUCTURE Debt/Asset 28.16% 27.29% 32.04% 33.94% 33.17% 33.28% 32.92% 34.03% OPERATING EFFICIENCY INDICATORS Average Collection Period 16 22 24 27 27 26 27 26 Account Receivable Turnover 22.54 16.93 15.52 13.76 13.41 14.24 13.55 14. Account Payable Turnover 3.25 3.65 4.88 3.98 3.75 3.67 3.40 3. Cash Conversion Cycle (156) (134) (121) (153) (167) (167) (175) (167) PROFITABILITY RATIO Gross Margin 31% 30% 35% 34% 35% 33% 32% 32% Net Margin 17% 16% 20% 20% 20% 18% 18% 17% Return on Assets (ROA) 13% 13% 19% 18% 18% 17% 16% 16% DUPONT ANALYSIS ROE 18% 18% 27% 27% 26% 25% 23% 24% EBIT margin (EBIT/Sales) 21% 19% 24% 24% 24% 22% 21% 21% Interest burden (EBT/EBIT) 0.87 0.86 0.90 0.85 0.87 0.86 0.90 0. Tax Burden (NI/EBT) 0.90 0.94 0.89 0.94 0.90 0.94 0.89 0. Asset T.O (Sales/Asset) 1.32 1.27 1.31 1.29 1.32 1.27 1.31 1. Leverage (Asset/Equity) 1.39 1.37 1.45 1.47 1.47 1.47 1.45 1. GROWTH INDICATOR Total Asset Growth 4% 15% 11% 4% 7% 5% 9% 10% Revenue Growth 13% 13% 28% 11% 3% 10% 5% 12% Earnings Growth 19% 3% 62% 9% 4% 1% 1% 9% SHAREHOLDER'S INDICATOR Earnings Per Share 3,512 3,605 5,839 6,379 6,659 6,749 6,802 7, APPENDIX D- 1 : FINANCIAL ANALYSIS (return) APPENDX D: MODELING AND VALUATION AND FINANCIAL ANALYSIS

APPENDIX E: ESG Benchmark Refinitiv ESG Scores reflect the underlying ESG data framework and are a transparent, data-driven assessment of companies' relative ESG performance and capacity. Refinitiv's ESG Scoring methodology follows a number of key calculation principles which stated clearly in ESG Annual Report of Refinitiv. Based on these principles and professional judgement, the final ESG detail results are stated below: Category Criteria Score Avg score Weight Score Environmental Emission Emission 0. 0.78 0. 33

ESG reporting and transparency 0. Management Structure (independence, diversity, committees) 0.6^ 0.65 0. Compensation 0. Shareholders Shareholder rights 0. 0.50 0. Takeover defense 0. ESG Score 0. 71 Criteria Weight Comment OECD Score The rights of shareholder and key ownership functions 15% QNS complies with legal requirements in protecting shareholders’ right. 12% Equitable treatment of shareholders 20%^ All transactions between majority shareholders and related parties are disclosed accordance to legal requirements. 16% Roles of stakeholders in corporate governance 5% Clear remuneration policy of BOD.^ QNS’s creditors’ right are held to a higher standard than average public companies. 2.5% Transparency and disclosure 30% Not only complying with current standards of disclosure, QNS also provides in-depth quarterly report, both in writing and video format. Information inside QNS’s reports and website are clearer than average. 18% Responsibilities of the board 30% 2/^6 BoD^ members^ are independent members.^ QNS^ also review code of ethics every year based on the regulation and CG. 21.6% Average score Evaluation Below 50% Need improvement Between 50% and 64% Fair Between 65% and 74% Good Above 75% Excellent Bonus 2 The audited annual financial report released within 60 days from the financial year end. Level 1 QNS’s Level 1 Score: 70. 1 / 100 - > Classified as “Good” Level 2 : Level 2 consists of (i) bonus items reflecting other emerging good practices, and (ii) minus items reflecting actions and events that are indicative of poor governance. OVERALL SCORE: 72. 1 / 100 - > Classified as “Good” APPENDIX E-1: ESG Score APPENDIX E-2: CORPORATE GOVERNANCE’S OECD SCORE CARD