Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Securities transactions are the focal point of relationships between investment banks and their corporate clients. Until the middle of the ...

Typology: Lecture notes

1 / 66

This page cannot be seen from the preview

Don't miss anything!

∗We are grateful to Ron Burt, Zhaohui Chen, Brian Coulter, Leora Friedberg, Mike Gallmeyer, Bill Greene, Anna Kovner, Pedro Matos, Hamid Mehran, Stavros Peristiani, Chris Yung and seminar participants at the Federal Reserve Bank of New York, William & Mary and the Oxford University Centre for Corporate Reputation 2013 Symposium forhelpful comments. Paul Bennett, Steve Wheeler, Janet Linde (New York Stock Exchange), Tom Nicholas (Harvard Business School), and the staff at the Mudd Library (Princeton University) provided generous assistance in gaining access to the historical data. Patrick Dennis provided valuable programming assistance and Brendan Abrams, Ye Feng, Vaibhav Kapoor, Thomas Knull, Qiao Ma, Mary Weisskopf, and David Wilhelm provided excellent research assistance. We gratefully acknowledge financial support from the Oxford Centre for Corporate Reputation (Morrison and Thegeya); the Ledford Faculty Fellowship at the McIntire School of Commerce (Schenone); and the Walker Fund and the King Fund for Excellence at the McIntire School of Commerce (Wilhelm).

Abstract

We use a unique dataset of underwritten securities offerings and their syndicate composition from 1933-1969, together with similar data for 1970-2007 from SDC, to study long-run trends in investment-bank relationships with their clients, and with one another. The degree to which issuers conditioned upon prior relationship strength when selecting an investment bank declined steadily after the 1960s. The probability of an issuer selecting a bank that had strong relationships with the issuer’s competitors also declined after the 1970s. In contrast, issuers have placed an increasing emphasis upon the quantity and the quality of their investment bank’s connections with other banks. We argue that these changes reflect technological changes that have served to alter the institutional constraints under which security issuance occurs.

for private (investment) banks.^3 The Act was followed in close succession by further regulatory intervention aimed at weakening bank relationships culminating with an unsuccessful 1947 civil suit filed by the U.S. Justice Department (U.S. v. Henry S. Morgan et al.) against 17 investment banks charged with conspiring through their syndicate connections to monopolize the U.S. securi- ties business. In spite of this regulatory upheaval during the early part of the sample period, we find that issuers placed increasing weight on the state of their banking relationships in their decision whether to (re)engage a bank to manage a transaction and on the state of the bank’s relationships with the issuer’s competitors. On the other hand, banks’ syndicate connections had a modest but negative effect on bank selection. In other words, during the early part of our sample period, it appears that the influence of bank/client relationships strengthened in the face of regulatory action intended to weaken them and that, contrary to the motivation for U.S. v. Henry S. Morgan et al., strong syndicate connections provided little, if any, competitive advantage. In contrast, we find that the influence of bank/client relationships began to weaken and syndi- cate ties strengthen beginning in the 1960s. By the time that commercial banks began to reenter the securities underwriting business the influence of bank/client relationships had stabilized at a level similar to that observed in the immediate aftermath of the post-Depression regulatory effort. Similarly, issuers responded much less favorably to banks with strong relationships within the is- suer’s SIC category after the 1970s. On the other hand, by the last decade of the sample period, the increase in a bank’s odds of being selected for a one unit increase in our measure of the strength of its syndicate connections was about 8 times larger than its estimated level for the 1960s. We explain the declining influence of bank/client relationships by first recognizing that they rest on banks’ ability to build and preserve a reputation for their bankers being skillful and trustwor- thy. Morrison and Wilhelm (2004) identify limited organizational scale and relative immobility among human capitalists as being conducive to building and preserving institutional reputation. We show that these conditions were met by banking partnerships throughout the early part of our sample period. But beginning around 1960 the investment-banking industry entered a period of (^3) By the end of the 1920s two large commercial banks, Chase National and National City of New York, sponsored over half of all new securities offerings. See Morrison and Wilhelm (2007, p.210).

unprecedented technological and organizational upheaval that culminated in 1970 with the New York Stock Exchange’s (NYSE) membership (including virtually all of the major banks) agreeing to permit members to operate as public corporations. Morrison and Wilhelm (2008) argue that these changes began to undermine reputation concerns among investment banks at precisely the time that we observe the influence of bank/client relationships beginning to weaken. Bank/client relationships stem from interactions between individual bankers and client repre- sentatives. During the early part of our sample period, bankers generally spent their entire careers with a single, typically quite small, banking partnership. It was not unusual for a banker to be responsible for a specific client relationship for many years, even decades. Coupling long-term partnership commitments with longstanding client relationships provided bankers with the oppor- tunity to build client trust and the incentive to protect their individual and institutional reputations for having done so. We document the longevity of individual bankers and their long-term commit- ments to a single institution by tracking the identity of bank partners annually. We also illustrate bankers’ long-term responsibility for specific clients by documenting the number and length of individual bankers’ directorships through the first part of our sample period for the 17 defendant banks in U.S. v. Henry S. Morgan et al. Tracking individual partners annually provides evidence of erosion in the conditions that contributed to long-lived, personal relationships with clients be- ginning in the late 1950s and gathering force through the 1970s. Our bank-choice model indicates that issuers responded negatively to the departure of bank partners during the 1960s and 1970s. Our results related to the state of a bank’s relationships within an issuer’s industry suggest that issuer’s valued industry expertise throughout the sample period. The substantial decline in this effect during the 1980s is consistent with evidence provided by Asker and Ljungqvist (2010) of potential conflicts of interest and leakage of strategic information causing large issuers to avoid engaging banks that also managed transactions for firms in the same industry.^4 Coupled with the simultaneous decline in the influence of bank/client relationships and the negative effect of banker turnover, these results suggest that the 1970s and 1980s mark the outset of an erosion of trust between banks and their clients. (^4) See Bodnaruk, Massa, and Simonov (2009) and Griffin, Shu, and Topaloglu (2012) for mixed evidence on whether client information is exploited for trading purposes.

Our use of eigenvector centrality to study bank connectedness is motivated by recent work indicating that network connections influence the performance of financial intermediaries.^7 For example, Ljungqvist et. al. (2009) report that strong syndicate connections weakly strengthen a bank’s bid for lead management (and only for debt offerings) but they find stronger evidence of a positive effect on the likelihood of being appointed a co-manager. Hochberg, Ljungqvist, and Lu (2007) report that funds run by better-networked venture capital firms perform better than their peers and that their portfolio companies are more likely to gain subsequent financing and achieve a successful exit. Hochberg, Ljungqvist, and Lu (2010) show further that strong local venture capital networks pose a barrier to entry for nonlocal venture capitalists. Finally, our documentation of weakening client relationships and diminishing institutional commitment among bankers provides a suggestive backdrop for recent theoretical work aimed at better understanding why reputation concerns appear to have become less effective for control- ling conflicts of interest within investment banks. Chen, Morrison, and Wilhelm (2013a; 2013b) study the tension between a bank’s interest in maintaining a reputation for trustworthy behavior and individual bankers having opportunities to signal their ability by taking actions that conflict with their clients’ interests. In these models, the technological changes that we associate with weakening client relationships can undermine banks’ incentives to curb self-interested behavior within their ranks and give rise to the sort of transactions that have been subject to criticism in the aftermath of the recent financial crisis. The asset securitization market has been a prominent focal point for such criticism. Winton and Yerramilli (2011), Hartman-Glaser (2013), and Griffin, Lowery, and Saretto (2013) all develop models in which reputation concerns can fail to resolve conflicts of interest in this setting. Because our study of banking relationships cuts across a wide time span, much of which has been subject to limited statistical analysis, we begin in section 2 with a brief overview of events that shaped banks’ relationships both with their clients and with one another during the early decades of our sample period. In section 3 we provide a detailed characterization of the pre-1970 data used in our analysis and document broad patterns in the data over the entire sample period. In section 4 (^7) See Bonacich (1972) for development of the eigenvector centrality measure and Podolny (1993) for an early application to investment-banking syndicates.

we define and provide summary statistics for the measures of the state of bank relationships used in the econometric analysis. Section 5 outlines the econometric methodology and section 6 presents the estimation results. We conclude in section 7 by placing our results in historical context and suggesting implications for the current state of investment banking.

This section provides a timeline of events that influenced investment-banking relationships over the course of our sample period. It is intended as an overview and therefore is by no means complete. Carosso (1970), Medina (1954 [1975]), and Seligman (1982) provide authoritative accounts of events through the first half of the sample period. Morrison and Wilhelm (2007, ch.7-8) and Morrison and Wilhelm (2008) provide further detail on events during the latter part of the sample period as well as a discussion of the influence of technological change on the industry. From 1933 through the early 1950s investment banks were subject to political and regulatory efforts aimed at weakening their ties with clients and with one another. The 1933 Banking Act was signed into law on June 16, 1933 and was followed on June 6, 1934 by the Securities Exchange Act. For our purposes, the Banking Act’s separation of deposit collection and lending from securities market activity (to be completed by June 16, 1934) stands out for having forced reorganization of many important banks and and thereby potentially upsetting existing banking relationships. Some prominent banks (e.g., Goldman Sachs, Kuhn Loeb, Lehman) already specialized in se- curities offerings and were able to carry on relatively undisturbed. By contrast, in June 1934 J.P. Morgan formally discontinued its investment banking operations but had effectively left the busi- ness when the Banking Act was enacted. It was not until September 16, 1935 that several J.P. Mor- gan partners (Harold Stanley, Henry S. Morgan, and William Ewing) left the firm to incorporate Morgan Stanley & Co. They were joined by former partners from Drexel & Co. and soon thereafter by two officers from the former securities affiliate of Guaranty Trust. The fact that the founding members of the new firm had considerable experience in the industry (each of the three Morgan men had been a partner for seven years when J.P. Morgan discontinued its investment-banking operations) contributed to the new firm’s ability to quickly gain a leading position among under-

“entering into combination, conspiracy and agreements to restrain and monopolize the securities business of the United States...” and it identified the underwriting syndicate as a primary vehicle for the alleged abuse of longstanding banking relationships.The opinion rendered by Judge Harold Medina in October 1953 (and filed on February 4, 1954) dismissed all charges against the defen- dants and castigated the government for the weakness of its case.^10 With respect to the syndicate system Medina found “...no concert of action, no agreement and no conspiracy, integrated over-all or otherwise” [Medina (1954 [1975], p.119)]. By the 1940s, the underwriting syndicate’s distribution function already had undergone sub- stantial change. At the beginning of the 20th century, banks’ securities distribution operations were quite small and concentrated on the east coast. Underwriting syndicates routinely remained in place for a year or more as syndicate members travelled to peddle securities to individual investors [Medina (1954 [1975], pp.22-23)]. Distribution improved as retail brokerage networks expanded [e.g., Perkins (1999, p.219)] and by the late 1940s syndicate contracts usually were written for 15-30 days [Medina (1954 [1975], p.43)]. The 1940s also witnessed the early stages of change in the investor community that would re- shape both syndicate and client relationships. Institutional ownership of U.S. equities outstanding doubled from 7% to 14% between 1945 and 1960 [Federal Reserve Flow of Funds, L.213]. Mutual fund assets grew from $448 million to $3.5 billion between 1940 and 1952 while pension fund as- sets grew from $3 billion in 1947 to $18 billion in 1955. And as their assets grew rapidly during the 1940s, life-insurance companies became dominant investors in the burgeoning market for private placements to the point of crowding out investment banks by investing in direct placements.^11 By the 1950s, The NYSE’s daily trading volume averaged about 2.2 million shares on open interest of 5.6 billion shares. Average daily trading volume stood at about 3 million shares in 1960 and then nearly quadrupled by 1970, and then quadrupled again by 1980 [Morrison and Wilhelm (2007, pp.232-233)]. The evolution of block trading provides a more direct account of the influence of

(^10) The case did not go to trial until November 28, 1950 and it concluded on May 19, 1953. In the interim, counsel for the government and defendant banks produced, in the words of Judge Medina, “truckloads of documents... The precise number of the hundreds of thousands of documents... will probably never be known.” [Medina (1954 [1975], p.213)]. 11 See Kemmerer (1952), Carosso (1970, pp.499-501), and Sobel (1986, p.64).

institutional trading. In 1965, the NYSE reported 2,171 block trades accounting for about 3% of reported volume. By 1972 the number of block trades had grown about 15 times to 31,207 trades (18.5% of volume) and then tripled by 1979 (97,509 transactions, 26.5% of volume). In spite of fixed commission rates (abolished in May, 1975), the rapid increase in trading vol- ume proved a life-threatening burden for many investment banks. Closing transactions required physical exchange of stock certificates and back office capacity was being challenged by the pa- perwork required to manage the flood of new business. Although fixed commissions prevented price competition, early adopters of nascent batch-processing computer technology, such as Mer- rill Lynch, gained a competitive edge that ultimately proved to be decisive. By the late 1960s the industry was in the midst of a back-office crisis stemming from the inability of many firms to close transactions in a timely manner. “Losses associated with ‘too much business’ led approxi- mately 160 NYSE member firms either to merge with competitors or to dissolve their operations” [Morrison and Wilhelm (2007, pp.235-236)]. Among firms that survived, Merrill Lynch, Goldman Sachs, and Salomon Brothers were noteworthy for having strengthened their investor relationships by investing heavily in block trading and arbitrage services [New York Times, July 17, 1971]. With other firms claiming to have been forced to decline institutional business for want of capital to fund investments in technology, the NYSE membership decided in 1970 to permit member firms to op- erate as public corporations. Investment banks went public in two waves [Morrison and Wilhelm (2008)]. Most banks with substantial retail brokerage operations had gone public or combined with a public firm by the end of the 1970s. By 1987, among the major wholesale banks, only Goldman Sachs and Lazard remained private partnerships. As we noted earlier, advising on mergers and acquisitions evolved into a significant fee-for- service business during the 1960s and 1970s. The 1978 Bankruptcy Code reversed the provisions in the 1938 Chandler Act that prevented banks taking an active role in corporate reorganization. The confluence of fee-for-service advisory operations, the new bankruptcy code, the development of the market for junk bonds, and the leveraged buyout helped to fuel 172 successful hostile takeovers and a total of 35,000 completed mergers in the U.S between 1976 and 1990 [Morrison and Wil- helm (2007, pp.251-262)]. Hostile takeovers were viewed from the outset as an affront to client

3.1. Data for Issues Between 1933 and 1969

We collected the details of securities offerings between 1933 and 1969 from two sources. Counsel for several defendants in United States v. Henry S. Morgan, et al assembled details of all under- written issues of $1, 000 , 000 or more from July 26, 1933 to December 31, 1949.^13 The records were subsequently published in 1951 as Issuer Summaries.^14 Data for 1950s and 1960s deals were collected from the Investment Dealers’ Digest.^15 Transaction details were scanned using opti- cal character recognition software, and then checked by hand. Our database contains a complete transcription of records from these two sources. For each transaction, the 1933-69 source data includes the name of the issuer,^16 the date of the offering,^17 the exact title of the security issue, bond ratings where reported in the source data, the manager or co-managers for underwritten offerings and the dollar amount raised.^18 For transac- tions between 1933 and 1949 additional information about the gross spread and issue registration are also included. A descriptive field contains additional information in free text. We used text processing software to extract information about stock type (preferred, common, cumulative pre- ferred), debt offerings (preferred, cumulative, convertible, note, debenture), number of shares, debt yield, and debt maturity from this field. We need to identify the lead manager for each issue. However, the source data for deals prior (^13) United States v. Henry S. Morgan, et al., doing business as Morgan Stanley & Co.; et al, (Civil Action No. 43- 757), United States District Court for the Southern District of New York. Additional information related to the case is drawn either from the Corrected Opinion of Judge Harold R. Medina or from the Harold R. Medina Papers housed at the Mudd Library, Princeton University. 14 Sullivan & Cromwell, Issuer summaries; security issues in the United States, July 26, 1933 to December 31,

to 1950 lists all managers and co-managers in alphabetical order, and does not name the lead man- ager. In practice, this is a relatively small problem: only 1, 378 of the offerings performed in the 1940s (17 percent of the total) had more than one manager. We identified the lead bank for 20 percent of those transactions by matching them with contemporary tombstones. The remaining transactions appear to have been too small to have published tombstones, and we were unable to identify lead managers for them. We retain them in the database, with syndicate seniority as- signed alphabetically. Excluding these transactions from our econometric analysis does not have a significant effect upon our results. The source data for 1950-1969 records managers and co-managers in decreasing order of se- niority. We checked that this was the case by matching a random sample of 400 syndicates to contemporary tombstone advertisements that listed underwriters in decreasing order of seniority. The combined hand-collected 1933-1969 database comprises 51,278 transactions. We ex- cluded data that were obviously erroneous, or that were ambiguous.^19 We also excluded a subset of issuance data that were duplicated in 1950s and 1960s source documents. This reduced the sample to 49,155 transactions. The 1933-1969 source data does not include SIC codes. We extracted SIC codes, as well as closing prices and trading volumes, for issuers of sufficient size to appear in the CRSP database. The SIC codes were then matched to Cusips for use in extracting financial statements from the Compustat North American database. Since company SIC codes can change over time, we match company names to SIC codes by decade. Company names not matched in CRSP were manually checked; those that were easily identi- fied as banking, insurance, re-insurance, real estate, and securities industry players were assigned SIC code 6000. Similarly, all public and government bodies were assigned SIC code 9000. We used text-processing programs to identify companies in the natural resources and agricultural sec- tors, to which we assigned SIC code 1000, railroad companies, which were assigned SIC code 4011, and utilities and transport companies excluding railroads, which were assigned SIC code

(^19) Generally, this occurred when commas were misplaced: for example, we excluded data that included numbers recorded as 1,00,000.

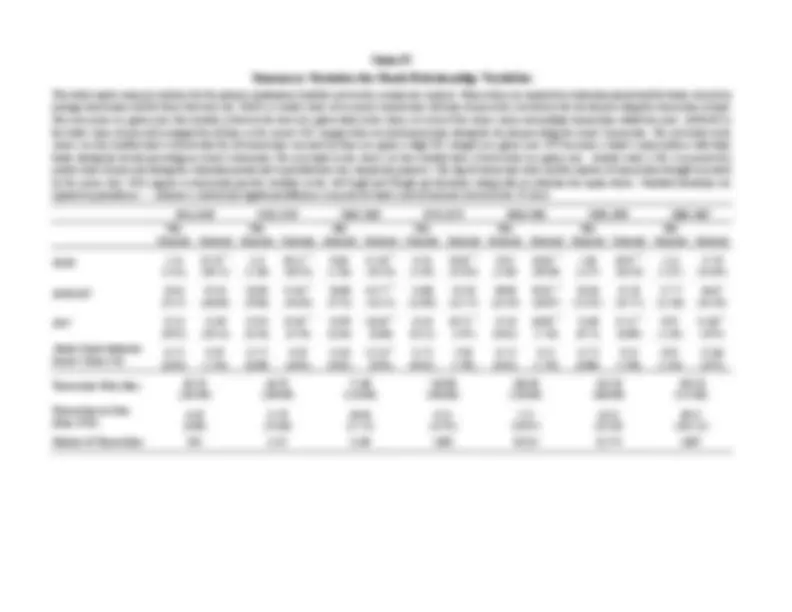

funded issues. Finally, we include only straight equity issues that are classified as common, ordinary, cumu- lative, or capital shares. We retain only those preferred deals that are identified in the source data as cumulative, convertible, capital, or certificate. We exclude floating, indexed, reset, serial, and variable coupon debt issues, and retain other debt deals only if they are classified as bonds, deben- tures, notes, or certificates, and if they have a maturity of at least two years. These exclusions trim the sample to 63,302 transactions. Table I provides an overview of the banking landscape from the perspective of this subsample by reporting the top 30 banks by market share for the 1933-1969 and 1970-2007 periods. Looking across the two halves of the sample period, concentration levels increased markedly. The top 30 banks measured by proceeds held about 84% of market share during the first half of the sample and about 91% during the second half. The top 5 (10) banks accounted for 40% (61%) of proceeds during the first half of the sample and about 50% (75%) during the second half.^22

3.4. The Issuer’s Bank Choice Set

Our econometric analysis involves estimation of bank choice models for 7 time periods that, with the exception of the first, correspond with decades. The issuer’s choice set for a given transaction includes the top 30 banks ranked by the dollar volume of transactions for which they served as the lead manager during the decade in which the transaction took place. This means that transactions managed by banks outside of the top 30 in a given decade are excluded from the analysis.^23 We use the 1933-1942 time window to seed the relationship measure described in the following section. Finally, we retain only those transactions for which the issuer’s SIC code is available. Taken together these restrictions yield a final sample of 33,577 transactions for use in the econometric analysis.

(^22) This table is not used as a basis for our relationship analysis and, in order to make trends of the type discussed in this paragraph clear, it does not reflect the lifeline mappings discussed in the next section. Hence, for example, Bank of America deals are illustrated independently of Merrill Lynch deals, even though both are assigned to the same lifeline in our relationship analyses. 23 The appendix includes a list of the 30 banks that appear in each decade’s choice set and their market share during the decade.

Table II reports the distribution of transactions in total and by type across the estimation peri- ods. The number of transactions in an estimation period ranges from a minimum of 842 for the 1943-1949 sample to a maximum of 12,574 for 1990-1999 sample. Debt issues substantially out- number equity (and preferred) issues in every estimation period. Over the entire sample period, debt, equity, and preferred issues accounted for 64%, 31%, and 5% of the sample of transactions. We also report the number and fraction of transactions for which the issuer had no other transac- tion during the 10 years preceding the year of the transaction at hand managed by a bank in its choice set. In the full sample, the percentage of transactions carried out by issuers that had no prior relationship with a bank in its choice set ranged from 73% during the 1943-1949 estimation period to 21% during the 1950-1959 estimation period. The absence of a relationship was most prevalent between 1970 and 1989. As we show later, this was a period of considerable upheaval in bank/client relationships. Generally, equity issuers were were less likely than debt issuers to have dealt with a bank in its choice set during the preceding ten years. In the next section we explain how the state of a banking relationship is measured for estimation purposes. The relatively small number of observations for the 1970-1979 period reflects the previously mentioned absence of private placement coverage by SDC during this decade. This could bias our results if issuers systematically approach the selection of an underwriter differently for private placements than for other transactions. With respect to the relationship strength variable, there is considerable anecdotal evidence that the sharp increase in private placements following the 1938 Chandler Act’s implementation of a statute-based approach to bankruptcy reorganization dimin- ished the influence of banks in securities issuance.^24 If the same is true for the 1970s, the exclusion of private placements should bias our results toward greater issuer dependence on its relationship with a prospective bank than would be the case if private transactions were included in the anal- ysis. But any such bias would then lend weight to our conclusion that the extent to which issuers conditioned their bank selection on the strength of a prior relationship declined during the 1970s.

(^24) See Skeel (2001) for a detailed account of the Chandler Act and its influence on the industry.

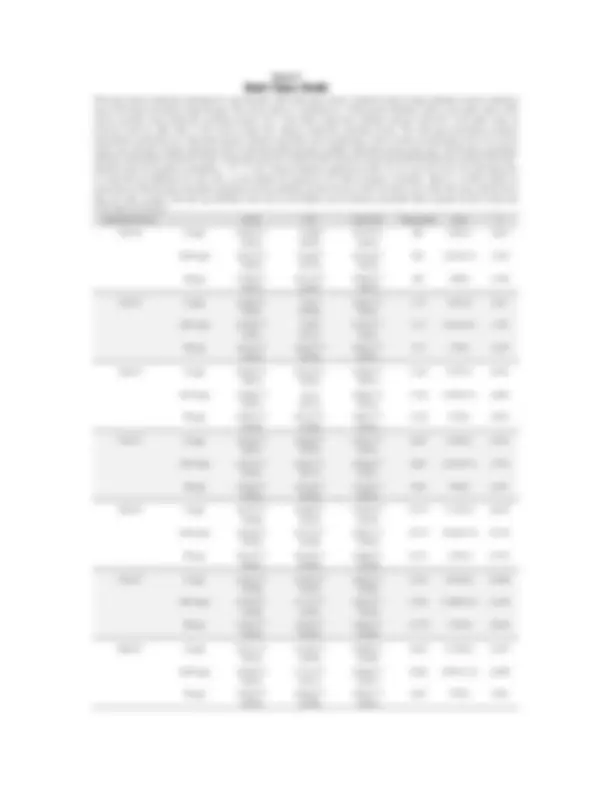

in the issuer’s corporate family during the preceding ten years. Second, the total amount A lead managed for the firm’s corporate family by a member of the bank’s date D lifeline is computed. The strength of the relationship between the bank and the company at date D is defined to be the ratio of A to Q. In our analysis we use relationship strength measures calculated using data for all deals between the bank and the company as well as separate measures for debt and equity deals. Table III provides an overview of client relationships for the top 30 banks by market share for the periods 1933-1969 and 1970-2007. The table reports the number of clients for which each bank managed securities offerings, the percentage of its clients with which it had an exclusive relation- ship, and the fraction of all of its clients’ transactions by value for which the bank was the lead manager. Proceeds from transactions with multiple bookrunners are apportioned equally among the bookrunners.^25 Table III reveals a shift from a single bank underwriting a large fraction, and in many cases all, of an issuer’s securities offerings from 1933-1969 to a world in which underwriting relationships were far less exclusive. During the first half of the sample period 53% of all client relationships among the top 30 banks were exclusive – the bank managed every deal that the issuer brought to market. This figure dropped to “only” 34% during the second half of the sample period. The larger change occurred in the banks’ share of proceeds raised by both clients with which it maintained an exclusive relationship and those with which it did not. The decline from about 39% to 16% reflects, in no small part, large-scale “poaching” of active issuers by commercial banks during the 1990s and 2000s. This effect is most evident among relative latecomers such as UBS which ranked 16th by market share over the 1970-2007 period but accounted for only about 7% of proceeds raised during this period by issuers for which it managed deals. Figure 1 provides a different perspective on this change by reporting average relationship strengths on an annual basis for Goldman Sachs, Merrill Lynch, and Morgan Stanley as well as for the 30 banks that appear in the choice set facing issuers in a given year in our econometric analysis. Goldman and Morgan Stanley managed deals accounting for nearly 90% of proceeds raised by their clients through the 1960s (and later in the case of Goldman). By contrast, dur- (^25) We use the terms “lead underwriter,” “lead manager,” and “bookrunner” interchangeably and distinguish them from co-manager with equal apportionment of proceeds. The presence of co-managers and multiple bookrunners is largely a post-1990 phenomenon. Ljungqvist, Marston, and Wilhelm (2009) provide evidence of co-management serving as a stepping-stone to lead-management opportunities.

ing the early part of the sample period Merrill accounted for less than 80% of proceeds raised by firms for which it managed a deal in the preceding 10 years. This is likely a reflection of the fact that Merrill remained primarily a retail-oriented firm with a modest underwriting presence. But over time the firm’s retail brokerage network attracted syndicate invitations and, ultimately, lead- management opportunities. By 1970 the three firms maintained similarly exclusive relationships with their clients and followed a similar path of declining exclusivity through the remainder of the sample period. By 2009, the average relationship strength among clients for all three banks, as well as the average among the top 30 banks by market share from 2000-2009, was slightly above 50%.

4.2. Measuring Bank Relationships within Industry Groups

In addition to treating issuers as conditioning their bank choice on the state of their relationship with each bank in the choice set, we allow for the issuer conditioning on whether banks have relationships with their competitors. Asker and Ljungqvist (2010) find that issuers avoid banks that work with their competitors out of concern for leakage of strategic information. Alternatively, it is conceivable that some banks maintain industry-specific expertise that is attractive to issuers within that industry. We use the following strategy to design measures of each bank’s breadth and depth of activity within an industry group. For each year and bank in the issuer’s choice set during the year of a given transaction, we measure the state of the bank’s relationships with all recent issuers in 4-digit SIC categories. We use a 10-year, rolling window to identify all transactions for each bank in the issuer’s choice set in a given year. These transactions are then sorted by the issuer’s 4-digit SIC code. Within each SIC code category, we identify banks that managed one or more transactions with more than one firm during the 10-year window. For these banks, we measure the relationship strength variable described above for each firm in the SIC category with which the bank worked during the window and the number of firms with which the bank worked. The relationship strength measures are averaged to create an annual measure of the state of a bank’s relationships within the SIC category. For banks that managed deals for one or fewer firms within the SIC category during