Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The Philippine E-Commerce Roadmap, which highlights the importance of e-commerce in economic development and presents trends in e-commerce development globally, within the Asia-Pacific region, and within ASEAN. The document sets the direction, strategies, and policy and industry support measures for e-commerce to grow and contribute 25% of the Philippines’ GDP by 2020. It also discusses the Asia-Pacific and ASEAN perspectives on e-commerce and the challenges and opportunities in the region.

Typology: Thesis

1 / 42

This page cannot be seen from the preview

Don't miss anything!

E XECUTIVE S UMMARY

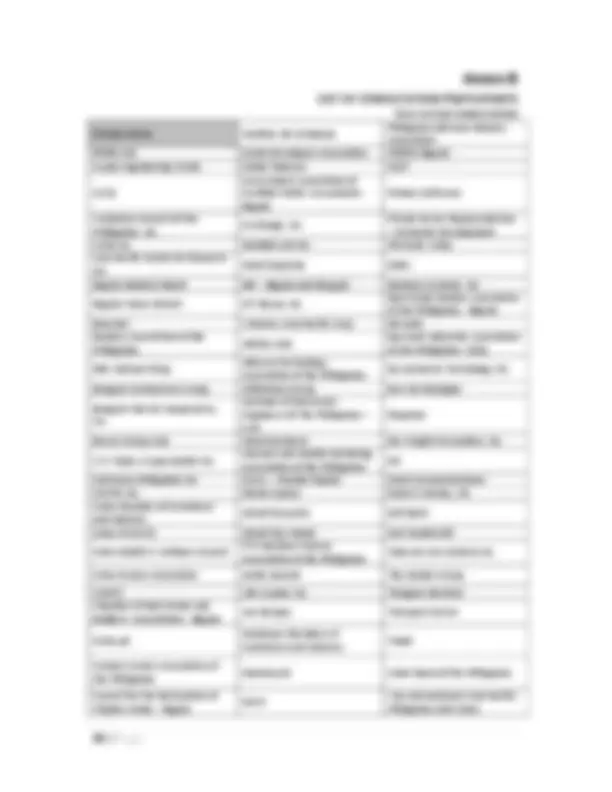

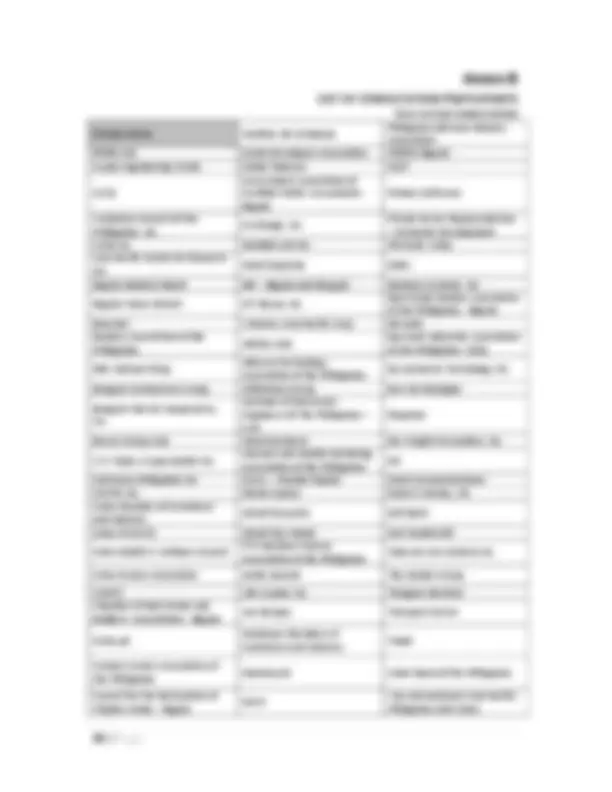

Page No. List of Tables Table 1. B2C E-Commerce Sales Worldwide by Region, (values in billion US$) Source: E-Commerce Across Asia - Trends and Developments 2014 - Asia Briefing, pg. 4

Table 2. Most Preferred Form of Online Payment Method in Asia- Pacific Source: Online Shopping in Asia-Pacific - Patterns, Trends and Future Growth MasterCard Worldwide, pg. 7

Table 3. Status of E-Commerce Law Harmonization in ASEAN as of March 2013 Source: Review of E-commerce Legislation Harmonization in the Association of Southeast Asian Nations, pg. xi

Table 4. ASEAN Internet Status (4th Quarter 2014) 15

List of Figures Figure 1. World’s Key Digital Statistical Indicators Source: We Are Social

Figure 2. ASEAN Average Internet Speed Index 2014 Source: http://www.aseanbriefing.com/news/2014/04/24/internet- speeds-across-asean.html

Figure 3. The Philippines’ Key Digital Statistical Indicators Source: We Are Social

Figure 4. Industry Performance of IT-BPM (2006 – 2014) Source: Board of Investments

Figure 5. Framework for the Promotion of E-Commerce in the Philippines

CHAPTER 1: I NTRODUCTION

(^1) Formulated to revitalize and reinvigorate Philippine manufacturing under the Manufacturing Resurgence Program (^2) Please refer to Annex A for the Summary of Meetings and Consultations Conducted (^3) Please refer to Annex B for the List of Consultation Participants

C HAPTER 2: G LOBAL AND R EGIONAL P ERSPECTIVES:

T RENDS , G OALS , AND T ARGETS

E-commerce has seen a rapid pace of growth worldwide in both developed and developing countries. With increasing internet penetration and use of personal computers and mobile devices, more and more consumers now have the opportunity to purchase goods and services they want online. In terms of the projected sales for 2015, 5 China remains the biggest e- commerce market (US$562.66B) followed by the United States of America (US$349.06B) and the United Kingdom (US$93.89B).

Figure 1. World’s Key Digital Statistical Indicators

Source: We Are Social

In a study conducted by Nielsen, non-consumable products such as clothing, airline ticket, hotel reservations and event tickets are the most prominent categories. 6 For some products like electronic devices, sporting goods and even vehicles, consumers still prefer to purchase them in a brick-and-mortar setting rather than online since some of these products require physical inspection and in-store trial. However, more consumers often use the internet to compare prices and technical specifications and read the reviews of other people before deciding which specific product to buy.

The contribution of e-commerce to economic development is now widely recognized. It may be for this reason that recently concluded trade agreements and those that are currently on the negotiating table have devoted a separate chapter on e-commerce. As countries push for cross-

(^5) – Keith, M. (2015, September 2). Global E-commerce Sales, Trends and Statistics 2015. Retrieved October 26, 2015, from

http://www.remarkety.com/global-ecommerce-sales-trends-and-statistics-2015 6

border e-commerce, discussions in international engagements are focused on the development of a harmonized legal framework for e-commerce.

Asia-Pacific is expected to become the leading region for e-commerce sales globally in 2015, representing 33.4% of the total retail sales, compared with 31.7% in North America and 24.6% in Western Europe. 7

According to the International Telecommunications Union (ITU), more than 36.9% of individuals and 39% of households in the Asia-Pacific region have internet access in 2015 with a 42.3% mobile broadband penetration rate. 8

With the global spread of internet access to 40% of the world’s population^9 , e-commerce has brought new ways on how commodities and services are being purchased, sold and advertised. Business-to-consumer (B2C) e-commerce sales in the Asia-Pacific region broke the US$1 trillion mark in 2012. By the end of 2015, the Asia-Pacific region will become the largest regional e- commerce market in the world, with consumers projected to outspend their North American counterparts by US$40 billion and account for more than 45% of all online buyers worldwide. 10

Table 1. B2C E-Commerce Sales Worldwide by Region, (values in billion US$)

Region 2012 2013 2014 2015 2016 2017 Asia-Pacific 301.2 383.9 525.2 681.2 855.7 1,052. North America 379.8 431.0 482.6 538.3 579.9 660. Western Europe 277.5 312.0 347.4 382.7 414.2 445. Central & Eastern Europe

41.5 49.5 58.0 64.4 68.9 73.

Latin America 37.6 48.1 57.7 64.9 70.6 74. Middle East &Africa

37.6 48.1 57.7 64.9 70.6 74.

Worldwide 1,058.2 1,251.4 1,504.6 1,771.0 2,052.7 2,357. Source: E-Commerce Across Asia - Trends and Developments 2014 - Asia Briefing, pg. 4

Understanding consumer demographics and spending habits is quickly becoming the key to identifying strategic growth markets. While reliable statistics on online shoppers in the Asia- Pacific region are still limited, analysts suggest they closely resemble their European and North American counterparts who come from the middle class and between the ages of 25 and 64.^11

Existing rules and regulations on the entry of foreign investments in e-commerce activities in some countries are considered as major deterrents to the expansion of e-commerce in the region. Some of the most promising markets for foreign investment in e-commerce remain off- limits to foreign companies, such as in India. Some may even feature significant barriers to

(^7) – Demandware and Singapore (2015). Developing eCommerce Market Entry Strategies in Asia-Pacific – Advisory Report 2015. Retrieved

October 26, 2015, from http://www.demandware.fr/uploads/resources/Whitepaper_MarketEntryAsia_ENG.pdf (^8) – International Telecommunication Union. (2015, May 1). ICT Facts and Figures. Retrieved October 26, 2015, from

http://www.itu.int/en/ITU-D/Statistics/Documents/facts/ICTFactsFigures2015.pdf 9

2015, from http://www.physeon.eu/wp-content/uploads/2013/01/E-commerce-across-asia-trends-developments-2014.pdf (^11) – Asia Briefing/Dezan Shira& Associates (2014, May 9). E-commerce Across Asia: Trends and Developments 2014. Retrieved October 26,

2015, from http://www.physeon.eu/wp-content/uploads/2013/01/E-commerce-across-asia-trends-developments-2014.pdf

(32% penetration) in 2014. This figure is expected to rise to 294 million (48% penetration) within three (3) years. 18 The ASEAN is also leading the world in terms of social media use. 19

Despite the millions of users and increasing internet penetration, most people in the region still prefer shopping in brick and mortar than online. Less than one of six consumers from the region purchase online 20 which is due to the fact that shopping in malls has become part of the routine of consumers.

Improvements on internet infrastructure should also be considered in order to maximize the potential of e-commerce in Southeast Asia. The speed of internet in ASEAN is relatively low compared to other regions but is surprisingly more expensive. The Philippines lags behind other ASEAN countries in terms of internet speed with an average of 3.6 Mbps while Singapore has 61 Mbps outspeeding even the USA (22.3 Mbps) and Japan (41.7 Mbps).

Figure 2. ASEAN Average Internet Speed Index 2014

Source: http://www.aseanbriefing.com/news/2014/04/24/internet-speeds-across-asean.html

In terms of laws and regulations, ASEAN countries have individual legislations governing e- commerce but there are no laws that oversee cross-border trading and other regional e- commerce activities. Harmonizing these individual laws will promote growth, competitiveness and safeguard the areas of e-transactions, consumer protection, data protection and privacy, cybercrime, content regulation, domain names and dispute resolution, as well as cloud computing policy. 21

(^18) – UBS. (2014, June 13). ASEAN eCommerce - Is ASEAN at an inflection point for eCommerce? Retrieved October 26, 2015, from http://simontorring.com/wp-content/uploads/UBS-report-2014.pdf 19

2015, from http://unctad.org/en/PublicationsLibrary/dtlstict2013d1_en.pdf

Table 3. Status of E-Commerce Law Harmonization in ASEAN as of March 2013

Country e-Transactions Privacy Cybercrime ConsumerProtection RegulationContent DomainNames Brunei Darussalam Enacted^ None^ Enacted^ Partial^ Enacted^ Enacted Cambodia Draft None Draft None Draft Enacted Indonesia Enacted Partial Enacted Partial Enacted Enacted Laos Enacted None None Draft Enacted Partial Malaysia Enacted Enacted Enacted Enacted Enacted Enacted Myanmar Enacted None Enacted Enacted Enacted Enacted Philippines Enacted Enacted Enacted Enacted

Provisions in some existing laws

Enacted

Singapore Enacted Enacted Enacted Enacted Enacted Enacted Thailand Enacted Partial Enacted Enacted Partial Partial Viet Nam Enacted Partial Enacted Enacted Enacted Enacted Source: Review of E-commerce Legislation Harmonization in the Association of Southeast Asian Nations, pg. xi

The Electronic Commerce Act (ECA) or Republic Act No. 8792 was signed into law on 14 June 2000 by President Joseph Ejercito Estrada. The law gave legal recognition to electronic forms of data messages, documents, signatures, transactions, storage of information. It provided penalties for access of data without consent, piracy, hacking, and other violation. Provisions on DTI’s authority, under Section 29 of R.A. 8792, gave the DTI the authority to direct and supervise the promotion and development of e-commerce in the country with relevant government agencies.

The law was instrumental, in addition to other policies, in driving investments into the business process outsourcing (BPO) sector. At that time, these investments were referred to as e-commerce back-office operations. It is known today as the Information Technology- Business Process Management (IT-BPM) sector, which recorded US$18.1 billion revenues in

Figure 4. Industry Performance of IT-BPM (2006 – 2014)

Source: Board of Investments

Information Technology and Electronic Commerce Council (ITECC)

On 12 July 2000, the Information Technology and Electronic Commerce Council (ITECC) was formed through Executive Order No. 264 - “Establishing the Information Technology and E- commerce Council (ITECC) from the merger of the National Information Technology Council (NITC) and the Electronic Commerce Promotion Council (ECPC).” The ITECC was chaired by DTI Secretary Manuel A. Roxas II and Jaime Augusto Zobel De Ayala, as the private sector co-chair. The day after, 13 July 2000, the ECA’s Implementing Rules and Regulations (IRR) were issued.

In 2001, ITECC was restructured through the issuance on 25 May 2001 of Executive Order No. 18 - “Amending Certain Portions of Executive Order No. 264, Series of 2000.” President Gloria Macapagal-Arroyo became the Chairperson with DTI Secretary Roxas and Presidential Adviser on International Competitiveness Ambassador Roberto R. Romulo as co-chairs for the government and the private sector, respectively.

2006 2007 2008 2009 2010 2011 2012 2013 2014 Revenue (US$ Billion) 3.4 4.5 6.1 7.1 8.9 11 13.2 16.1 18. YoY Growth (^) 45% 32% 36% 16% 25% 24% 19% 22% 17%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

0

2

4

6

8

10

12

14

16

18

20

Employment ('000) Revenue (in USD billion)

IT-BPM Industry Performance

ITECC committees were formed to address issues and gaps, help drive investments into the ICT outsourcing sector, and move towards e-government implementation as mandated under the E-Commerce Law. These committees were the Business Development Committee, e- Government Implementation Committee, Information Infrastructure Committee, Human Resource Development Committee, and the Legal and Regulatory Committee, each of which was co-chaired by government and private sector representatives. Supporting ITECC and its committees was an auxiliary Communications Committee in charge of advocacy and information dissemination. Under ITECC, various offices/units of DTI and other government agencies actively participated as members of its committees.

Various programs were undertaken by ITECC during this period. One of its biggest achievements was the creation of the E-Government Fund to support the implementation requirements as indicated in the E-Commerce Law and other related policies. Specifically, it is a source of funding for strategic ICT projects of government that are mission-critical, high- impact and cross-agency in nature.

ITECC was subsequently dissolved with the issuance on 20 July 2004 of Executive Order No. 334, “Abolishing the Information Technology and Electronic Commerce Council and Transferring Its Budget, Assets, Personnel, Programs, and Projects to the Commission on Information and Communications Technology.”

Commission on Information and Communications Technology (CICT)

The Commission on Information and Communication Technology (CICT) was created on 12 June 2004 through Executive Order No. 269- “Creating the Commission on Information and Communications Technology (CICT).” CICT, which was attached to the Office of the President, was the "primary policy, planning, coordinating, implementing, regulating, and administrative entity of the executive branch of Government that will promote, develop, and regulate integrated and strategic ICT systems and reliable and cost-efficient communication facilities and services." Section 4(n) of the EO stipulated the CICT’s function to “harmonize, synchronize and coordinate with appropriate agencies all ICT and e-commerce policies, plans and programs.” Section 4(e) gave CICT the mandate to “provide an integrating framework and oversee the identification and prioritization of all e-government systems and applications as provided for in the Government Information Systems Plan; manage and/or administer the e- Government Fund, which shall be institutionalized and included in the proposed annual national budget.”

Under the administration of President Benigno C. Aquino III, CICT was moved under the Department of Science and Technology (DOST) and renamed as the Information and Communications Technology Office (ICTO) (Executive Order No. 47, “Reorganizing, Renaming and Transferring the Commission on Information and Communications Technology and its Attached Agencies to the Department of Science and Technology, Directing the Implementation Thereof and for Other Purposes,” issued 23 June 2011).

Congressional Oversight Committee for the E-Commerce Law (COCEC)

The E-Commerce Act created the Congressional Oversight Committee for the E-Commerce Law (COCEC) to oversee and monitor the implementation of the law. It was activated in three

Other Policy Issuances and Government Initiatives

In 2012, the Data Privacy Act (Republic Act No. 10173) and Cybercrime Law (Republic Act No.

In relation, several government agencies such as the Department of Science and Technology (DOST), through the ICTO, has set off the formulation of a National Broadband Plan (NBP) as a segment of its Philippine Digital Masterplan that aims to improve the country’s internet infrastructure (e.g., speed, access, connectivity, etc.).

Moreover, DOST initiated the Integrated Government Philippines (iGovPhil) Project, which aims to establish, upgrade and improve government ICT infrastructure, systems and ICT- related procedures to allow for integrated government operations.

Similarly, the Bangko Sentral ng Pilipinas (BSP) or the Central Bank of the Philippines has also put in place a new system to facilitate the country’s retail payments, which was deemed to be a significant contributor to the stability and efficiency of the Philippine financial system. The National Retail Payment System (NRPS) is geared to support the migration from cash- and check-based payments to electronic payment, with the aim to have a safer, more efficient and reliable payment system.

Relevant laws, rules and regulations, policies and guidelines were enacted and issued to support the implementation of the E-Commerce Act. (Refer to Annex)

The formulation of the Philippine E-Commerce Roadmap 2016-2020 is deemed critical in addressing challenges encountered by various sectors as e-commerce becomes prevalent in our daily lives and business operations. Itis focused on needed policies and programs to solve present challenges, categorized according to the six (6) I’s of the APEC Digital Prosperity Checklist.

So far, the official data on e-commerce released by the Philippine Statistics Authority was as of 2012: 26

“E-commerce refers to the selling of products or services over electronic systems such as the Internet Protocol-based networks and other computer networks. This is a new data item gathered in the 2012 Census of Philippine Business and Industry (CPBI). E- commerce sales in 2012 reached PHP79.00 billion, accounting for 0.6 percent of total income in 2012.

Among the three industry groups, Services sector reported the highest sales through e- commerce amounting to PHP60.17 billion or 76.2 percent share to the total e- commerce sales in 2012. Eighty-nine percent of these were contributed by Transport and Storage registering PHP53.42 billion sales from e-commerce. Administrative and Support Service Activities recorded PHP2.63 billion or 4.4 percent share and Wholesale and retail trade with PHP2.00 billion or 3.3 percent share to the total e-commerce sales of the Services sector.

No e-commerce sales were reported for Real Estate Activities, Professional, Scientific and Technical Activities, Human Health and Social Work Activities as well as for Agriculture sector in 2012.

Among Industry sector, only Manufacturing reported e-commerce sales amounting to PHP18.8 billion. This accounts for 0.3 percent of the total income of the Industry sector in 2012.

The top three regions in terms of e-commerce sales were NCR with PHP62.31 billion (78.9%) or 0.9 percent of the total income of the region, Central Visayas with PHP11. billion (14.0%) and Western Visayas with PHP2.44 billion (3.1%). However, no e- commerce sales were reported for Eastern Visayas and ARMM.”

As more countries measure the impact of their internet economy in relation to their GDP, the action agenda listed in the PECR views e-commerce as an economic growth enabler and the Philippines’ competitive advantage.

(^26) Philippine Statistics Authority