Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Learn about forecasting and forecasting methods in statistic world.

Typology: Lecture notes

1 / 30

This page cannot be seen from the preview

Don't miss anything!

Lesson 1: Forecasting

Lesson 2: Qualitative Techniques

Lesson 3: Quantitative Techniques

3.1 Straight-Line Method

3.2 Moving Average

Forecasting is a process of estimating a future event by casting

forward past data. The past data are systematically combined in a

predetermined way to obtain the estimate of the future. In business

applications, forecasting serves as a starting point of major decisions

in finance, marketing, productions, and purchasing.

This module contains what forecasting is, its importance, the

qualitative and quantitative forecasting and its types or models.

At the end of this module, you will be able to:

A forecast is an estimate of a future event achieved by systematically

combining and casting forward in predetermined way data about the past. It

is simply a statement about the future. It is clear that we must distinguish

between forecast per se and good forecasts. Good forecast can be quite

valuable and would be worth a great deal. Long-run planning decisions

require consideration of many factors: general economic conditions, industry

trends, probable competitor’s actions, overall political climate, and so on.

Forecasts are possible only when a history of data exists.

In general, when business people speak of forecasts, they usually

mean some combination of both forecasting and prediction. Forecasts are

often classified according to time period and use. In general, short-term (up

to one year) forecasts guide current operations. Medium-term (one to three

years) and long-term (over five years) forecasts support strategic and

competitive decisions.

Bear in mind that a perfect forecast is usually impossible. Too many

factors in the business environment cannot be predicted with certainty.

Therefore, rather than search for the perfect forecast, it is far more

important to establish the practice of continual review of forecasts and to

learn to live with inaccurate forecasts. This is not to say that we should not

try to improve the forecasting model or methodology, but that we should try

to find and use the best forecasting method available, within reason.

Because forecasts deal with past data, our forecasts will be less reliable the

further into the future we predict. That means forecast accuracy decreases

as time horizon increases. The accuracy of the forecast and its costs are

interrelated. In general, the higher the need for accuracy translates to higher

costs of developing forecasting models. So how much money and manpower

is budgeted for forecasting? What possible benefits are accrued from

accrued from accurate forecasting? What are possible cost of inaccurate

forecasting? The best forecast are not necessarily the most accurate or the

Businessmen use various qualitative and quantitative demand forecasting

techniques to predict future demand for products and accordingly take

business decisions.

Forecasts are needed for marketing, production, purchasing,

manpower, and financial planning. Further, top management needs forecasts

for planning and implementing long-term strategic objectives and planning

for capital expenditures.

The following are the general steps in forecasting:

1) Identify the general need

2) Select the Period (Time Horizon) of Forecast

3) Select Forecast Model to be used : For this, knowledge of

various forecasting models, in which situations these are applicable, how

reliable each one of them is; what type of data is required. On these

considerations; one or more models can be selected.

4) Data Collection: With reference to various indicators identified-

collect data from various appropriate sources-data which is compatible with

the model(s) selected in step(3). Data should also go back that much in past,

which meets the requirements of the model.

5) Prepare forecast: Apply the model using the data collected and

calculate the value of the forecast.

6) Evaluate: The forecast obtained through any of the model should

not be used, as it is, blindly. It should be evaluated in terms of ‘confidence

interval’ – usually all good forecast models have methods of calculating

upper value and the lower value within which the given forecast is expected

to remain with certain specified level of probability. It can also be evaluated

from logical point of view whether the value obtained is logically feasible? It

can also be evaluated against some related variable or phenomenon. Thus, it

is possible, sometimes advisable to modify the statistically forecasted’ value

based on evaluation.

Lesson 2: Qualitative Techniques in Forecasting

Qualitative forecasting is an estimation methodology that uses expert

judgment, rather than numerical analysis. This type of forecasting relies

upon the knowledge of highly experienced employees and consultants to

provide insights into future outcomes. This approach is substantially different

from quantitative forecasting, where historical data is compiled and analyzed

to discern future trends. Qualitative forecasting is most useful in situations

where it is suspected that future results will depart markedly from results in

prior periods, and which therefore cannot be predicted by quantitative

means.

Another situation in which qualitative forecasting can be useful is in

the assimilation of large amounts of narrowly-focused local data to discern

trends that a more quantitative analysis might not find.

This approach also works well when a course of action must be derived

from inadequate data.

The results produced by qualitative forecasting can be biased, for the

following reasons:

historical events in extrapolating future trends.

Market research ranges from consumer surveys to interviews to panels

which all provide subjective, qualitative information. Many consumer product

companies use market research as their primary forecasting tool.

For example, a personal trainer may want a better idea of what people

look for in a trainer. There are plenty of websites to mine public opinion such

as Quora, Reddit and Facebook groups. For example, a trainer could jump on

Reddit and analyze any number of subreddits like /r/fitness, /r/bodybuilding

or /r/running to get niche (and often candid) information or post questions

himself. Once he’s familiar with the group, he can even post a link to a

custom survey.

Panel Consensus

In a panel consensus, the idea that two heads are better than one is

extrapolated to the idea that a panel of people from a variety of positions

can develop a more reliable forecast than a narrower group. Panel forecasts

are developed through open meetings with free exchange of ideas form all

levels of management and individuals.

The difficulty with this open style is that lower employee levels are

intimidated by higher levels of management.

For example, a salesperson in a particular product line may have a

good estimate of future product demand but may not speak up to refute a

much different estimate given by the vice president of marketing. The Delphi

technique (which we discuss shortly) was developed to try to correct this

impairment to free exchange.

When decisions in forecasting are at a broader, higher level (as when

introducing a new product line or concerning strategic product decisions

such as new marketing areas) the term executive judgment is generally

used. The term is self-explanatory: a higher level of management is involved.

Historical Analogy

The historical analogy method is used for forecasting the demand for a

product or service under the circumstances that no past demand data are

available. This may specially be true if the product happens to be new for the

organization. However, the organization may have marketed product(s)

earlier which may be similar in some features to the new product. In such

circumstances, the marketing personnel use the historical analogy between

the two products and derive the demand for the new product using the

historical data of the earlier product. The limitations of this method are quite

apparent. They include the questionable assumption of the similarity of

demand behaviors, the changed marketing conditions, and the impact of the

substitutability factor on the demand.

Delphi Method

As mentioned under panel consensus, a statement or opinion of a

higher-level person will likely be weighted more than that of a lower-level

person. The worst case in where lower level people feel threatened and do

not contribute their true beliefs. To prevent this problem, the Delphi method

conceals the identity of the individuals participating in the study. Everyone

has the same weight. A moderator creates a questionnaire and distributes it

to participants. Their responses are summed and given back to the entire

group along with a new set of questions.

The Delphi method was developed by the Rand Corporation in the

1950s. The step-by-step procedure is

knowledgeable people in different areas.

premises or qualification captions for the forecasts) from all participants.

along with appropriate new questions.

Forecasting.

best?

It is a statistical technique to make predictions about the future which

uses numerical measures and prior effects to predict future events. These

techniques are based on models of mathematics and in nature are mostly

objective. They are highly dependent on mathematical calculations.

There are many different quantitative models to choose from and

selecting the most beneficial strategy will vary depending on the company's

situation and goals.

The main advantage of utilizing quantitative techniques is based on

available hard data. This ensures forecasting results are as objective as

possible, as the importance is placed on numerical information and

quantifiable past performance rather than the opinions of industry experts or

customers.

The more historical sales data a company has to work with, the more

reliable the forecasting results will be, as they'll have a better chance of

producing accurate seasonal averages throughout the years.

For example, a business could accurately predict how much a

particular product is likely to sell within a specific period of time, purely

based on past performance and previous sales information.

This method of forecasting requires more than just a few quick glances at

charts and other past data; some approaches may require more complex

calculations than others.

There are many techniques or models in Quantitative forecasting. Here

are the main classes of quantitative models used by companies to forecast.

I. Time Series Models

i. Trend Projection (long term)

ii. Decomposition methods (intermediate term)

iii. Smoothing methods (short term)

a. Exponential smoothing

b. Naïve forecasting

II. Causal Models

Random variations: Erratic and unpredictable variation in the data

over time with no discernable pattern.

Trend Projection (long term)

The trend projection method is based on the assumption that the

factors liable for the past trends in the variables to be projected shall

continue to play their role in the future in the same manner and to the same

extent as they did in the past while determining the variable’s magnitude

and direction.

In predicting demand for a product, the trend projection method is

applied to the long time-series data. A long-standing firm can obtain such

data from its departments (such as sales) and the books of accounts. While

the new firms can obtain data from the old firms operating in the same

industry. The trend projection method includes three techniques based on

the time-series data. These are:

the annual sales data are plotted on a graph, and a line is drawn

through these plotted points. A free hand line is drawn in such a way

that the distance between points and the line is the minimum. Under this

method, it is assumed that future sales will assume the same trend as

followed by the past sales records. Although the graphical method is

simple and inexpensive, it is not considered to be reliable. This is because

the extension of the trend line may involve subjectivity and personal bias

of the researcher.

method is a formal technique in which the trend-line is fitted in the

time-series using the statistical data to determine the trend of demand.

The form of trend equation that can be fitted to the time-series data can

be determined either by plotting the sales data or trying different forms of

the equation that best fits the data. Once the data is plotted, it shows

several trends. The most common types of trend equations are:

Linear Trend: when the time-series data reveals a rising or a linear

trend in sales, the following straight line equation is fitted: F = a + bt

Where S = annual sales; T = time (years); a and b are constants.

Exponential Trend: The exponential trend is used when the data

reveal that the total sales have increased over the past years either at

an increasing rate or at a constant rate per unit time.

method used for short-term predictions and projections. This method is

often used with stationary time-series sales dat a. A stationary time-

series data is the one which does not reveal a long term trend. In other

words, Box-Jenkins method is used when the time-series data reveal

monthly or seasonal variations that reappear with some degree of

regularity.

Thus, these are the commonly used trend-projection methods that tell

about the trend of demand for a product and are based on a long and

reliable time-series data.

When a time series reflects a shift from a stationary pattern to real

growth or decline in the time series variable of interest (e.g., product

demand or student enrollment at the university), that time series is

demonstrating the trend component. The trend projection method of time

January 1 1000

February 2 1150

March 3 1200

April 4 1240

May 5 1300

June 6 1310

July 7 1350

August 8?

The output will be as follows:

Month Period (t)

Actual Demand

(y)

ty (^) t

2

January 1 1000 1000 1

February 2 1150 2300 4

March 3 1200 3600 9

April 4 1240 4960 16

May 5 1300 6500 25

June 6 1310 7860 36

July 7 1350 9450 49

∑t = 28 ∑ y = 8550 ∑ ty = (^35670) ∑t

2 = 140

b = n ¿ ¿

b =

2

a =

∑ y − b^ (∑ t ¿)

n

The slope = b = 52.5, the y-intercept = a = 1011.429.

So the linear trend equation is: Ft =1011.429+52.5^ t

To find the forecast for August, we plug in t=8 in the above equation as

follows:

t

Ft =1431.429= 1431

∴The demand forecast for themonth of August is 1431.

The linear trend equation is known as the Slope-Intercept Form in Algebra.

Exponential smoothing

Exponential smoothing was proposed in the late 1950s (Brown, 1959;

Holt, 1957; Winters, 1960), and has motivated some of the most successful

forecasting methods. Forecasts produced using exponential smoothing

methods are weighted averages of past observations, with the weights

decaying exponentially as the observations get older. In other words, the

more recent the observation the higher the associated weight. This

framework generates reliable forecasts quickly and for a wide range of time

Feb 1,

Mar 1,

Apr 1,

May 1,

Jun 1,

Jul?

a) What is we use a 3-month simple moving average?

Jul

Jun

May

Apr

b) What is we use a 5-month simple moving average?

Jul

Jun

May

Apr

Mar

Feb

Jul

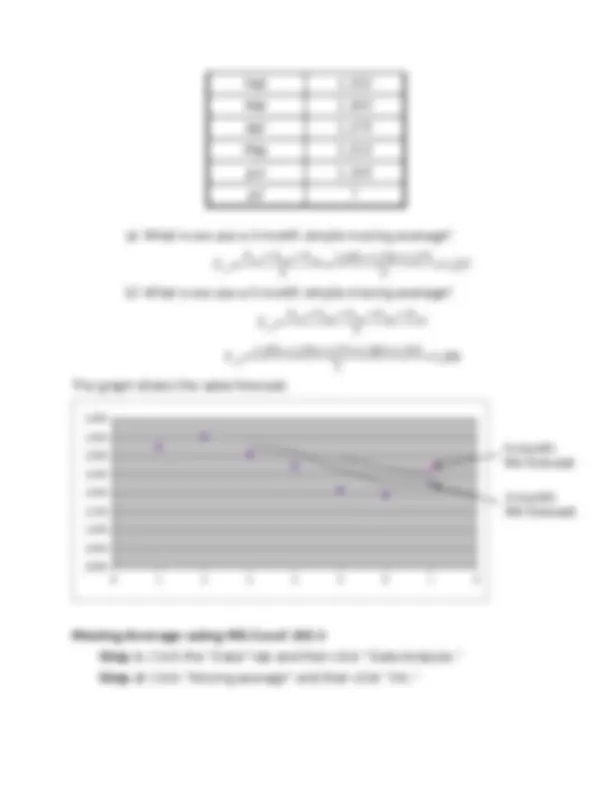

The graph shows the sales forecast:

0 1 2 3 4 5 6 7 8

1000

1050

1100

1150

1200

1250

1300

1350

1400

Moving Average using MS Excel 2013

Step 1: Click the “Data” tab and then click “Data Analysis.”

Step 2: Click “Moving average” and then click “OK.”

3-month

MA forecast

5-month

MA forecast

Step 3: Click the “Input Range” box and then select your data. If you

include column headers, make sure you check the Labels in first Row

box.

Step 4: Type an interval into the box. An interval is how many prior

points you want Excel to use to calculate the moving average. For

example, “5” would use the previous 5 data points to calculate the

average for each subsequent point. The lower the interval, the closer

your moving average is to your original data set.

Step 5: Click in the “Output Range” box and select an area on the

worksheet where you want the result to appear. Or, click the “New

worksheet” radio button.

Step 6: Check the “Chart Output” box if you want to see a chart of your

data set (if you forget to do this, you can always go back and add it or

choose a chart from the “Insert” tab.”

Step 7: Press “OK.” Excel will return the results in the area you

specified in Step 6.

Illustrative Example 3: Simple Moving Average using MS Excel

Analyze the company’s revenue for 11months and make a forecast for the

twelfth month.

Month Revenues (in

millions)