Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Given are some of the problems on how to deal with accounting for Inventory.

Typology: Exercises

1 / 2

This page cannot be seen from the preview

Don't miss anything!

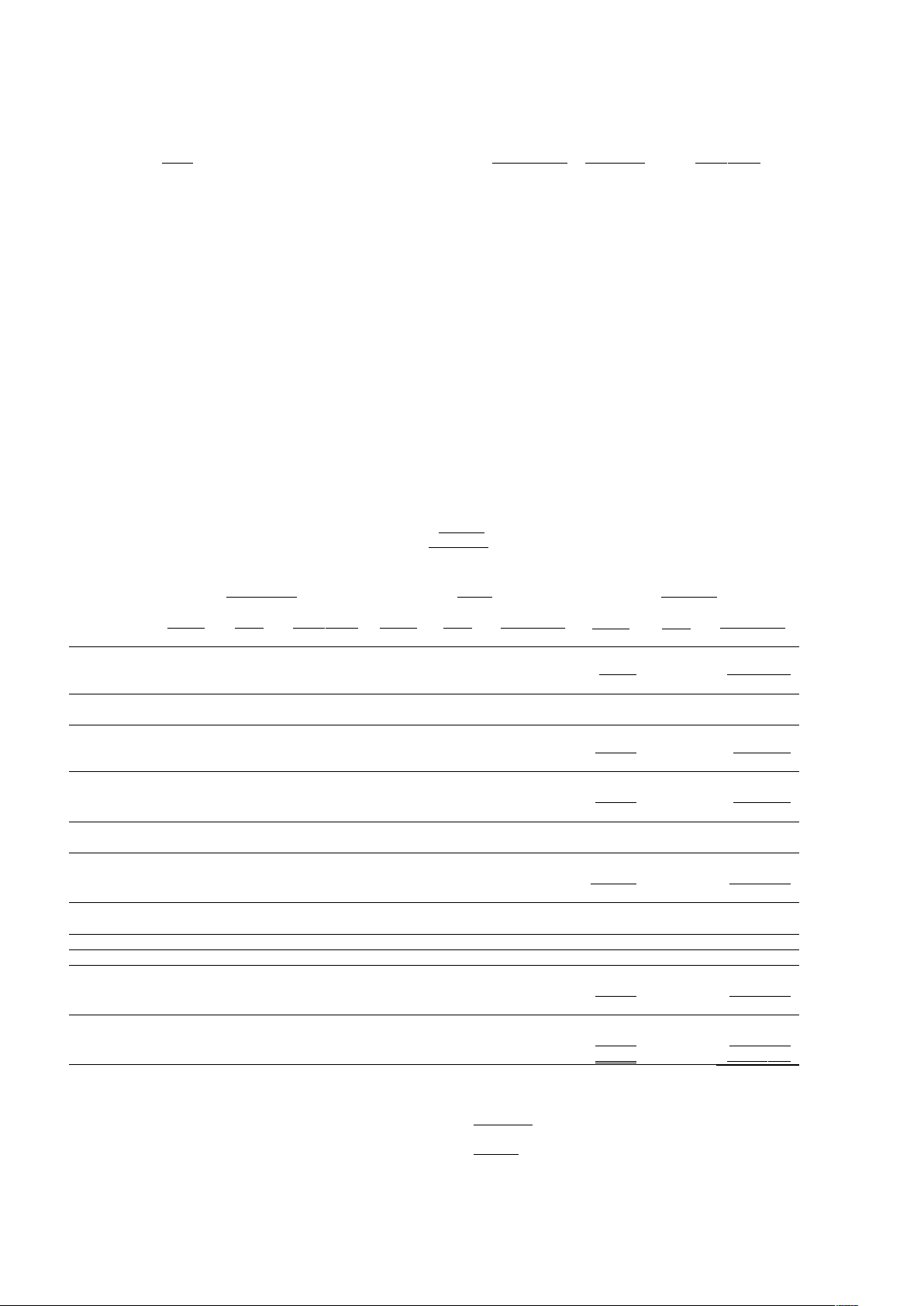

Answer key Activity on Accounting for Inventories The following information has been extracted from the records of Praktis Corporation about one of its products. Date No. of Units Unit Cost Total Cost January 1 Beginning balance 1,600 P14.00 P22, January 6 Purchased 600 14.10 8, February 5 Sold @ P24.00 per unit 2, March 19 Purchased 2,200 14.70 32, March 24 Purchase returns 160 14.70 2, April 10 Sold @ P24.20 per unit 1, June 22 Purchased 16,800 15.00 252, July 31 Sold @ P26.50 per unit 3, August 4 Sales returns @ P26.50 per unit 40 September 4 Sold @ P27.00 per unit 7, November 15 Purchased 1,000 16.00 16, December 28 Sold @ P30.00 per unit 6, REQUIRED: Compute for the closing inventory under each of the following pricing methods. (Round unit costs to two decimal places.)

FIFO – Perpetual Purchases Sales Balance Unit Unit Unit Jan. 1 Units Cost Total Cost Units Cost Total Cost Units 1, Cost

Total Cost 22, Jan. 6 600 14.10 8,460 1,600 14.00 22, 600 14.10 8, 2,200 30, Feb. 5 1,600 14.00 22, 400 14.10 5,640 200 14.10 2, Mar. 19 2,200 14.70 32,340 200 14.10 2, 2,200 14.70 32, 2,400 35, Mar. 24 (160) 14.70 (2,352) 200 14.10 2, 2,040 14.70 29, 2,240 32, Apr. 10 200 14.10 2, 1,200 14.70 17,640 840 14.70 12, Jun. 22 16,800 15.00 252,000 840 14.70 12, 16,800 15.00 252, 17,640 264, Jul. 31 840 14.70 12, 2,760 15.00 41,400 14,040 15.00 210, Aug. 4 (40) 15.00 (600) 14,080 15.00 211, Sep. 4 7,000 15.00 105,000 7,080 15.00 106, Nov. 15 1,000 16.00 16,000 7,080 15.00 106, 1,000 16.00 16, 8,080 122, Dec. 28 6,200 15.00 93,000 880 15.00 13, 1,000 16.00 16, 1,880 2 9,

Total cost (1,880 units x P14.92) - P28,0 50 Weighted average unit cost (P328,848/22,040 units) - P14.

Jan. 1 Units Purchases Unit Cost Total Cost Units Sales Unit Cost Total Cost Units 1, Balance Unit Cost

Total Cost 22, Jan. 6 600 14.10 8,460 1,600 14.00 22, 600 14.10 8, 2,200 14.03 30, Feb. 5 2,000 14.03 28,060 200 14.03 2, Mar. 19 2,200 14.70 32,340 200 14.03 2, 2,200 14.70 32, 2,400 14.64 35, Mar. 24 (160) 14.70 (2 352) 200 14.03 2, 2,040 14.70 29, 2,240 14.64 32, Apr. 10 1,400 14.64 20,496 840 14.64 12, Jun. 22 16,800 15.00 252,000 840 14.64 12, 16,800 15.00 252, 17,640 14.98 264, Jul. 31 3,600 14.98 53,928 14,040 14.98 210, Aug. 4 (40) 14.98 (599) 14,080 14.98 210, Sep. 4 7,000 14.98 104,860 7,080 14.98 106, Nov. 16 1,000 16.00 16,000 7,080 14.98 106, 1,000 16.00 16, 8,080 15.11 122, Dec. 28 6,200 15.11 93,682 1,880 15.11 28,