Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

It shows the effect effec OF MONEY LENDING INSTITUTIONS TO SMEs

Typology: Thesis

1 / 38

This page cannot be seen from the preview

Don't miss anything!

During these hard times, a lot of people would seek the help of those engaged in money lending business. It’s a way to help support their families, to support financial needs of micro- entrepreneurs and to ease poverty. This research study aims to know the effectiveness of informal money lending business to the micro-entrepreneurs. Informal money lenders are money lenders who are not licensed to do money lending business. They are also called “5-6 money lenders” and are well known about this kind of informal lending business which is patronized by some micro-entrepreneurs and people who wants to put-up a new business in urban areas. “5-6” is the term used in such a reason that they lend money with 20% interest. Like for example, if you borrow from them worth 500 pesos, you will be returning it at the amount of 600 pesos or 20% interest rate within one month or upon the agreed condition. Micro-entrepreneurs are the most patronizing party in this form of business because they are the ones who are in needs of financial capital for the daily financing activities of their businesses. In order for us to understand and give us the idea why do they are more preferred to borrow in Bombay than other formal institutions, the selected researchers wish to understand and measure the effects of this form of business to them, the advantages and the disadvantages. In order to find ways in understanding the behavior of micro-entrepreneurs and to identify and recommend solution for the problem encountered between informal money lenders and micro-entrepreneurs, researchers conduct this research study to know more about the strengths, weaknesses and threats of the informal money lending business and in order to formulate reasonable decision that will lead to the competitive advantages in the informal money lending business. Researchers try to study and analyze if the informal money lending business if it is recommendable or not to the micro-entrepreneurs and to the general public.

As a developing country, the Philippines have a large informal sector as comprised of micro-enterprises and there are nearly 21.5 million micro entrepreneurs in the Philippines. Micro entrepreneurs are the owners of small businesses that have fewer than five employees and have start up costs of less than 10,000 pesos and with annual revenue less than 15,000 pesos. Examples of micro-enterprise are bakeries, beauty salon, child care facilities, repair shops, arts and crafts shops, painting businesses, contracting businesses, family-owned shops, auto body shops, small-scale restaurants, and small-inventory trading businesses whose survival in the business relies heavily on access to micro-financing businesses. These micro-financing businesses usually comes from the informal money lending business called “5-6” lending business and this is why researcher conduct this study that will give central attention to the effect of informal money lenders to the micro-entrepreneurs in Barangay Batasan Hills, Quezon City for the reason of Informal financier exist because there is a strong demand for them. (Mari Kondo, 2006) The judicial or extrajudicial demand under and subject to the provisions of Article 1169 of the Civil Code that in the absence of stipulation between the creditors and money lenders on the rate of interest payable, the rate of interest will be 12% per annum. It means that if both money lenders and creditors did not agree on interest payable, automatically, the interest is 12% but if they agreed on interest payable under the Article 1856 of the Civil Code, the interest due is what has been stipulated upon them. The agreed interest must have been expressly stipulated in writing. (Hector M. de Leon Jr, 2009) Barangay Batasan Hills is one who has the biggest micro-entrepreneur populations in the Phillipines; micro-entrepreneurs are the one who borrow money from “5-6’ or informal money lending business. Most of the micro-entrepreneurs are borrowing money from informal money lenders due to lack of capital to start up their businesses or to support the day to day activities of their businesses. ( EzineArticles.com)

spaces at the back of public market together with the other vendors and the third are the stall vendors , they are required to be residents of the place where the market is and pay P15, 000 per stall annually. If the vendors are not genuine residents, they will pay P20, 000 annually to the stall owner. Mari Kondo explained that informal sector of micro-entrepreneurs which are the severely restricted small vendors operating in public markets are relies heavily on informal money lenders that serve as access to their financing aspect in order to survive their business. The theory of Mari Kondo will guide and lead the researchers in answering the formulated problems that they encounter and to know the strength, weakness, opportunity and threats (SWOT) in the research which is all about the micro-entrepreneurs and informal money lenders who provides their financial needs.

The conceptual model that will be used in this research study is the input-process-output model where it shows the series of boxes that are connected to each other. FIGURE 1. Paradigm of the Study

Demographic profile of the respondents Age Gender Civil Status Number of Family Members Residential Type Source of Income Source of Loan Monthly Income Statement of the problem Reasons of borrowing money from informal money lenders Amount that can be borrow from informal money lenders Terms and conditions applied to each micro- entrepreneurs who borrow money from in formal money lenders The advantages and disadvantages on the part of micro-entrepreneurs when they transact with informal money lenders Questionnaire Interview Tabulation To understand the behaviour of micro- entrepreneurs in order to find the strengths, threats and weaknesses of the business. Identify and recommend solution for the problem encountered between informal money lenders and micro- entrepreneurs. Conclusion for the subject matter of this study.

Specific Problems: Specifically it sought to answer the following sub problems:

The researchers strongly believed that this research study will provides a vital information and importance to the following: To the Business Students. This study will give information to the business students that will serve as their source of information on the strength and weaknesses and in developing strategy about money lending business. To the Micro-entrepreneurs who are Planning to Borrow Money from Informal Money Lenders. The result of this study may give awareness to micro-entrepreneurs who are planning to borrow money from informal money lenders in relation to the effect of informal money lenders in their business and how they will react in this situation. To the Money Borrowers. The study will help them look into possible situations that may guide them in deciding whenever they borrow money. To the Local Government. Hopefully, this study and its result may lead to the local government officials in implementing some laws and regulations that will help the micro - entrepreneurs in supporting their business. DEFINITION OF TERMS

1. Lender - any institution or individual who loans borrower money. 2. Micro Entrepreneurs - Micro entrepreneurs are the owners of small businesses that have fewer than five employees and have start up costs of less than 10,000 pesos and also annual revenue less than 15,000 pesos. There are nearly 21.5 million

16. Rolling store vendors – they sell foods, dresses, or shoes in a customized vehicle, eliminating the need to rent a stall. They occupy spaces at the back of public market together with the other vendors. 17. Stall vendors – are required to be residents of the place where the market is and pay P15, 000 per stall annually if the vendors are not genuine residents will pay P20, 000 annually to the stall owner.

Related Studies and Literature This Chapter presents the current study into the context of previous related research. It deals with the Related Literature and Studies which are great help to the researcher in carrying out the study.

the village and have to use other means to overcome the information problems like traditional screening methods, collateral, written contracts or middlemen. *****Manny Canto** stated on his article entitled “ In Depth ” that “it is an open secret that these Indian Nationals are doing business all over the Philippines and their business is within the ambit of economy. According to his research “Underground Economy: refers to the part of the economy that generates income, but goes untaxed. *****Godofredo Rompers** in his Sun Star comment on taxing “5-6” lenders. He states that “money lending among those whom the banks, would never extend a loan to, and those who believe borrowings from the banks is a lot of paper work and red tape, is a highly lucrative business operation, able it a lot of hard work, sacrifice and patience. Interest, I think it is well worth their sacrifice and patience. This kind of lending that is all over the rural areas is operated only by the so- called “ Bombay” or the Indian Nationals. ****The Great Greek Philosopher Aristotle has openly expressed his opposition against Money Lending on interest. He says: ‘’Money maybe a useful instrument of exchange but when it tempts people to pile up unused gains or accumulate wealth by lending money, it is sterile or unproductive and it promotes disparity in riches and financial irregularities.” ** The informal money lenders remains dominant, whenever the borrowers need then they always there to lend money. The study shows that we see money lenders in different places and it is an opportunity to conduct a study that will help to the micro- entrepreneurs. ** building relationship between the informal money lenders and borrowers will gain trust and loyalty. This is one of the factors also, why some of informal money lenders had a flexible operation. *** Indians or the Bombay’s originate the informal money lending in the Philippines. They are the one who started it and some of the Filipino impersonated it. That is there are two type of informal money lenders exist in this country. *** One of the reasons why most of the micro-entrepreneurs preferred to borrow money from informal money lenders is a lot paper works. It takes time to entrepreneurs who want a started capital of less 10, 000 for his/her business. Some of them are belong to the below poverty lines.

******Eugine Matura** from Kigali in her write up about informal money lending stated that “this illegal money lending has high side effects because it affects property and individual’s security as well as crippling the nation’s economy”. Legend:

Sampling Technique The sampling technique or procedure used by the researcher is simple random sampling. This was used to select number of individuals to be part of the sample size wherein the researchers selected those individuals or respondents who are experience in borrowing money from informal money lenders, especially the so-called “5-6”. Research Instrument The proponents used researcher made questionnaire and conduct an interview for gather information for this study. The questionnaire is consisted of 4 parts questions wherein every question are answerable by putting check mark on the box provided in the listed choices after every questions made. The researcher used the summated rating scale or Likert’s scale to measure the degree of agreement/disagreement of the respondents to the given effects: SD – Strongly Disagree D – Disagree A – Agree SA – Strongly Agree NA – Not Applicable Data gathering Procedures The researchers gathered data by distributing the questionnaire to the respondents through a letter and personally administered to individual respondents. The respondents answer the questionnaire with enough given time. Aside from questionnaire and respondents, researchers also used books and surf through the internet for additional information. Data that are relevant and reliable are gathered and data that are not are rejected by the researchers.

Statistical Treatment of the Data After the data needed were obtained from the respondents. Tallying, computing and tabulating were made. The statistical formula that was applied in the computation is the following: Frequency/Percentage Distribution The percentage distribution was use in computation of the profile of the respondents (Part I) and the Advantages and Disadvantages of lending money from informal money lenders (Part IV). Formula: P = f N ∗ 100 % Where: P (Percentage) = The number of time any event occur in a period F = Frequency note or proportion per hundred N = Total number of respondents answer Mean The researcher used also this computation in order to know the mean of every criteria in Part II which is all about the reasons of borrowing money from informal money lenders and Part III consisted of terms and conditions of money lending procedu Formula: X = fx N Where:

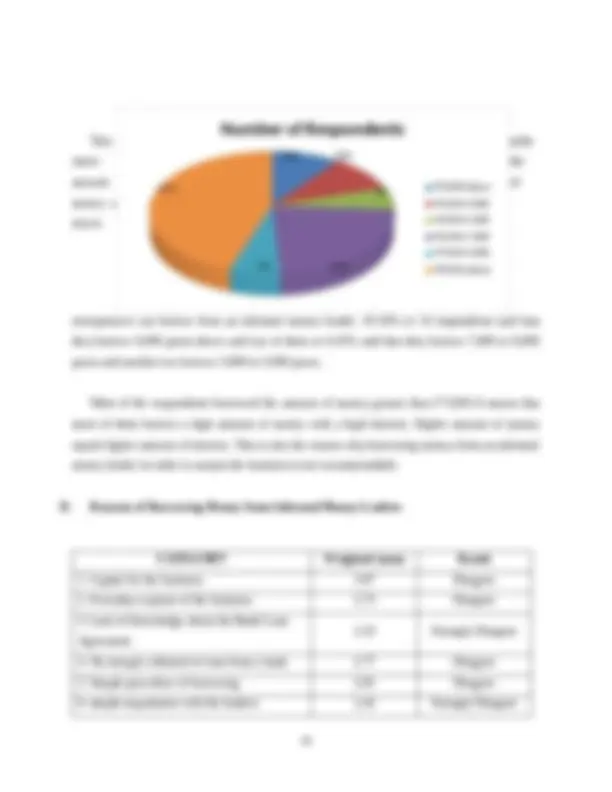

Interpretation and Analysis of Data This chapter shows the interpretation and analysis of data of every criterion that shows the result of the profile of the respondents, the reason of borrowing money from an informal money lender, terms and conditions of money lending procedure and the advantages and disadvantages on lending money from an informal money lenders. The questionnaires that were answered by the respondents are the basis for these results. I. Profile of the Respondents Table 1 Number and percentage of respondents according to their Age Age Respondents Percentage 20 years old below 5 16.12% 21-30 years old 8 25.80% 31-40 years old 10 32.25% 41-50 years old 6 19.35% 51 years old and above 2 6.45% Total 31 100% 16% 26% 32% 19% 6%

20 years old below 21-30 years old 31-40 years old 41-50 years old 51 years old and above

This table shows the age brackets of the respondents, 30-40 yrs.old being the highest with percentage of 32.25% and the lowest consisting of ages 50 below with 6.45%. Most of the respondents involve and participate in this study are at the age of 31 to 40 years old which is the 32.25% of the total respondents. These ages are mostly in the stage of family. Table 2 Number and percentage of respondents according to Gender Gender Respondents Percentage Male 11 35.48% Female 20 64.51% Total 31 100% This table shows that out of 31 respondents, the female group got the highest percentage of 64.51% or a total of 20 respondents. And male group of the respondents got 35.48% or a total of 11 respondents. It means that most of the micro-entrepreneurs at Batoda Terminal are female. 35% 65%

Male Female