Download Cost Accounting, De Leon, Answer Key and more Cheat Sheet Cost Accounting in PDF only on Docsity!

Chapter 1

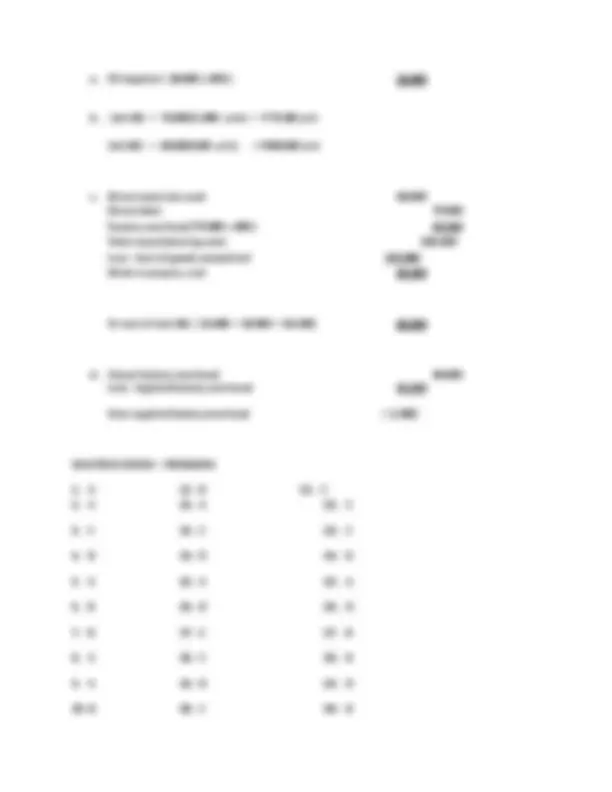

TRUE/FALSE

1. TRUE 6. FALSE

2. TRUE 7. TRUE

3. FALSE 8. FALSE

4. TRUE 9. TRUE

5. TRUE 10.TRUE

MULTIPLE CHOICE

1. B 6. D 11. D

2. C 7. A 12. B

3. A 8. A 13. B

4. C 9. B 14. A

5. C 10.D 15. D

Cost Accounting - 2014

Chapter 2 - Costs – Concepts and classification

Problem 1- Ram Corporation

- Manufacturing overhead

- Manufacturing overhead

- Direct materials

- Direct labor

- Manufacturing overhead

- Manufacturing overhead

- Direct materials

- Manufacturing overhead

- Manufacturing overhead

- Manufacturing overhead

Problem 2

- Manufacturing 6. Manufacturing

- Selling 7. Administrative

- Manufacturing 8. Seling

- Selling 9. Administrative

- Administrative 10.Selling

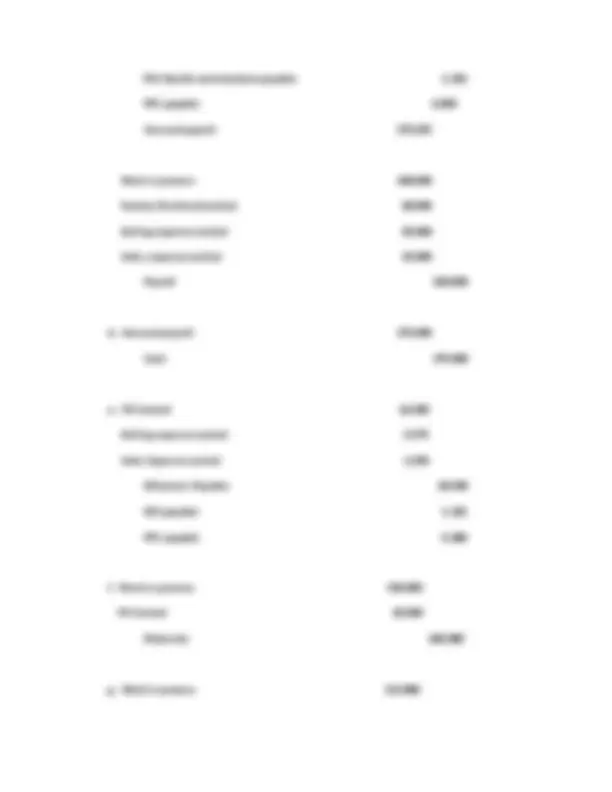

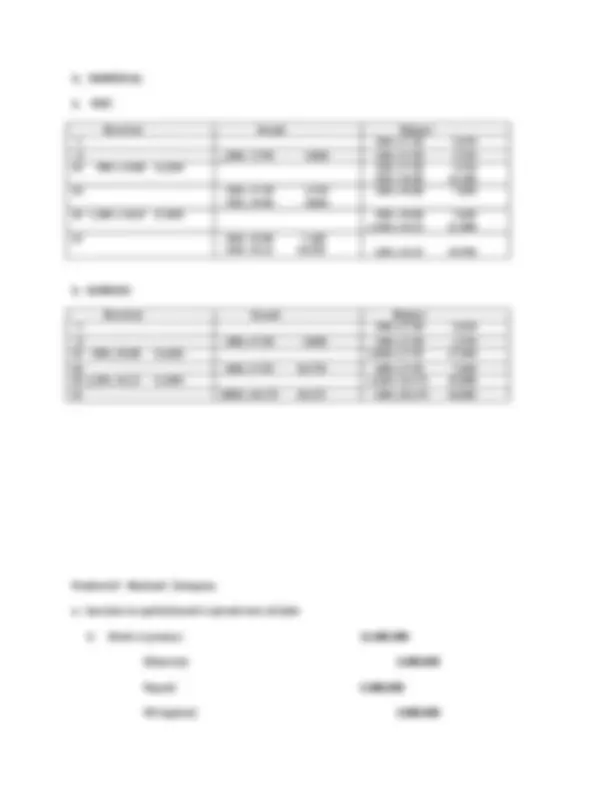

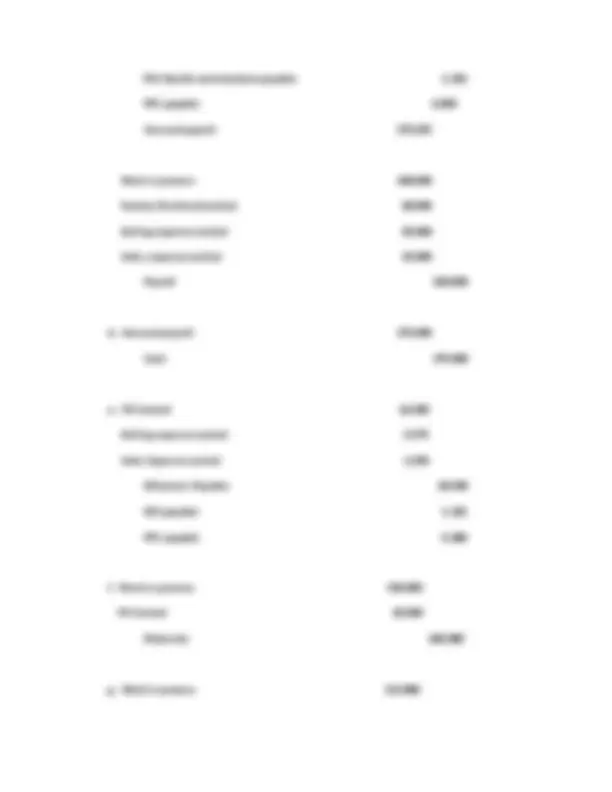

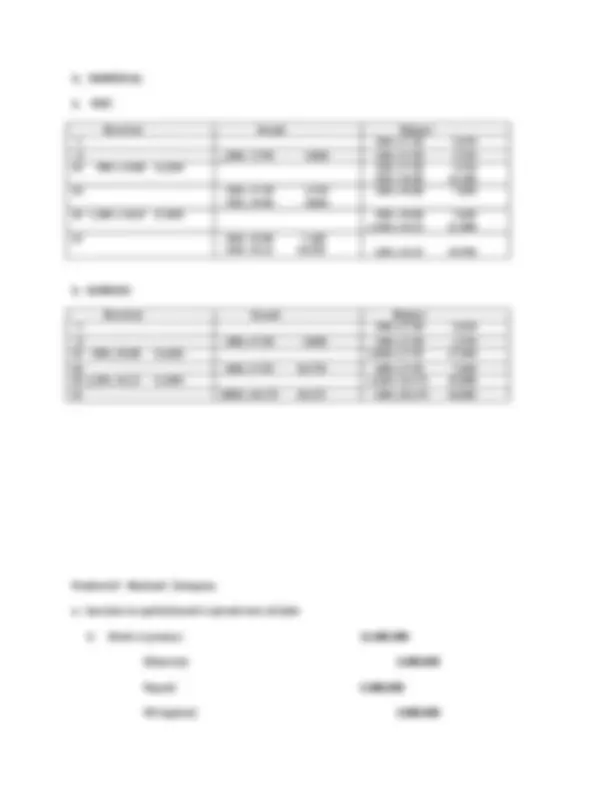

Problem 3-Rocco Product Cost Period Cost

Direct mat. Direct labor Mfg. OH Selling Adm

- DM 220,

- Factory rent 50,

- Direct labor 180,

- Factory utilities 8,

- Supervision 60,

- Depreciation-FE 20,

- Sales Commission 57,

- Advertising 47,

- Depreciation-OE 10,

- Salary - pres. 250,

1. TOTAL PRODUCT CST = 220,000 + 180,000 + 138,

2. TOTAL PERIOD COST = 57,000 + 307,

- COST PER UNIT = 538,500/ 40,000 units = P 13,

Problem 4 – Bug Company

- Fixed Period 6. Variable Period

- Fixed Inventoriable 7. Variable Inventoriable

- Fixed Inventoriable 8. Fixed Inventoriable

- Variable Inventoriable 9. Fixed Period

- Fixed Inventoriable 10. Fixed Inventoriable

Problem 5 – Mighty Muffler, Inc.

a. P 50,

- Total period costs - 305,

Problem 8 –

a. c - fixed (total amount is constant) b. a – variable (4,480/3,200 = 1.40; 6,300/4,500 = 1.40 per unit is constant) c. d - mixed ( 3,950/3,200 = 12.34; 5,250/4,500 = 1.16) total amount and amount per unit varies in relation to units sold)

Problem 9 - Blanche Corporation

` 1. Direct materials used P 32.

Direct labor 20.

Variable manufacturing overhead 15.

Variable marketing 3.

Total variable cost per unit 70.

X No. of units produced and sold 12,

Total variable costs per month P 840,

- Fixed manufacturing overhead P 6.

Fixed marketing costs 4.

Total fixed cost per unit 10.

X No. of units produced and sold 12,

Total fixed costs per month P 120,

Problem 10

- Direct materials P 60.

Problem 11 – Johnson Corporation

= 7.80 per machine hour

- Controllable direct fixed costs Supervisory salaries P 45,000 P 55,

- Uncontrollable direct fixed costs: Depreciation – machinery and Equipment P 100,000 P 180,

- Controllable direct fixed cost P 45,000 P 55, Uncontrollable direct fixed cost 100,000 180, Total direct fixed cost P 145,000 P 235,

- Allocated costs from headquarters P 120,000 P 180, Allocated repairs & maintenance 40,000 80, Allocated factory rent – bldg. 60,000 140, Allocated plant executive’s salaries 140,000 210, Total indirect costs P 360,000 P 610,

- Allocated costs from headquarters P 120,000 P 180, Allocated factory rent – bldg. 60,000 140, Allocated plant executive’s salaries 140,000 210, Depreciation- mach. & equipment 100,000 180, Total unavoidable costs P 420,000 P 710,

True/False Questions

- False 6. True 11. False 16. True

- False 7. False 12. False 17. False

- True 8. True 13. True 18. True

- False 9. False 14. False 19. False

- False 10. True 15. False 20. True

Multiple choice

1. B 11. C 21. A

2. C 12. D 22. C

3. B 13. C 23. A

4. C 14. B 24. C

5. D 15. A 25. D

6. A 16. B 26. B

7. D 17. B 27. A

8. D 18. A 28. B

9. B 19. D 29. C

10. C 20. B 30. B

CHAPTER 3 - COST ACCOUNTING CYCLE

Problem 1

1. A

2. A

3. A, C

4. A

5. A

6. B

7. A

8. A, C

9. A

10. A

11. A

12. C

13. A

14. A

15. C

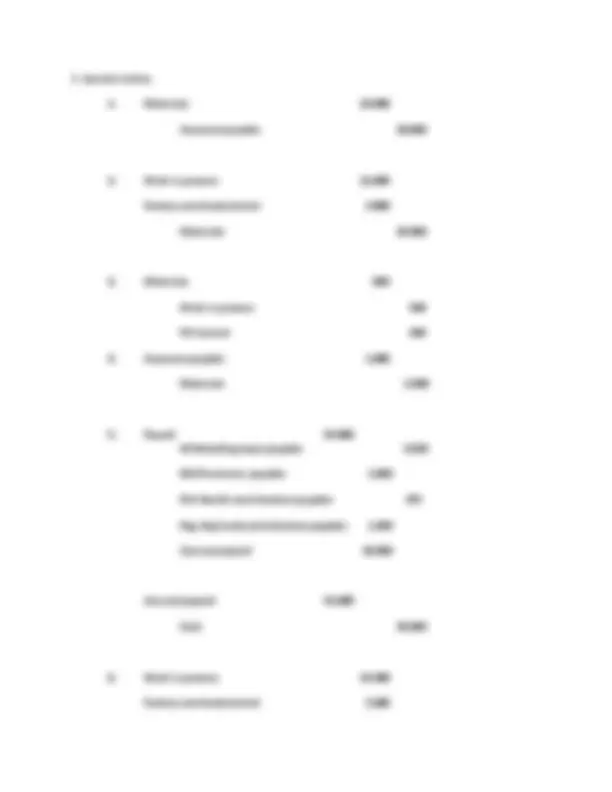

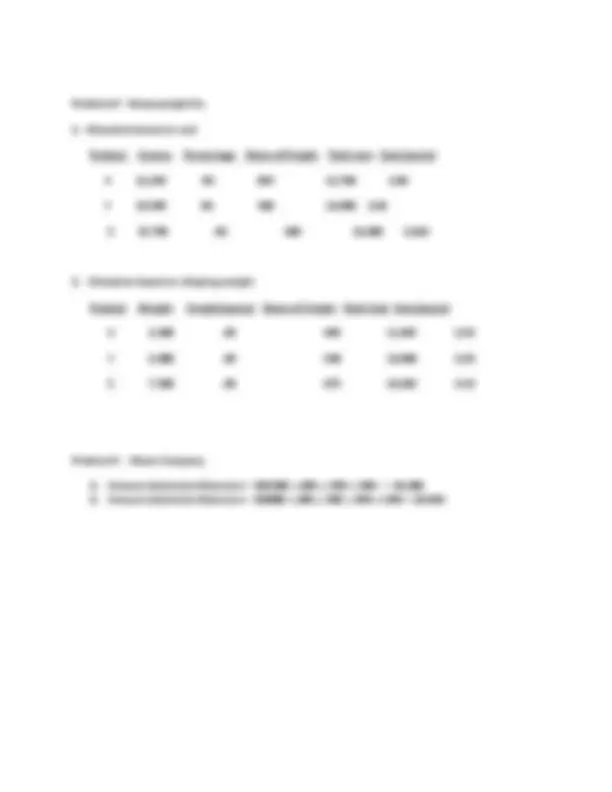

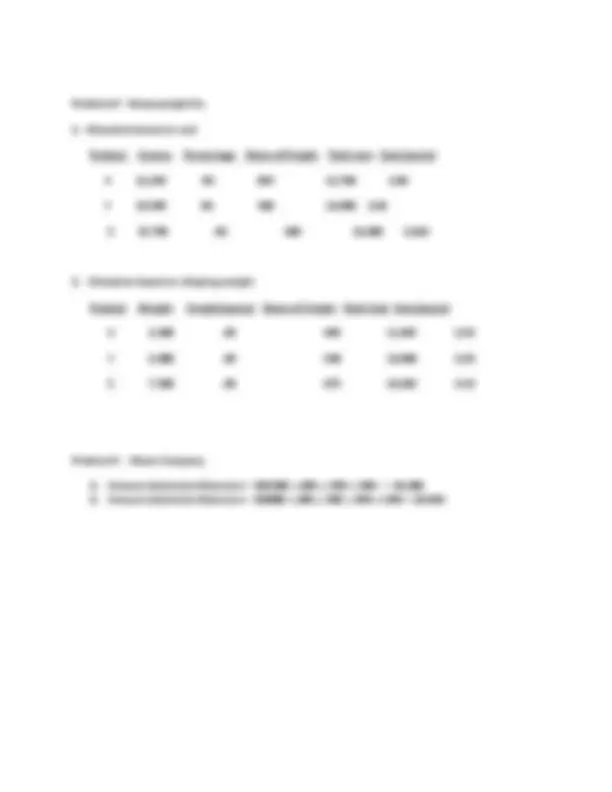

Problem 2 - Marvin Manufacturing Company

Problem 3 – Donna Company

Donna Company

Problem 4 - Ram Company

Over applied factory overhead ( 7,705)

Problem 5 – Darvin Company

Problem 6 - Blanche Corporation

- Cost of goods manufactured 800,

Finished goods, January 1 80,

Total goods available for sale 880,

Cost of goods sold (750,000)

Finished goods, December 31 130,

- Direct materials used 590,

Materials, December 31 150,

Total available for sale 740,

Materials, January 1 (100,000)

Materials purchased 640,

Problem 8 – Ellery Company

- The company is using job order costing because the it is manufacturing a unique and custom made furniture

- Manufacturing is allocated based on the direct labor cost incurred Factory overhead rate - 24,000,000/20,000,000 = 120% of direct labor cost

- Actual factory overhead ( 500,000 + 750,000+1,000,000+11,000,000+2,000,000) 22,000, Applied ( 20,000,000 x 120%) 24,000, Overapplied overhead ( 2,000,000)

- Direct materials used 30,000, Direct labor 20,000, Factory overhead applied 24,000, Total manufacturing cost 74,000, Work in process, January 1 5,000,

Work in process, December 31 ( 4,000,000)

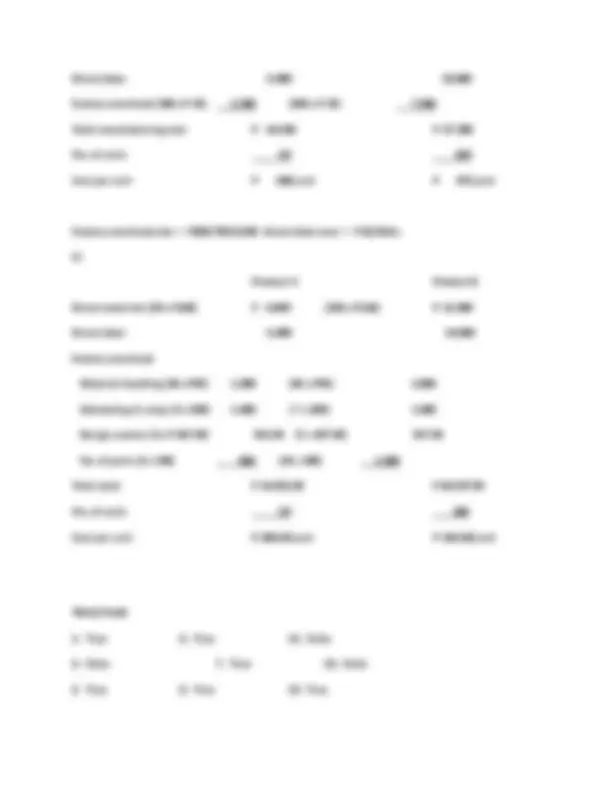

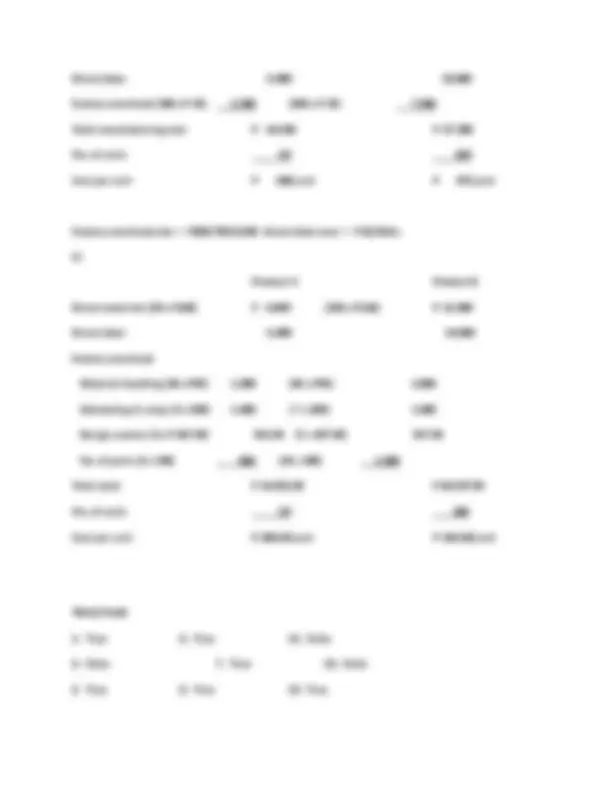

- Direct labor 30. - Variable manufacturing overhead 9. - Total variable manufacturing cost per unit P 99.

- ` 2. Total variable manufacturing cost per unit P 99. - Variable marketing and administrative 6. - Total variable costs per unit 105.

- Total variable manufacturing cost per unit P 99, - Fixed manufacturing overhead (30,000/1,200) 25.

- Full manufacturing cost per unit 124.

- Full manufacturing cost per unit 124.

- Variable marketing and administrative 6.

- Fixed marketing and administrative 20.

- Full cost to make and sell per unit 150.

- Variable cost per machine hour = 35,600 – 20, - 4,000 - 2,

- Total electricity expense 35,600 20, 2. 4,000 hours 2000 hours

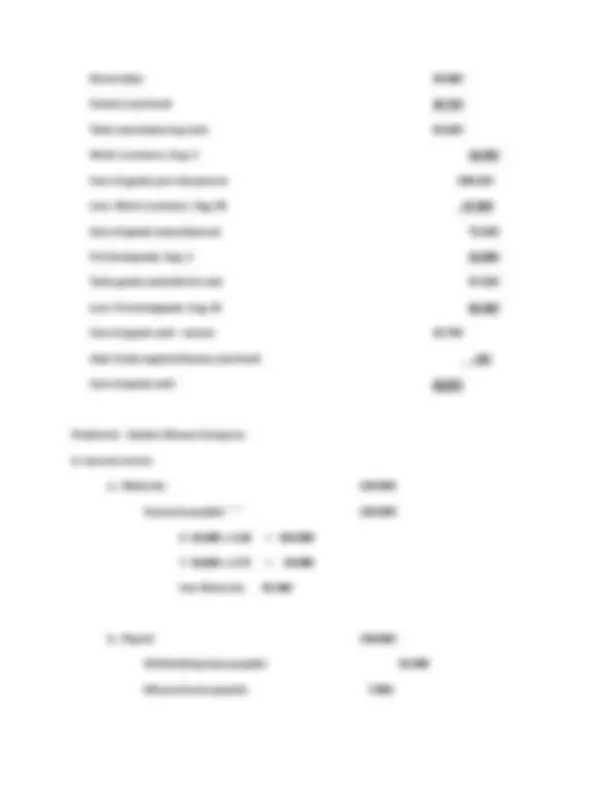

- For the year ended December 31, Cost of Goods Sold Statement

- Materials, January 1 175, Direct materials used

- Purchases 250,

- Total available for use 425,

- Less> Materials, December 31 125,000 300,

- Direct labor 270,

- Factory overhead 324,

- Total manufacturing costs 894,

- Work in process, January 1 90,

- Cost of goods put into process 984,

- Less: Work in process, December 31 120,

- Cost of goods manufactured 864,

- Finished goods, January 1 100,

- Total goods available for sale 964,

- Less: Finished goods, December 31 80,

- Cost of goods sold 884, - For the month of May, Cost of Goods Sold Statement

- Materials, May 1 124, Direct materials used

- Purchases 107,

- Total available 231,

- Less> Material - May 31 115,000 116,

- Direct labor 160,

- Factory overhead 240,

- Total manufacturing costs 516,

- Work in process, May 1 129,

- Cost of goods put into process 646,

- Less: Work in process, May 31 124,

- Cost of goods manufactured 522,

- Finished goods – May 1 150,

- Total goods available for sale 672,

- Less: Finished goods – May 31 122,

- Cost of goods sold 550,

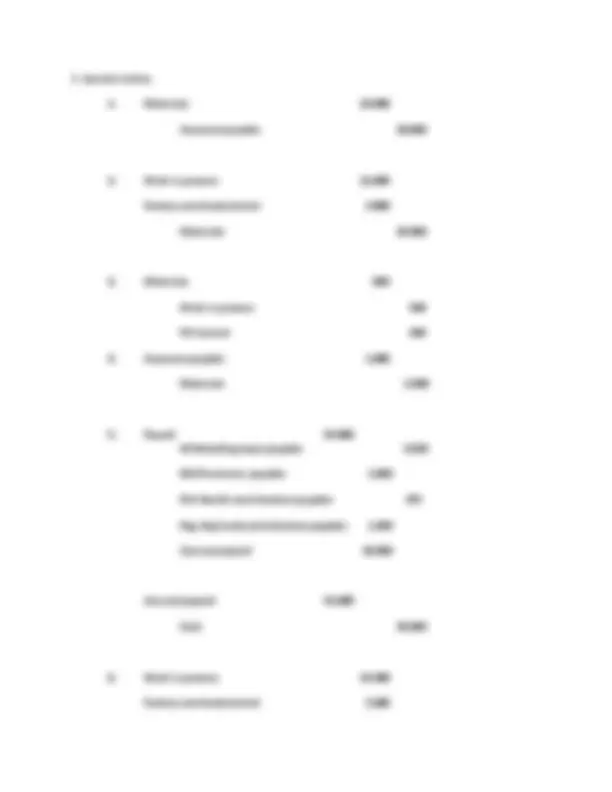

- a. Materials 150, 1, Entries - Accounts payable 150,

- b. Payroll 75, - Withholding taxes payable 11, - SSS Premiums payable 2, - Phil Health contributions payable - Pag-ibig funds contributions payable 1, - Accrued payroll 59, - Work in process 56, - Factory overhead control 19, - Payroll 75,

- c. Materials 20, - Accounts payable 20,

- d. Factory overhead control 5, - SSS premiums payable 3, - Phil Health contributions payable - Pag-ibig funds contributions payable 1.

- e. Work in process 120,

- Factory overhead control 10,

- f. Accounts payable 2, - Materials 2,

- g. Accounts payable 148,

- h. Factory overhead control 24, - Miscellaneous accounts 24,

- i. Work in process 67, - Factory OH Applied (56,000 x 120%) 67,

- j. Finished goods 175. - Work in process 175,

- k. Accounts receivable 2200, - Sales 2200,

- Cost of goods sold 140,

- Finished goods 140,

- Purchases 170, Direct materials used

- Less: Purchase returns 2,

- Total available for use 168,

- Less: Ind. Mat. used 10,

- Mat.- October 31 38,000 48,000 120,

- Direct labor 56,

- Factory overhead 67,

- Total manufacturing costs 243,

- Less: Work in process, October 31 68,

- Cost of goods manufactured 175,

- Less: Finished goods – March 31 35,

- Cost of goods sold, normal 140,

- Less: OA-FO 7,

- Cost of goods sold, actual 132,

- Actual factory overhead (FO Control ) 59,

- Less: Applied factory overhead 67,

- a. Materials 200, 1. Entries

- b. FOControl 35,

- c. Payroll 210,

- W/Taxes payable 18,

- SSS Premium payable 8,

- Phil Health contributions payable 1,

- PFC payable 6,

- Accrued payroll 175,

- Work in process 140,

- Factory Overhead control 30,

- Selling expense control 25,

- Adm. expense control 15,

- d. Accrued payroll 175, - Cash 175,

- e. FO Control 14, - Selling expense control 2, - Adm. Expense control 1, - SSS prem. Payable 10, - MC payable 1, - PFC payable 6,

- f. Work in process 185,

- FO Control 35, - Materials 220,

- g. Work in process 112, - FO Applied (140,000x80%) 112,

- h. Finished goods 410, - Work in process 410,

- i. Accounts receivable 539, - Sales 539,

- j. Cash 405, - Accounts receivable 405,

- k. Accounts payable 220, - Cash 220,

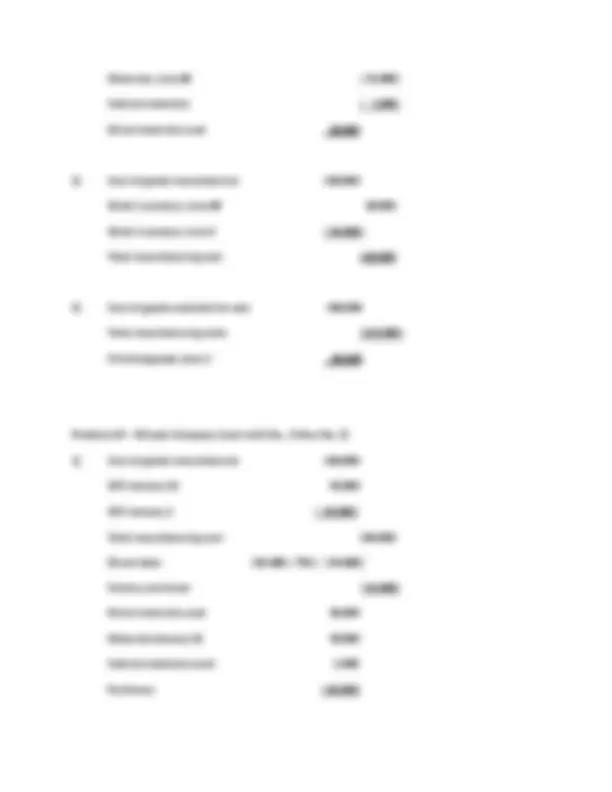

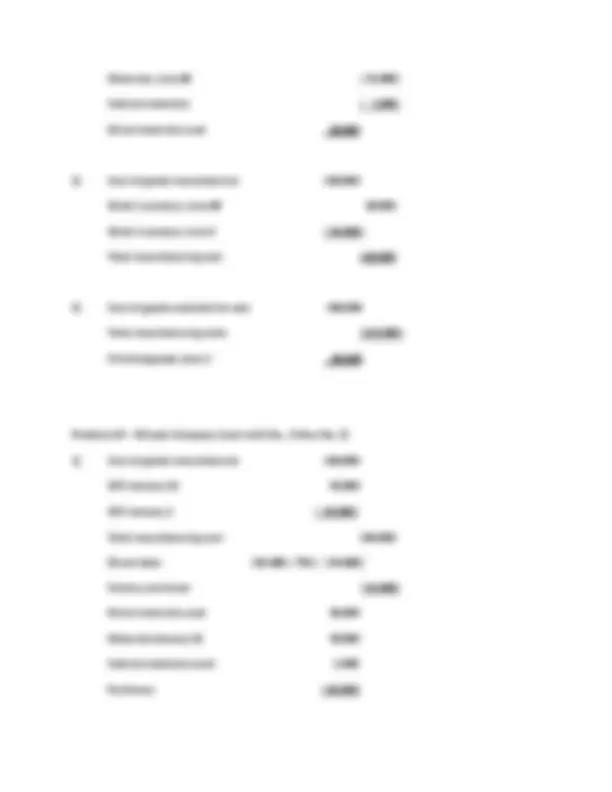

- Materials, January 1 50,

- Purchases 200,

- Total available 250,

- Less> Mat.- Jan. 31 30,

- Ind. Materials 35,000 65,000 185,

- Direct labor 140,

- Factory overhead 112,

- Total manufacturing costs 437,

- Work in process, January 1 18,

- Cost of goods put into process 455,

- Less: Work in process, January 31 45,

- Cost of goods manufactured 410,

- Finished goods – January 1 35,

- Total goods available for sale 445,

- Less: Finished goods – January 31 60,

- Cost of goods sold - normal 385,

- Underapplied factory overhead 2,

- Cost of goods sold – actual 387,

- Sales 539, 3. Income Statement

- Less: Cost of goods sold 387,

- Gross profit 151,

- Selling 27, Less: Operating expenses - Administrative 16,350 43,

- Cash 110,000 Accounts payable 25, 4 Balance sheet

- Accounts receivable 194,000 Accrued payroll 8,

- Finished goods 60,000 W/tax payable 18,

- Work in process 45.000 SSS Prem. payable 18,

- Materials 30,000 Medicare Cont. payable 2, - PFC payable 12, - Common stock 200, - _______ Retained earnings 153,

- Total 439,000 439, - Sales 1,200, 1, Income Statement - Less: Cost of goods sold 755, - Gross profit 444, - Marketing 60, Less: Operating expenses - Administrative 12,000 72,

- Net income 372, - Materials, March 1 50, Direct materials used - Purchases 400, - Total available 450, - Less> Mat.- March 31 47,485 402,

- Direct labor 210,

- Factory overhead 140,

- Total manufacturing costs 752,

- Work in process, March 1 102,

- Cost of goods put into process 854,

- Less: Work in process, March 31 117,

- Cost of goods manufactured 737,

- Finished goods – March 1 100,

- Total goods available for sale 837,

- Less: Finished goods – March 31 82,

- Cost of goods sold 755,

- Problem

- Cost of goods manufactured 800,

- Work in process, December 31 87,

- Cost of goods put into process 887,

- Work in process, January 1 97, Total manufacturing costs ( 790,000)

- Cost of goods manufactured 75,000,

- Finished goods, January 1 13,000,

- Finished goods, December 31 (11,000,

- Cost of goods sold – normal 77,000,

- 1, Materials, October 1 25, Problem 9 - Norman Company

- Purchases 180,

- Direct materials used 165, Materials, October 31 (40,000)

- Direct labor 220,

- Factory overhead 200,

- Total manufacturing costs 585,

- Total manufacturing costs 585,

- Work in process, Oct. 1 23,

- Cost of goods manufactured 593, Work in process, Oct. 31 ( 15,000)

- Cost of goods manufactured 593,

- Finished goods, Oct. 1 37,

- Cost of goods sold 599, Finished goods, Oct. 31 ( 31,000)

- Sales 980,