Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Information on Cinemark Holdings Inc.'s financial statements for the nine months ended September 30, 2020, including details on 8.750% Secured Notes, dividends paid and accrued, National CineMedia activity, and treasury stock activity. It also includes a summary of intangible assets and liabilities measured at fair value.

What you will learn

Typology: Lecture notes

1 / 59

This page cannot be seen from the preview

Don't miss anything!

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 30, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number: 001-

(Exact name of registrant as specified in its charter) Delaware 20- (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 3900 Dallas Parkway Plano, Texas 75093 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: ( 972 ) 665- Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol(s) Name of each exchange on which registered Common stock, par value $.001 per share CNK New York Stock Exchange Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit files). Yes ☒ No ☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒ As of October 30, 2020, 118,158,433 shares of common stock were issued and outstanding.

Page

Item 1. Financial Statements CINEMARK HOLDINGS, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except share data, unaudited) September 30, December 31, 2020 2019 Assets Current assets Cash and cash equivalents $ 825,706 $ 488, Inventories 15,159 21, Accounts receivable 24,645 83, Current income tax receivable 84,105 4, Prepaid expenses and other 34,394 37, Total current assets 984,009 634, Theatre properties and equipment 3,252,987 3,348, Less: accumulated depreciation and amortization 1,707,164 1,612, Theatre properties and equipment, net 1,545,823 1,735, Operating lease right-of-use assets, net 1,286,224 1,383, Other assets Goodwill 1,249,427 1,283, Intangible assets, net 315,569 321, Investment in NCM 250,434 265, Investments in affiliates 118,589 155, Long-term deferred tax asset 16,491 9, Deferred charges and other assets, net 36,047 39, Total other assets 1,986,557 2,074, Total assets $ 5,802,613 $ 5,828, Liabilities and equity Current liabilities Current portion of long-term debt $ 7,965 $ 6, Current portion of operating lease obligations 216,382 217, Current portion of finance lease obligations 16,224 15, Current income tax payable — 5, Current liability for uncertain tax positions — 13, Accounts payable and accrued expenses 383,306 450, Total current liabilities 623,877 708, Long-term liabilities Long-term debt, less current portion 2,366,380 1,771, Operating lease obligations, less current portion 1,137,822 1,223, Finance lease obligations, less current portion 128,727 141, Long-term deferred tax liability 103,906 141, Long-term liability for uncertain tax positions 14,678 848 NCM screen advertising advances 346,237 348, Other long-term liabilities 62,538 44, Total long-term liabilities 4,160,288 3,670, Commitments and contingencies (see Note 19) Equity Cinemark Holdings, Inc.'s stockholders' equity: Common stock, $ 0.001 par value: 300,000,000 shares authorized, 123,029,693 shares issued and 118,161,153 shares outstanding at September 30, 2020 and 121,863,515 shares issued and 117,151,656 shares outstanding at December 31, 2019 123 122 Additional paid-in-capital 1,238,547 1,170, Treasury stock, 4,868,540 and 4,711,859 shares, at cost, at September 30, 2020 and December 31, 2019, respectively (84,432 ) (81,567 ) Retained earnings 267,193 687, Accumulated other comprehensive loss (414,398 ) (340,112 ) Total Cinemark Holdings, Inc.'s stockholders' equity 1,007,033 1,435, Noncontrolling interests 11,415 12, Total equity 1,018,448 1,448, Total liabilities and equity $ 5,802,613 $ 5,828, The accompanying notes are an integral part of the condensed consolidated financial statements.

(in thousands, except per share data, unaudited)

Revenues Admissions $ 14,901 $ 454,429 $ 307,400 $ 1,371, Concession 9,116 289,477 199,596 886, Other 11,461 77,911 81,072 237, Total revenues 35,478 821,817 588,068 2,494, Cost of operations Film rentals and advertising 8,257 254,911 165,262 759, Concession supplies 2,688 51,573 39,879 157, Salaries and wages 20,181 103,270 116,589 308, Facility lease expense 67,047 87,436 214,490 262, Utilities and other 43,412 123,877 178,806 357, General and administrative expenses 30,342 44,702 99,361 127, Depreciation and amortization 62,543 67,760 191,380 196, Impairment of long-lived assets 24,595 27,304 41,214 45, Restructuring costs 524 — 20,062 — (Gain) loss on disposal of assets and other (13,327 ) 2,453 (10,997 ) 8, Total cost of operations 246,262 763,286 1,056,046 2,222, Operating income (loss) (210,784 ) 58,531 (467,978 ) 271, Other income (expense) Interest expense (36,577 ) (24,967 ) (92,284 ) (75,037 ) Interest income 1,348 3,903 4,235 10, Foreign currency exchange loss (2,251 ) (4,406 ) (6,183 ) (4,785 ) Distributions from NCM 1,061 2,474 6,975 9, Interest expense - NCM (5,901 ) (4,666 ) (17,726 ) (14,180 ) Equity in income (loss) of affiliates (16,077 ) 15,139 (27,711 ) 33, Total other expense (58,397 ) (12,523 ) (132,694 ) (40,790 ) Income (loss) before income taxes (269,181 ) 46,008 (600,672 ) 231, Income taxes (121,145 ) 14,053 (222,398 ) 64, Net income (loss) $ (148,036 ) $ 31,955 $ (378,274 ) $ 167, Less: Net income (loss) attributable to noncontrolling interests ( 444 ) 602 ( 702 ) 1, Net income (loss) attributable to Cinemark Holdings, Inc. $ (147,592 ) $ 31,353 $ (377,572 ) $ 165, Weighted average shares outstanding Basic 116,707 116,356 116,552 116, Diluted 116,707 116,600 116,552 116, Earnings (loss) per share attributable to Cinemark Holdings, Inc.'s common stockholders Basic $ (1.25 ) $ 0.27 $ (3.22 ) $ 1. Diluted $ (1.25 ) $ 0.27 $ (3.22 ) $ 1. The accompanying notes are an integral part of the condensed consolidated financial statements.

(in thousands, unaudited) Nine Months Ended September 30, 2020 2019 Operating activities Net income (loss) $ (378,274 ) $ 167, Adjustments to reconcile net income (loss) to cash provided by (used for) operating activities: Depreciation 187,748 193, Amortization of intangible and other assets 3,632 3, Amortization of debt issue costs 4,942 3, Non-cash accretion on convertible notes 1,739 — Interest accrued on NCM screen advertising advances 17,726 — Amortization of NCM screen advertising advances and other deferred revenues (23,647 ) (12,203 ) Amortization of accumulated losses for amended swap agreements 5,338 — Impairment of long-lived assets 41,214 45, Share based awards compensation expense 12,859 10, (Gain) loss on disposal of assets and other (10,997 ) 8, Non-cash rent expense 1,649 (3,252 ) Equity in (income) loss of affiliates 27,711 (33,982 ) Deferred income tax expenses (29,941 ) (5,314 ) Distributions from equity investees 25,430 28, Changes in assets and liabilities and other (54,782 ) (7,909 ) Net cash provided by (used for) operating activities (167,653 ) 397, Investing activities Additions to theatre properties and equipment (67,618 ) (186,512 ) Acquisition of U.S. theatres, net of cash acquired — (10,170 ) Proceeds from sale of theatre properties and equipment and other 212 377 Investment in joint ventures and other, net ( 50 ) — Net cash used for investing activities (67,456 ) (196,305 ) Financing activities Dividends paid to stockholders (42,311 ) (119,452 ) Payroll taxes paid as a result of stock withholdings (2,865 ) (2,247 ) Proceeds from convertible notes issued 460,000 — Proceeds from other borrowings 257,167 — Repayments of long-term debt (4,947 ) (4,947 ) Payment of debt issue costs (24,981 ) — Purchase of convertible note hedges (142,094 ) — Proceeds from warrants issued 89,424 — Payments on finance leases (11,497 ) (10,830 ) Other ( 392 ) (1,588 ) Net cash provided by (used for) financing activities 577,504 (139,064 ) Effect of exchange rate changes on cash and cash equivalents (5,002 ) (5,296 ) Increase in cash and cash equivalents 337,393 56, Cash and cash equivalents: Beginning of period 488,313 426, End of period $ 825,706 $ 482,

The accompanying notes are an integral part of the condensed consolidated financial statements. CINEMARK HOLDINGS, INC. AND SUBSIDIARIES NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS In thousands, except share and per share data

1. The Company and Basis of Presentation The Company and its subsidiaries operate in the motion picture exhibition industry, with theatres in the United States (“U.S.”), Brazil, Argentina, Chile, Colombia, Peru, Ecuador, Honduras, El Salvador, Nicaragua, Costa Rica, Panama, Guatemala, Bolivia, Curacao and Paraguay. The accompanying condensed consolidated balance sheet as of December 31, 2019, which was derived from audited financial statements, and the unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete consolidated financial statements. In the opinion of management, all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation have been included. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and the accompanying notes. Actual results could differ from these estimates. Majority-owned subsidiaries of which the Company has control are consolidated while those affiliates of which the Company owns between 20 % and 50 % and does not control are accounted for under the equity method. Those affiliates of which the Company owns less than 20 % are generally accounted for under the cost method, unless the Company is deemed to have the ability to exercise significant influence over the affiliate, in which case the Company would account for its investment under the equity method. The results of these subsidiaries and affiliates are included in the condensed consolidated financial statements effective with their formation or from their dates of acquisition. Intercompany balances and transactions are eliminated in consolidation. These condensed consolidated financial statements should be read in conjunction with the audited annual consolidated financial statements and the notes thereto for the year ended December 31, 2019, included in the Annual Report on Form 10-K filed February 21, 2020 by the Company under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Operating results for the three and nine months ended September 30, 2020 are not necessarily indicative of the results to be achieved for the full year. 2. Impact of COVID- The outbreak of the COVID-19 pandemic has had an unprecedented impact on the world and the movie exhibition industry. The social and economic effects are widespread, and the situation continues to evolve. As a movie exhibitor that operates spaces where patrons gather in close proximity, the Company has been, and continues to be, significantly impacted by protective actions taken by governmental authorities to control the spread of the pandemic. To comply with government mandates at the initial outbreak of the COVID-19 pandemic, the Company temporarily closed all of its theatres in the U.S. and Latin America effective March 17, 2020 and March 18, 2020, respectively. In conjunction with the temporary closure of its theatres in March 2020, the Company implemented temporary personnel and salary reductions, halted non- essential operating and capital expenditures, and negotiated modified timing and/or abatement of contractual payments with landlords and other major suppliers until its theatres reopened. In addition, the Company suspended its quarterly dividend. As of September 30, 2020, the Company had reopened 252 of its domestic theatres and 15 of its international theatres showing limited volume of new releases along with library content during reduced operating hours. While some staffing has been brought back to pre-COVID-19 levels given the theatre reopenings, the Company continues to maintain a temporary reduction in staffing while limiting capital expenditures to essential activities and projects. The Company also continues to work with landlords and other vendors on extended or modified contractual payment terms while evaluating the status of the COVID-19 pandemic and local government regulations in assessing its plans to reopen its remaining theatres. The Company’s focus on maintaining a healthy balance sheet and low leverage allowed it to enter the global COVID-19 crisis in a strong financial position. Based on the Company’s current level of operations, it believes that it has sufficient cash to sustain operations until late 2021, which would extend into 2022 when considering the additional income tax benefits discussed below. Nonetheless, the COVID-19 pandemic has had, and may continue to have, adverse effects on the Company’s business, results of operations, cash flows, financial condition, access to credit markets and ability to service existing and future indebtedness, some of which may be significant. Health and Safety Protocols

In thousands, except share and per share data 201 7 Tax Cuts and Jobs Act, which makes certain qualified improvement property eligible for bonus depreciation. Per the provisions of the CARES Act, the Company has deferred payment of certain employer payroll taxes for 2020 and has recorded payroll tax credits for expenses related to paying wages and health benefits to employees who were not working as a result of closures and reduced receipts associated with COVID-19. An income tax benefit of $(121,145) was recorded for the third quarter of 2020 compared to income tax expense of $14,053 for the third quarter of 2019 on book (loss)/income of $(269,181) and $46,008, respectively. The effective tax rate was approximately 45.0% for the third quarter of 2020 compared to 30.5% for the third quarter of

In thousands, except share and per share data Lease Deferrals and Abatements Upon the temporary closure of theatres in March 2020, the Company initiated discussions with landlords to negotiate the deferral of rent and other lease-related payments while theatres remained closed. These discussions and negotiations have remained ongoing as the Company continues to be impacted by the COVID- pandemic. The amendments signed with the landlords involve varying concessions, including the abatement of rent payments during closure, deferral of all or a portion of rent payments to later periods and deferrals of rent payments to later periods combined with an early exercise of an existing renewal option or extension of the lease term. In some cases, the Company is entitled to rent-free periods while theatres remain closed in certain locations due to local regulations. Total payments deferred as of September 30, 2020 were approximately $62,559 and are included in accounts payable and accrued expenses in the condensed consolidated balance sheet. In April 2020, the FASB staff released guidance indicating that in response to the COVID-19 crisis, an entity would not have to analyze each contract to determine whether enforceable rights and obligations for concessions exist in the contract and can elect to apply or not apply the lease modification guidance in Topic 842 to those contracts. The election is available for concessions related to the effects of the COVID-19 pandemic that do not result in a substantial increase in the rights of the lessor or the obligations of the lessee. For example, this election is available for concessions that result in the total payments required by the modified contract being substantially the same as or less than total payments required by the original contract. The Company elected to not remeasure the related lease liabilities and right-of-use assets for those leases where the concessions and deferrals did not result in a significant change in total payments under the lease and where the remaining lease term did not change as a result of the negotiation. For those leases that were renewed or extended as a result of the negotiation to defer rent payments, the Company recalculated the related lease liability and right-of-use asset based on the new terms. During the three and nine months ended September 30, 2020, the Company did not recognize a material amount of negative lease expense related to rent abatement concessions. The following table represents the Company’s aggregate lease costs, by lease classification, for the periods presented. Three Months Ended Nine Months Ended September 30 September 30 Lease Cost Classification 2020 2019 2020 2019 Operating lease costs Equipment (1)^ Utilities and other $ 823 $ 1,569 $ 2,495 $ 5, Real Estate (2)(3)^ Facility lease expense 65,970 88,149 211,088 262, Total operating lease costs $ 66,793 $ 89,718 $ 213,583 $ 267, Finance lease costs Amortization of leased assets Depreciation and amortization $ 3,665 $ 3,703 $ 11,052 $ 11, Interest on lease liabilities Interest expense 1,725 1,922 5,333 5, Total finance lease costs $ 5,390 $ 5,625 $ 16,385 $ 17, (1) Includes approximately $( 267 ) and $ 452 of short-term lease payments for the three months ended September 30, 2020 and 2019, respectively. Includes approximately $( 839 ) and $ 1,808 of short- term lease payments for the nine months ended September 30, 2020 and 2019, respectively. The amounts for the three and nine months ended September 30, 2020 were impacted by i) a decrease in short term lease payments while theatres were closed and ii) rent abatements on leases that were not recalculated in accordance with the FASB guidance discussed above, which resulted in variable rent credits in the amount of the rent abatements. (2) Includes approximately $( 191 ) and $ 18,591 of variable lease payments based on a change in index, such as CPI or inflation, variable payments based on revenues or attendance and variable common area maintenance costs for the three months ended September 30, 2020 and 2019, respectively. Includes approximately $9,146 and $ 54,209 of variable lease payments based on a change in index, such as CPI or inflation, variable payments based on revenues or attendance and variable common area maintenance costs for the nine months ended September 30, 2020 and 2019. The amounts for the three and nine months ended September 30, 2020 were impacted by rent abatements on leases that were not recalculated in accordance with the FASB guidance discussed above, which resulted in variable rent credits in the amount of the rent abatements. (3) Approximately $ 335 and $ 400 of lease payments are included in general and administrative expenses primarily related to office leases for the three months ended September 30, 2020 and 2019, respectively. Approximately $1,122 and $ 1,184 of lease payments are included in general and administrative expenses primarily related to office leases for the nine months ended September 30, 2020 and 2019, respectively.

In thousands, except share and per share data Accounts receivable as of September 30, 2020 and December 31, 2019 included approximately $6,162 and $31,620 of receivables, respectively, related to contracts with customers. The Company did not record any assets related to the costs to obtain or fulfill a contract with customers during the nine months ended September 30, 2020 or September 30, 2019. Disaggregation of Revenue The following tables present revenues for the three and nine months ended September 30, 2020 and 2019, disaggregated based on major type of good or service and by reportable operating segment and disaggregated based on timing of revenue recognition. Three Months Ended Nine Months Ended September 30, 2020 September 30, 2020 U.S. International U.S. International Operating Operating Operating Operating Major Goods/Services Segment (1)^ Segment Consolidated Segment (1)^ Segment Consolidated Admissions revenues $ 14,794 $ 107 $ 14,901 $ 247,157 $ 60,243 $ 307, Concession revenues 8,861 255 9,116 161,674 37,922 199, Screen advertising, screen rental and promotional revenues (2)^ 9,227 513 9,740 35,319 13,437 48, Other revenues 1,527 194 1,721 25,857 6,459 32, Total revenues $ 34,409 $ 1,069 $ 35,478 $ 470,007 $ 118,061 $ 588, Three Months Ended Nine Months Ended September 30, 2019 September 30, 2019 U.S. International U.S. International Operating Operating Operating Operating Major Goods/Services Segment (1)^ Segment Consolidated Segment (1)^ Segment Consolidated Admissions revenues $ 351,122 $ 103,307 $ 454,429 $ 1,066,884 $ 304,157 $ 1,371, Concession revenues 230,415 59,062 289,477 704,727 181,356 886, Screen advertising, screen rental and promotional revenues 21,114 16,448 37,562 63,996 49,587 113, Other revenues 30,394 9,955 40,349 95,180 28,409 123, Total revenues $ 633,045 $ 188,772 $ 821,817 $ 1,930,787 $ 563,509 $ 2,494, Three Months Ended Nine Months Ended September 30, 2020 September 30, 2020 U.S. International U.S. International Operating Operating Operating Operating Timing of Recognition Segment (1)^ Segment Consolidated Segment (1)^ Segment Consolidated Goods and services transferred at a point in time $ 24,945 $ 352 $ 25,297 $ 426,476 $ 101,681 $ 528, Goods and services transferred over time (2)^ 9,464 717 10,181 43,531 16,380 59, Total $ 34,409 $ 1,069 $ 35,478 $ 470,007 $ 118,061 $ 588, Three Months Ended Nine Months Ended September 30, 2019 September 30, 2019 U.S. International U.S. International Operating Operating Operating Operating Timing of Recognition Segment (1)^ Segment Consolidated Segment (1)^ Segment Consolidated Goods and services transferred at a point in time $ 610,063 $ 169,171 $ 779,234 $ 1,860,828 $ 504,702 $ 2,365, Goods and services transferred over time 22,982 19,601 42,583 69,959 58,807 128, Total $ 633,045 $ 188,772 $ 821,817 $ 1,930,787 $ 563,509 $ 2,494,

In thousands, except share and per share data (1) U.S. segment revenues include eliminations of intercompany transactions with the international operating segment. See Note 17 for additional information on intercompany eliminations. (2) Amount includes amortization of NCM screen advertising advances. See Deferred Revenues below. Deferred Revenues The following table presents changes in the Company’s advances and deferred revenues for the nine months ended September 30, 2020. NCM screen advertising advances (1) Other Deferred Revenues (2)^ Total Balance at January 1, 2020 $ 348,354 $ 138,426 $ 486, Amounts recognized as accounts receivable — 2,788 2, Cash received from customers in advance — 45,933 45, Common units received from NCM (see Note 9) 3,620 — 3, Interest accrued related to significant financing component 17,726 — 17, Revenue recognized during period (23,463 ) (44,714 ) (68,177 ) Foreign currency translation adjustments — (2,022 ) (2,022 ) Balance at September 30, 2020 $ 346,237 $ 140,411 $ 486, (1) See Note 9 for the maturity of balance as of September 30, 2020. (2) Includes liabilities associated with outstanding gift cards and discount ticket vouchers, points or rebates outstanding under the Company’s loyalty and membership programs and revenues not yet recognized for screen advertising, screen rental and other promotional activities. Classified as accounts payable and accrued expenses or other long-term liabilities on the condensed consolidated balance sheet. The table below summarizes the aggregate amount of the transaction price allocated to performance obligations that are unsatisfied as of September 30, 2020 and when the Company expects to recognize this revenue. Twelve Months Ended September 30, Remaining Performance Obligations 2021 2022 2023 2024 2025 Thereafter Total Other Deferred revenue $ 125,429 $ 14,936 $ 46 $ — $ — $ — $ 140,

6. Earnings Per Share The Company considers its unvested share-based payment awards, which contain non-forfeitable rights to dividends, participating securities, and includes such participating securities in its computation of earnings per share pursuant to the two-class method. Basic earnings per share for the two classes of stock (common stock and unvested restricted stock) is calculated by dividing net income by the weighted average number of shares of common stock and unvested restricted stock outstanding during the reporting period. Diluted earnings per share is calculated using the weighted average number of shares of common stock plus the potentially dilutive effect of common equivalent shares outstanding determined under both the two-class method and the treasury stock method.

In thousands, except share and per share data imposed by the covenant waiver, and (iv) makes such other changes to permit the issuance of the 4.50% Convertible Senior Notes discussed below. 8.750% Secured Notes On April 20, 2020, Cinemark USA, Inc. issued $250,000 8.750% senior secured notes (the “8.750% Secured Notes”). The 8.750% Secured Notes will mature onMay 1, 2025; provided, however, that if (i) on September 13, 2022, the aggregate outstanding principal amount of the5.125% Senior Notes that shall not have been purchased, repurchased, redeemed, defeased or otherwise acquired, retired, cancelled or discharged exceeds $50,000, the 8.750% Secured Notes will mature on September 14, 2022 and (ii) on February 27, 2023, the aggregate outstanding principal amount of the 4.875% Senior Notes that shall not have been purchased, repurchased, redeemed, defeased or otherwise acquired, retired, cancelled or discharged exceeds $50,000, the 8.750% Secured Notes will mature on February 28, 2023. Interest on the 8.750% Secured Notes will be payable on May 1 and November 1 of each year, beginning on November 1, 2020. The 8.750% Secured Notes will be fully and unconditionally guaranteed on a joint and several senior basis by certain of the Company’s subsidiaries that guarantee, assume or in any other manner become liable with respect to any of the Company’s or its guarantors’ other debt. If the Company cannot make payments on the 8.750% Secured Notes when they are due, the Company’s guarantors must make them instead. Under certain circumstances, the guarantees may be released without action by, or the consent of, the holders of the 8.750% Secured Notes. The 8.750% Secured Notes and the guarantees will be the Company’s and its guarantors’ senior obligations and they will:

In thousands, except share and per share data upon the occurrence of specified corporate events as described further in the indenture, or (4) during any calendar quarter commencing after the calendar quarter ending on September 30, 2020 (and only during such calendar quarter), if the last reported sale price of the Company’s common stock for at least 20 trading days during the period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is greater than or equal to 130 % of the conversion price (initially 14.35 per share), on each applicable trading day. Beginning May 15, 2025, holders may convert their notes at any time prior to the close of business on the second scheduled trading day immediately preceding the maturity date. Upon conversion of the notes, the Company will pay or deliver cash, shares of the Company’s common stock or a combination of cash and shares of the Company’s common stock, at the Company’s election. The conversion rate will initially be69.6767 shares of the Company’s common stock per $1,000 principal amount of the 4.50% Convertible Senior Notes. The conversion rate will be subject to adjustment upon the occurrence of certain events. If a make-whole fundamental change as defined in the indenture governing the 4.50% Convertible Senior Notes occurs prior to the maturity date, the Company will, in certain circumstances, increase the conversion rate for a holder who elects to convert its 4.50% Convertible Senior Notes in connection with such make-whole fundamental change. The 4.50% Convertible Senior Notes will be effectively subordinated to any of the Company’s, or its subsidiaries’, existing and future secured debt to the extent of the value of the assets securing such indebtedness, including obligations under the Credit Agreement. The 4.50% Convertible Senior Notes will be structurally subordinated to all existing and future debt and other liabilities, including trade payables, including Cinemark USA’s 5.125% senior notes due 2022, 4.875% senior notes due 2023 and the 8.750% Secured Notes due 2025, or, collectively, Cinemark USA’s senior notes (but excluding all obligations under the Credit Agreement which are guaranteed by the Company). The 4.50% Convertible Senior Notes rank equally in right of payment with all of the Company’s existing and future unsubordinated debt, including all obligations under the Cinemark USA, Inc. Credit Agreement, which such Credit Agreement is guaranteed by the Company, and senior in right of payment to any future debt that is expressly subordinated in right of payment to the 4.50% Convertible Senior Notes. The 4.50% Convertible Notes are not guaranteed by any of Cinemark Holdings, Inc.’s subsidiaries. In accordance with accounting guidance on debt and equity financing, the Company bifurcated the gross proceeds from the issuance of 4.50% Convertible Senior Notes and recorded a portion as long-term debt and a portion in equity. The long-term debt value was based on the fair value of the debt, determined as the present value of principal and interest payments assuming a market interest rate for similar debt that excluded a conversion feature. The difference between the face value of the 4.50% Convertible Senior Notes and the fair value is referred to as the debt discount, and represents the amount allocated to equity. The debt discount is being amortized to interest expense at an effective interest rate of 10.00% over the contractual terms of the notes. Concurrently with the issuance of the 4.50% Convertible Senior Notes, the Company entered into privately negotiated convertible note hedge transactions (the “Hedge Transactions”) with one or more of the Initial Purchasers or their respective affiliates (the “Option Counterparties”). The Hedge Transactions cover the number of shares of the Company’s common stock that will initially underlie the aggregate amount of the 4.50% Convertible Senior Notes, subject to anti-dilution adjustments substantially similar to those applicable to the 4.50% Convertible Senior Notes. The Hedge Transactions are generally expected to reduce potential dilution to the Company’s common stock upon any conversion of the 4.50% Convertible Senior Notes and/or offset any cash payments the Company may be required to make in excess of the principal amount of converted 4.50% Convertible Senior Notes, as the case may be. Concurrently with entering into the Hedge Transactions, the Company also entered into separate privately negotiated warrant transactions with Option Counterparties whereby it sold to Option Counterparties warrants to purchase (subject to the net share settlement provisions set forth therein) up to the same number of shares of the Company’s common stock, subject to customary anti-dilution adjustments (the “Warrants”). The Warrants could separately have a dilutive effect to the extent that the market value per share of the Company’s common stock exceeds the strike price of the warrants on the applicable expiration dates unless, subject to the terms of the Warrants, the Company elects to cash settle the Warrants. The exercise price of the Warrants is initially $ 22.08 and is subject to certain adjustments under the terms of the warrants. The Company received $89,424 in cash proceeds from the sale of Warrants, which were used along with proceeds from the 4.50% Convertible Senior Notes, to pay approximately $142,094 to enter into the Hedge Transactions. The tax impact of the conversion option and Warrants amounted to $10,960 and was recorded in additional paid-in-capital. Together, the Hedge Transactions and the Warrants are intended to reduce the potential dilution from the conversion of the 4.50% Convertible Senior Notes. The Hedge Transactions and Warrants are recorded in equity and are not accounted for as derivatives, in accordance with applicable accounting guidance. Additional Borrowings of International Subsidiaries During May 2020, the Company’s subsidiary in Peru borrowed the USD equivalent of approximately $2,811 under a loan that bears interest at approximately 1 %. Principal payments are due monthly beginning in July 2021 through June 2023. Accrued and

In thousands, except share and per share data

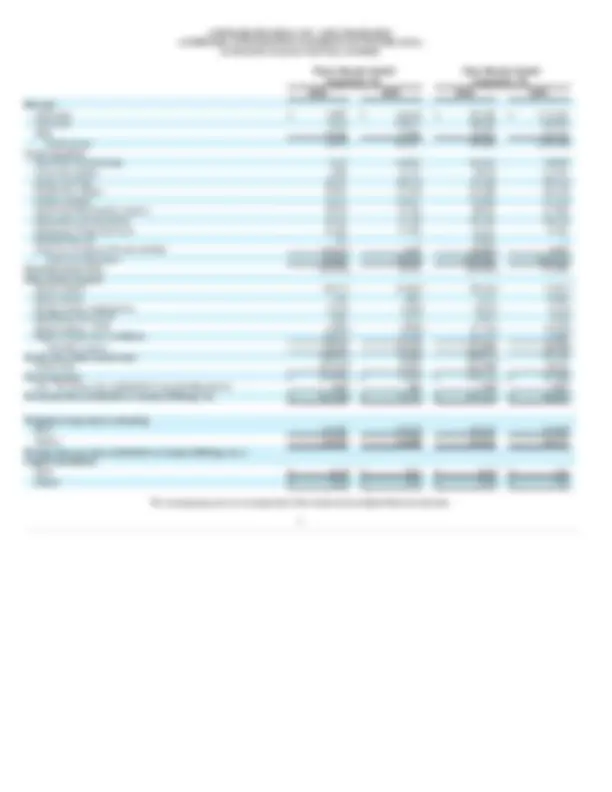

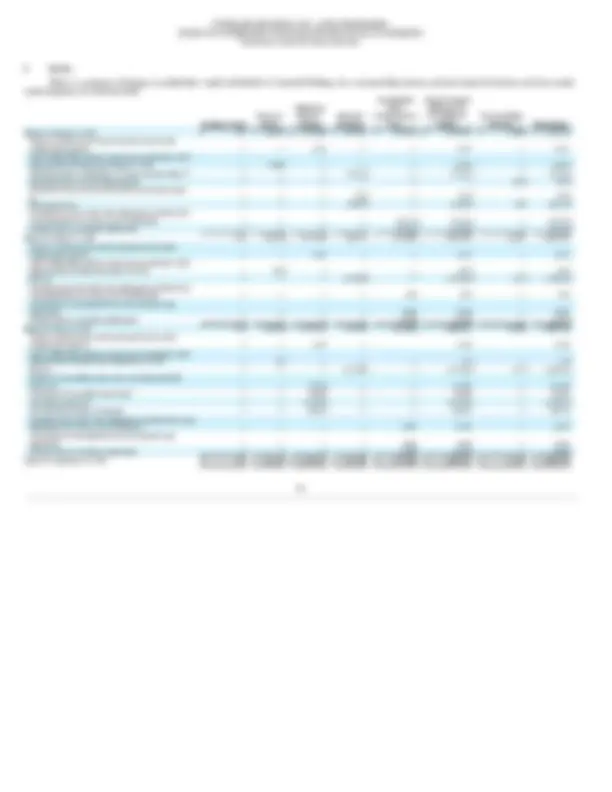

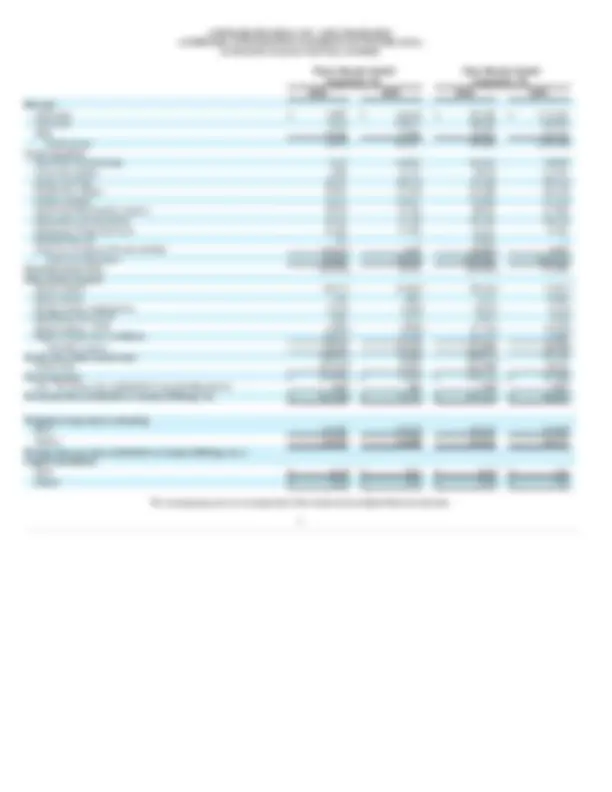

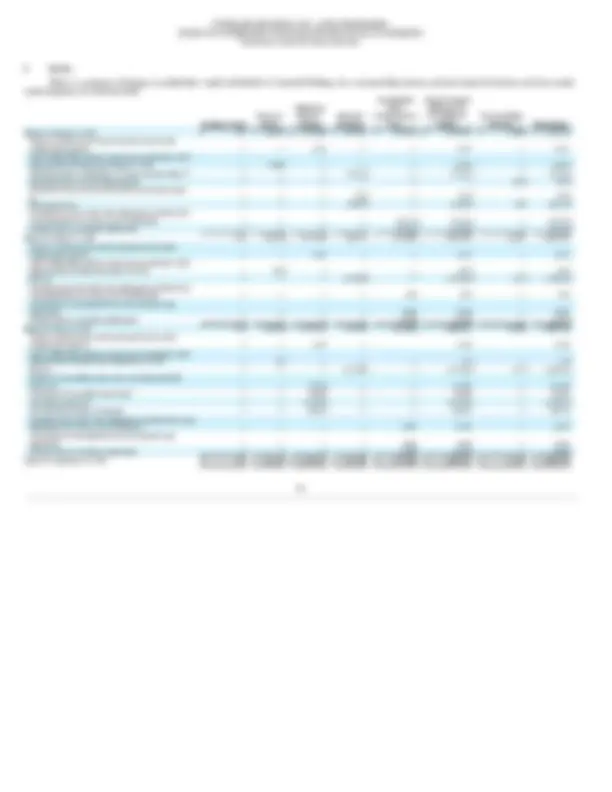

8. Equity Below is a summary of changes in stockholders’ equity attributable to Cinemark Holdings, Inc., noncontrolling interests and total equity for the three and nine months ended September 30, 2020 and 2019: Common Stock Treasury Stock Additional Paid-In- Capital Retained Earnings Accumulated Other Comprehensive Loss Total Cinemark Holdings, Inc. Stockholders’ Equity Noncontrolling Interests Total Equity Balance at January 1, 2020 $ 122 $ (81,567 ) $ 1,170,039 $ 687,332 $ (340,112 ) $ 1,435,814 $ 12,508 $ 1,448, Issuance of share based awards and share based awards compensation expense — — 4,111 — — 4,111 — 4, Stock withholdings related to share based awards that vested during the three months ended March 31, 2020 — (2,691 ) — — — (2,691 ) — (2,691 ) Dividends paid to stockholders, $ 0.36 per common share (1)^ — — — (42,311 ) — (42,311 ) — (42,311 ) Dividends paid to noncontrolling interests — — — — — — ( 392 ) ( 392 ) Dividends accrued on unvested restricted stock unit awards (1) —^ —^ —^ (^256 )^ —^ (^256 )^ —^ (^256 ) Net income (loss) — — — (59,591 ) — (59,591 ) 169 (59,422 ) Unrealized loss due to fair value adjustments on interest rate swap agreements, net of taxes, net of settlements — — — — (24,171 ) (24,171 ) — (24,171 ) Foreign currency translation adjustments — — — — (57,625 ) (57,625 ) — (57,625 ) Balance at March 31, 2020 122 (84,258 ) 1,174,150 585,174 (421,908 ) 1,253,280 12,285 1,265, Issuance of share based awards and share based awards compensation expense — — 4,321 — — 4,321 — 4, Stock withholdings related to share based awards that vested during the three months ended June 30, 2020 — ( 107 ) — — — ( 107 ) — ( 107 ) Net loss — — — (170,389 ) — (170,389 ) ( 427 ) (170,816 ) Unrealized gain due to fair value adjustments on interest rate swap agreements, net of taxes, net of settlements — — — — 849 849 — 849 Amortization of accumulated losses for amended swap agreements — — — — 2,669 2,669 — 2, Foreign currency translation adjustments — — — — (3,702 ) (3,702 ) — (3,702 ) Balance at June 30, 2020 122 (84,365 ) 1,178,471 414,785 (422,092 ) 1,086,921 11,859 1,098, Issuance of share based awards and share based awards compensation expense 1 — 4,427 — 4,428 4, Stock withholdings related to share based awards that vested during the three months ended September 30, 2020 — ( 67 ) — — — ( 67 ) — ( 67 ) Net loss — — — (147,592 ) — (147,592 ) ( 444 ) (148,036 ) Issuance of convertible senior notes, net of allocated debt issue costs — — 97,359 — — 97,359 — 97, Tax impact of convertible notes issued — — 10,960 — — 10,960 — 10, Call options purchased — — (142,094 ) — — (142,094 ) — (142,094 ) Proceeds from issuance of warrants — — 89,424 — — 89,424 — 89, Unrealized gain to fair value adjustments on interest rate swap agreements, net of taxes, net of settlements — — — — 6,528 6,528 — 6, Amortization of accumulated losses for amended swap agreements — — — — 2,669 2,669 — 2, Foreign currency translation adjustments — — — — (1,503 ) (1,503 ) — (1,503 ) Balance at September 30, 2020 $ 123 $ (84,432 ) $ 1,238,547 $ 267,193 $ (414,398 ) $ 1,007,033 $ 11,415 $ 1,018,

In thousands, except share and per share data Common Stock Treasury Stock Additional Paid-In- Capital Retained Earnings Accumulated Other Comprehensive Loss Total Cinemark Holdings, Inc. Stockholders’ Equity Noncontrolling Interests Total Equity Balance at January 1, 2019 $ 121 $ (79,259 ) $ 1,155,424 $ 686,459 $ (319,007 ) $ 1,443,738 $ 12,379 $ 1,456, Cumulative effect of change in accounting principle, net of taxes of $6,054 — — — 16,985 — 16,985 — 16, Issuance of share based awards and share based awards compensation expense — — 2,970 — 2,970 — 2, Stock withholdings related to share based awards that vested during the three months ended March 31, 2019 — (1,947 ) — — — (1,947 ) — (1,947 ) Dividends paid to stockholders, $ 0.34 per common share (1) — — — (39,797 ) — (39,797 ) — (39,797 ) Dividends paid to noncontrolling interests — — — — — — (1,000 ) (1,000 ) Dividends accrued on unvested restricted stock unit awards (1) —^ —^ —^ (^108 )^ —^ (^108 )^ —^ (^108 ) Net income — — — 32,728 — 32,728 465 33, Unrealized loss due to fair value adjustments on interest rate swap agreements, net of taxes, net of settlements — — — — (3,311 ) (3,311 ) — (3,311 ) Other comprehensive loss in equity method investees — — — — ( 71 ) ( 71 ) — ( 71 ) Foreign currency translation adjustments — — — — 755 755 — 755 Balance at March 31, 2019 121 (81,206 ) 1,158,394 696,267 (321,634 ) 1,451,942 11,844 1,463, Issuance of share based awards and share based awards compensation expense 1 — 3,676 — — 3,677 — 3, Stock withholdings related to share based awards that vested during the three months ended June 30, 2019 — ( 300 ) — — — ( 300 ) — ( 300 ) Dividends paid to stockholders, $ 0.34 per common share (1) — — — (39,823 ) — (39,823 ) — (39,823 ) Dividends paid to noncontrolling interests — — — — — — ( 294 ) ( 294 ) Dividends accrued on unvested restricted stock unit awards (1) —^ —^ —^ (^189 )^ —^ (^189 )^ —^ (^189 ) Net income — — — 100,971 — 100,971 890 101, Other comprehensive loss in equity method investees — — — — ( 22 ) ( 22 ) — ( 22 ) Unrealized loss due to fair value adjustments on interest rate swap agreements, net of taxes, net of settlements — — — — (5,902 ) (5,902 ) — (5,902 ) Foreign currency translation adjustments — — — — 4,925 4,925 — 4, Balance at June 30, 2019 $ 122 $ (81,506 ) $ 1,162,070 $ 757,226 $ (322,633 ) $ 1,515,279 $ 12,440 $ 1,527, Issuance of share based awards and share based awards compensation expense — — 3,840 — — 3,840 — 3, Dividends paid to stockholders, $ 0.34 per common share (1)^ — — — (39,832 ) — (39,832 ) — (39,832 ) Dividends paid to noncontrolling interests — — — — — — ( 294 ) ( 294 ) Dividends accrued on unvested restricted stock unit awards (1) —^ —^ —^ (^189 )^ —^ (^189 )^ —^ (^189 ) Net income — — — 31,353 — 31,353 602 31, Other comprehensive loss in equity method investees — — — — ( 49 ) ( 49 ) — ( 49 ) Unrealized loss due to fair value adjustments on interest rate swap agreements, net of taxes, net of settlements — — — — (1,291 ) (1,291 ) — (1,291 ) Foreign currency translation adjustments — — — — (25,408 ) (25,408 ) — (25,408 ) Balance at September 30, 2019 $ 122 $ (81,506 ) $ 1,165,910 $ 748,558 $ (349,381 ) $ 1,483,703 $ 12,748 $ 1,496, (1) Below is a summary of dividends paid to stockholders as well as dividends accrued on unvested restricted stock units during the nine months ended September 30, 2020 and 2019 :