Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

An analysis of a company's revenue trends, highlighting a decrease of $16 million or 4%. The decline is attributed to decreases in revenue from retail loans and direct financing leases, increases in provision for credit losses and interest expense, and offsetting increases in operating lease revenue and decreases in early termination loss on operating leases.

Typology: Study notes

1 / 59

This page cannot be seen from the preview

Don't miss anything!

(Mark One) QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2015

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File Number 001-

(Exact name of registrant as specified in its charter)

California 95 - 3472715 (State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.)

20800 Madrona Avenue, Torrance, California 90503 (Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer (^) Accelerated filer (^)

Non-accelerated filer (Do not check if a smaller reporting company) Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No

As of January 29, 2016, the number of outstanding shares of common stock of the registrant was 13,660,000 all of which shares were held by American Honda Motor Co., Inc. None of the shares are publicly traded.

American Honda Finance Corporation, a wholly owned subsidiary of American Honda Motor Co., Inc., which in turn is a wholly owned subsidiary of Honda Motor Co., Ltd., meets the requirements set forth in General Instruction H(1)(a) and (b) of Form 10-Q and is therefore filing this Form 10-Q with the reduced disclosure format.

Table of Contents Page

- For the quarter ended December 31, QUARTERLY REPORT ON FORM 10-Q Item1. Financial Statements

AMERICAN HONDA FINANCE CORPORATION AND SUBSIDIARIES

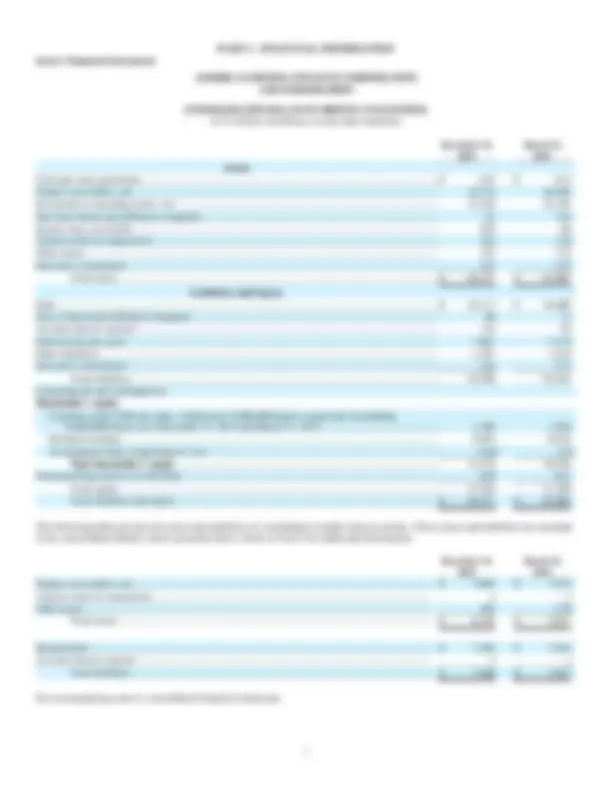

(U.S. dollars in millions, except share amounts)

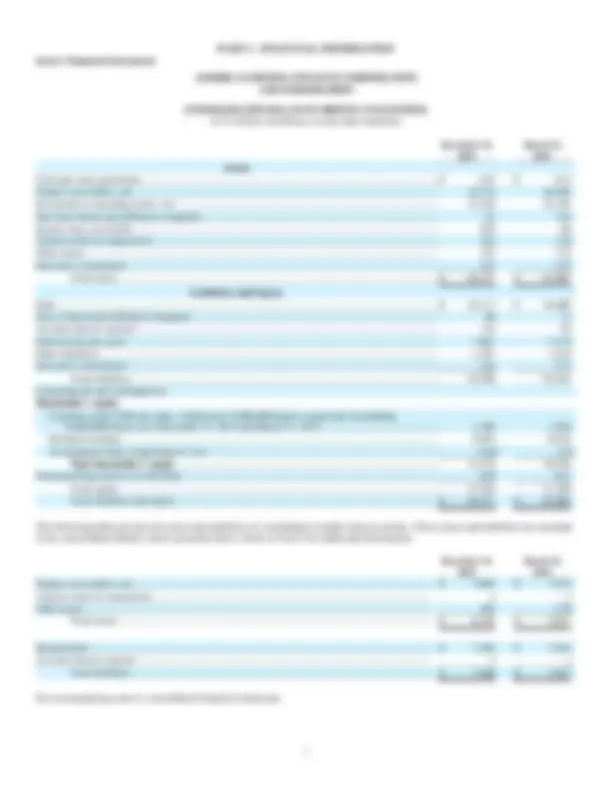

December 31, March 31, 2015 2015 Assets Cash and cash equivalents ......................................................................................................................$ 675 $ 634 Finance receivables, net ......................................................................................................................... 35,725 38, Investment in operating leases, net ........................................................................................................ 27,220 24,

Due from Parent and affiliated companies ............................................................................................. 92 104 Income taxes receivable ......................................................................................................................... 659 66 Vehicles held for disposition .................................................................................................................. 163 138 Other assets ............................................................................................................................................ 725 723

Derivative instruments ........................................................................................................................... 212 237 Total assets ...............................................................................................................................$ 65,471 $ 64, Liabilities and Equity Debt ........................................................................................................................................................$ 44,117 $ 44, Due to Parent and affiliated companies.................................................................................................. 89 71 Accrued interest expense ....................................................................................................................... 110 93

Deferred income taxes ........................................................................................................................... 7,861 7, Other liabilities....................................................................................................................................... 1,287 1, Derivative instruments ........................................................................................................................... 244 371

Total liabilities .......................................................................................................................... 53,708 53, Commitments and contingencies Shareholder’s equity:

Common stock, $100 par value. Authorized 15,000,000 shares; issued and outstanding 13,660,000 shares as of December 31, 2015 and March 31, 2015 .............................................. 1,366 1, Retained earnings ............................................................................................................................. 9,894 9, Accumulated other comprehensive loss ........................................................................................... (136 ) (75 ) Total shareholder’s equity ........................................................................................................ 11,124 10, Noncontrolling interest in subsidiary ..................................................................................................... 639 651

Total equity............................................................................................................................... 11,763 11, Total liabilities and equity ........................................................................................................$ 65,471 $ 64,

The following table presents the assets and liabilities of consolidated variable interest entities. These assets and liabilities are included in the consolidated balance sheets presented above. Refer to Note 9 for additional information.

December 31, March 31, 2015 2015 Finance receivables, net ...................................................................................................................... $ 7,865 $ 7,

Vehicles held for disposition ............................................................................................................... 4 3 Other assets ......................................................................................................................................... 295 270 Total assets ............................................................................................................................ $ 8,164 $ 7,

Secured debt ........................................................................................................................................ $ 7,483 $ 7, Accrued interest expense .................................................................................................................... (^3 )

Total liabilities ....................................................................................................................... $ 7,486 $ 7,

See accompanying notes to consolidated financial statements.

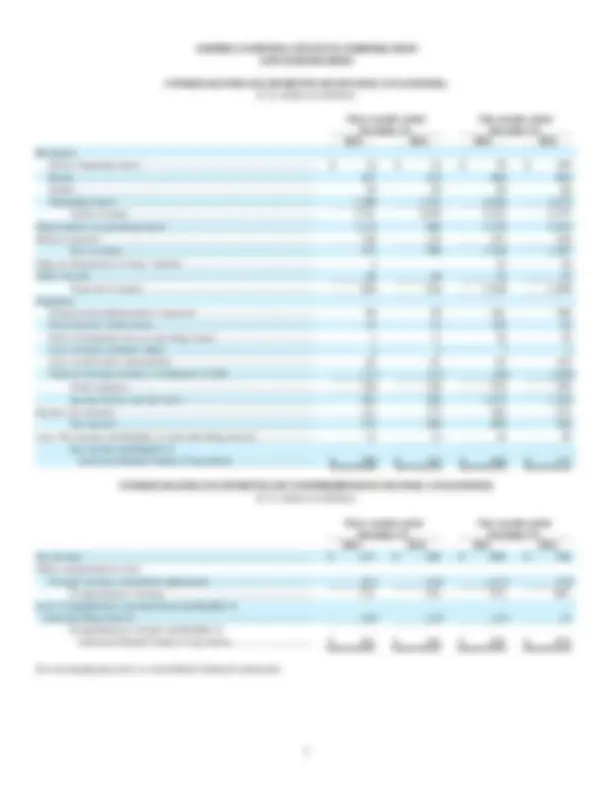

(U.S. dollars in millions)

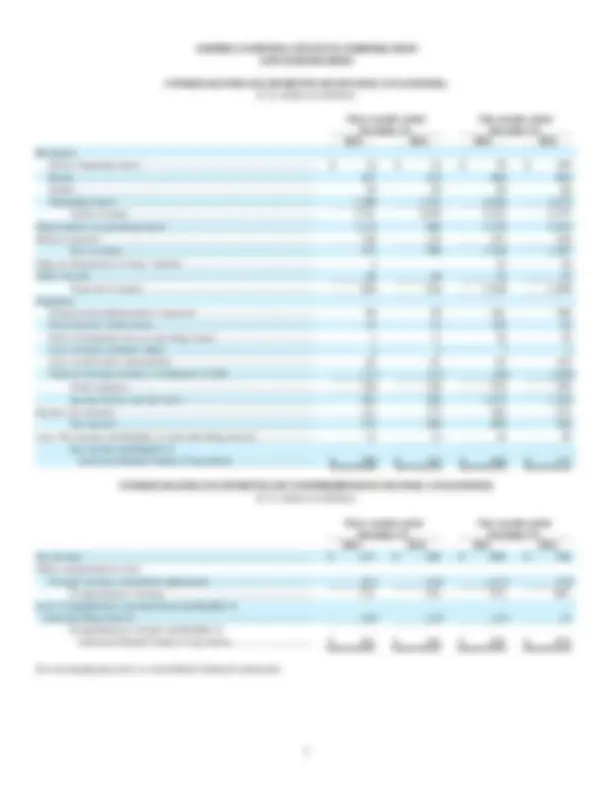

Three months ended Nine months ended December 31, December 31, 2015 2014 2015 2014 Revenues: Direct financing leases........................................................................ $ 16 $ 34 $ 59 $ 109 Retail .................................................................................................. 297 322 899 985 Dealer ................................................................................................. 30 29 90 88 Operating leases .................................................................................. 1,398 1,233 4,059 3, Total revenues ............................................................................ 1,741 1,618 5,107 4,

Depreciation on operating leases ............................................................. 1,119 986 3,236 2, Interest expense ........................................................................................ 148 142 431 438 Net revenues ............................................................................... 474 490 1,440 1,

Gain on disposition of lease vehicles ....................................................... 4 - 34 38 Other income ............................................................................................ 26 26 74 74

Total net revenues ...................................................................... 504 516 1,548 1, Expenses: General and administrative expenses .................................................. 98 99 301 298 Provision for credit losses ................................................................... 43 34 109 85 Early termination loss on operating leases.......................................... 1 11 30 29 Loss on lease residual values .............................................................. 4 2 7 4 Loss on derivative instruments ........................................................... 65 61 62 193 Gain on foreign currency revaluation of debt ..................................... (71 ) (71 ) (36 ) ( 250 ) Total expenses ............................................................................ 140 136 473 359 Income before income taxes ....................................................... 364 380 1,075 1, Income tax expense .................................................................................. 141 172 385 474 Net income ................................................................................. 223 208 690 766

Less: Net income attributable to noncontrolling interest ......................... 15 14 44 49 Net income attributable to American Honda Finance Corporation .................................... $ 208 $ 194 $ 646 $ 717

(U.S. dollars in millions)

Three months ended Nine months ended December 31, December 31, 2015 2014 2015 2014 Net income ............................................................................................... $ 223 $ 208 $ 690 $ 766 Other comprehensive loss: Foreign currency translation adjustment ............................................. (51 ) (54 ) (117 ) (75 ) Comprehensive income .............................................................. 172 154 573 691 Less: Comprehensive income/(loss) attributable to noncontrolling interest .......................................................................... (10 ) (12 ) (12 ) 13 Comprehensive income attributable to American Honda Finance Corporation .................................... $ 182 $ 166 $ 585 $ 678

See accompanying notes to consolidated financial statements.

(U.S. dollars in millions)

Nine months ended December 31, 2015 2014 Cash flows from operating activities: Net income ....................................................................................................................................... $ 690 $ 766 Adjustments to reconcile net income to net cash provided by operating activities: Debt and derivative instrument valuation adjustments ............................................................... (118 ) (201 ) Loss on lease residual values and provision for credit losses ..................................................... 116 89 Early termination loss on operating leases ................................................................................. 30 29 Depreciation and amortization ................................................................................................... 3,239 2, Accretion of unearned subsidy income ...................................................................................... (830 ) (810 ) Amortization of deferred dealer participation and IDC .............................................................. 239 254 Gain on disposition of lease vehicles and fixed assets ............................................................... (34 ) (38 ) Deferred income tax benefit ....................................................................................................... 735 437 Changes in operating assets and liabilities: Income taxes receivable/payable .......................................................................................... (594 ) (20 ) Other assets ........................................................................................................................... - 37 Accrued interest/discounts on debt ....................................................................................... 31 35 Other liabilities ..................................................................................................................... 83 6 Due to/from Parent and affiliated companies ....................................................................... 28 (28 ) Net cash provided by operating activities ........................................................................ 3,615 3,

Cash flows from investing activities: Finance receivables acquired ........................................................................................................... (10,951 ) (13,077 ) Principal collected on finance receivables ....................................................................................... 12,907 13, Net change in wholesale loans ......................................................................................................... 98 352 Purchase of operating lease vehicles ............................................................................................... (11,566 ) (10,458 ) Disposal of operating lease vehicles ................................................................................................ 5,055 4, Cash received for unearned subsidy income .................................................................................... 998 977 Other investing activities, net .......................................................................................................... (41 ) 3 Net cash used in investing activities ................................................................................ (3,500 ) (3,972 )

Cash flows from financing activities: Proceeds from issuance of commercial paper .................................................................................. 27,424 31, Paydown of commercial paper ........................................................................................................ (26,852 ) (29,913 ) Proceeds from issuance of related party debt .................................................................................. 15,338 32, Paydown of related party debt ......................................................................................................... (16,654 ) (32,581 ) Proceeds from issuance of medium term notes and other debt ........................................................ 5,832 7, Paydown of medium term notes and other debt ............................................................................... (5,301 ) (6,678 ) Proceeds from issuance of secured debt .......................................................................................... 3 ,503 2, Paydown of secured debt ................................................................................................................. (3,354 ) (3,820 ) Net cash (used in)/provided by financing activities ........................................................ (64 ) 1,

Effect of exchange rate changes on cash and cash equivalents ............................................................. (10 ) - Net increase in cash and cash equivalents ....................................................................... 41 533 Cash and cash equivalents at beginning of year .................................................................................... 634 138

Cash and cash equivalents at end of year .............................................................................................. $ 675 $ 671

Supplemental disclosures of cash flow information:

Interest paid ..................................................................................................................................... $ 386 $ 429 Income taxes paid ............................................................................................................................ 254 65

See accompanying notes to consolidated financial statements.

Notes to Consolidated Financial Statements (Unaudited)

(1) Interim Information

(a) Organizational Structure

American Honda Finance Corporation (AHFC) is a wholly owned subsidiary of American Honda Motor Co., Inc. (AHM or the Parent). Honda Canada Finance Inc. (HCFI) is a majority-owned subsidiary of AHFC. Noncontrolling interest in HCFI is held by Honda Canada Inc. (HCI), an affiliate of AHFC. AHM is a wholly owned subsidiary and HCI is an indirect wholly owned subsidiary of Honda Motor Co., Ltd. (HMC). AHM and HCI are the sole authorized distributors of Honda and Acura products, including motor vehicles, parts, and accessories in the United States and Canada.

Unless otherwise indicated by the context, all references to the “Company”, “we”, “us”, and “our” in this report include AHFC and its consolidated subsidiaries, and references to “AHFC” refer solely to American Honda Finance Corporation (excluding AHFC’s subsidiaries).

(b) Basis of Presentation

The unaudited consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) for interim information, and instructions to the Quarterly Report on Form 10-Q and Rule 10-01 of Regulation S-X. In the opinion of management, these unaudited interim financial statements include all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of the results of operations, cash flows, and financial condition for the interim periods presented. Results for interim periods should not be considered indicative of results for the full year or for any other interim period. These unaudited interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements, significant accounting policies, and the other notes to the consolidated financial statements for the fiscal year ended March 31, 2015 included in the Company’s Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission (SEC) on June 26, 2015. All significant intercompany balances and transactions have been eliminated upon consolidation.

(c) Recently Adopted Accounting Standards

Effective April 1, 2015, the Company adopted Accounting Standards Update (ASU) 2015-03, Interest—Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs. The amendments require that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. In August 2015, the Financial Accounting Standards Board (FASB) issued ASU 2015-15, Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements. This ASU states that the SEC staff would not object to an entity deferring and presenting debt issuance costs as an asset and subsequently amortizing deferred debt issuance costs ratably over the term of the line- of-credit arrangement, regardless of whether there are outstanding borrowings under the line-of-credit arrangement. The adoption of these ASU’s did not have material impact on the consolidated financial statements.

(d) Recently Issued Accounting Standards

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers and created the new Accounting Standards Codification (ASC) Topic 606, Revenue from Contracts with Customers , and added ASC Subtopic 340-40, Other Assets and Deferred Costs—Contracts with Customers. The guidance in this update supersedes the revenue recognition requirements in ASC Topic 605, Revenue Recognition , and most industry-specific guidance throughout the industry topics of the codification. In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date, which defers the effective date for the Company from April 1, 2017 to April 1, 2018 while permitting early adoption as of April 1, 2017. The Company is currently assessing the impact the adoption of this guidance will have on the consolidated financial statements.

Notes to Consolidated Financial Statements (Unaudited)

Credit Quality of Financing Receivables

Credit losses are an expected cost of extending credit. The majority of the credit risk is with consumer financing and to a lesser extent with dealer financing. Credit risk can be affected by general economic conditions. Adverse changes such as a rise in unemployment rates can increase the likelihood of defaults. Declines in used vehicle prices can reduce the amount of recoveries on repossessed collateral. Credit risk on dealer loans is affected primarily by the financial strength of the dealers within the portfolio. Exposure to credit risk is managed through purchasing standards, pricing of contracts for expected losses, focusing collection efforts to minimize losses, and ongoing reviews of the financial condition of dealers.

Allowance for Credit Losses

The allowance for credit losses is management’s estimate of probable losses incurred on finance receivables, which requires significant judgment and assumptions that are inherently uncertain. The allowance is based on management’s evaluation of many factors, including the Company’s historical credit loss experience, the value of the underlying collateral, delinquency trends, and economic conditions.

Consumer finance receivables in the retail loan and direct financing lease portfolio segments are collectively evaluated for impairment. Delinquencies and losses are monitored on an ongoing basis and this historical experience provides the primary basis for estimating the allowance. Management utilizes various methodologies when estimating the allowance for credit losses including models which incorporate vintage loss and delinquency migration analysis. These models take into consideration attributes of the portfolio including loan-to-value ratios, internal and external credit scores, and collateral types. Market and economic factors such as used vehicle prices, unemployment rates, and consumer debt service burdens are also incorporated into these models.

Dealer loans are individually evaluated for impairment when specifically identified as impaired. Dealer loans are considered to be impaired when it is probable that the Company will be unable to collect all amounts due according to the terms of the contract. The Company’s determination of whether dealer loans are impaired is based on evaluations of dealership payment history, financial condition, and ability to perform under the terms of the loan agreements. Dealer loans that have not been specifically identified as impaired are collectively evaluated for impairment.

There were no modifications to dealer loans that constituted troubled debt restructurings during the three and nine months ended December 31, 2015 and 2014.

The Company generally does not grant concessions on consumer finance receivables that are considered to be troubled debt restructurings other than modifications of retail loans in reorganization proceedings pursuant to the U.S. Bankruptcy Code. Retail loans modified under bankruptcy protection were not material to the Company’s consolidated financial statements during the three and nine months ended December 31, 2015 and 2014. The Company does allow payment deferrals on consumer finance receivables. However, these payment deferrals are not considered to be troubled debt restructurings since the deferrals are deemed to be insignificant and interest continues to accrue during the deferral period.

Notes to Consolidated Financial Statements (Unaudited)

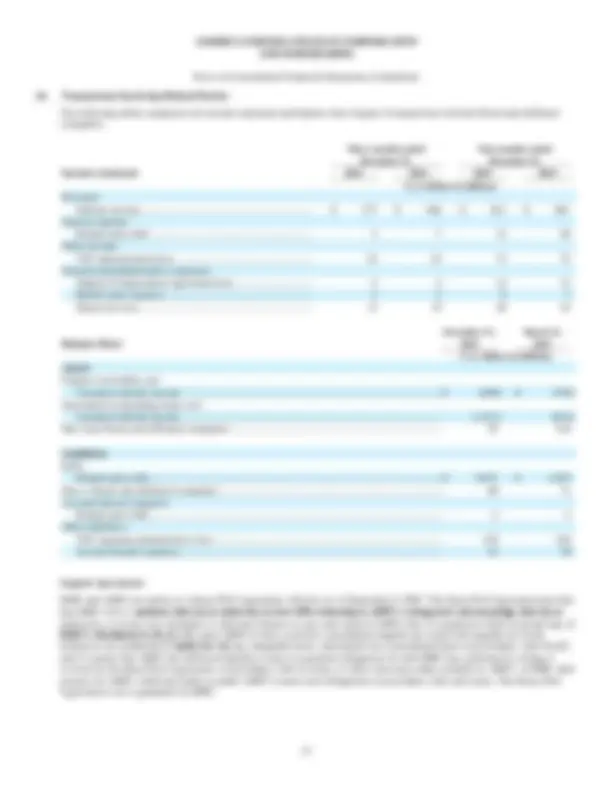

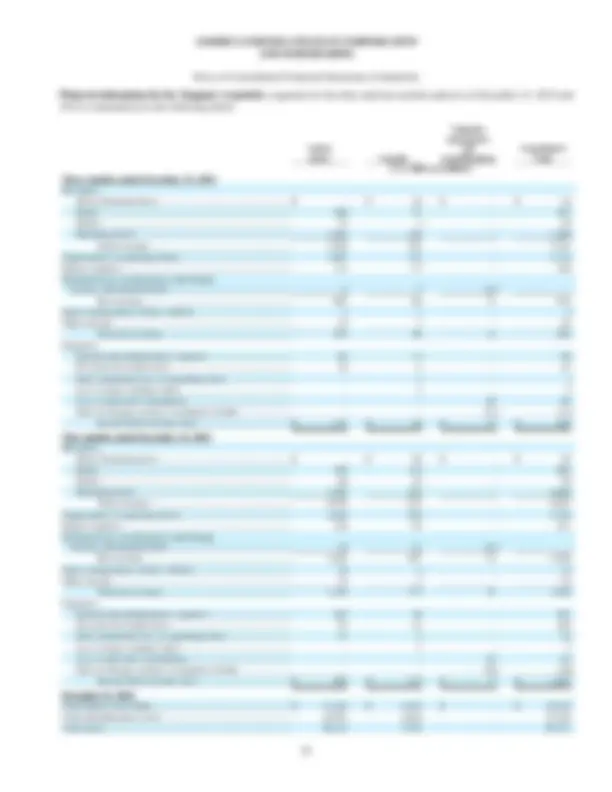

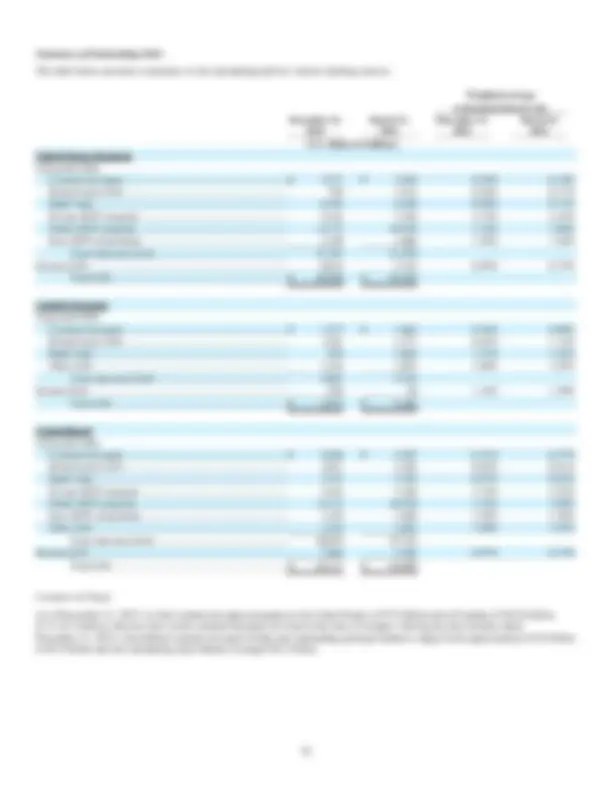

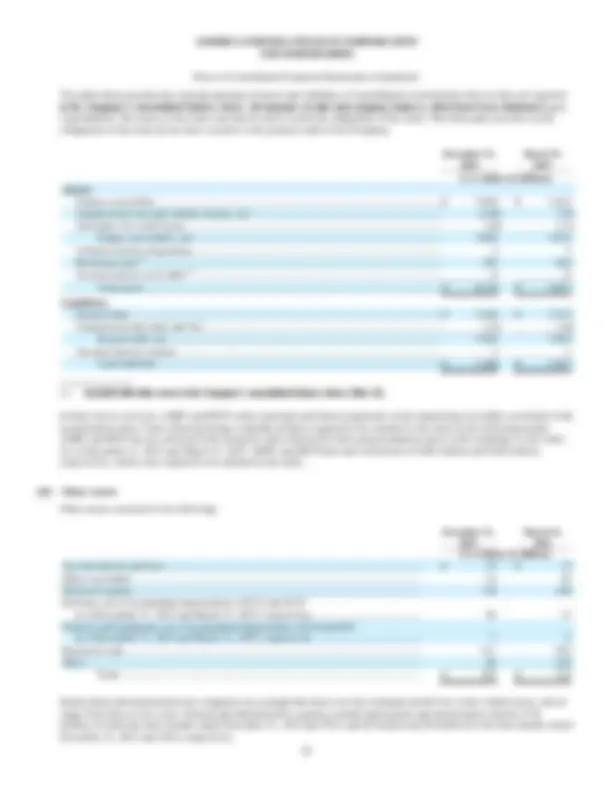

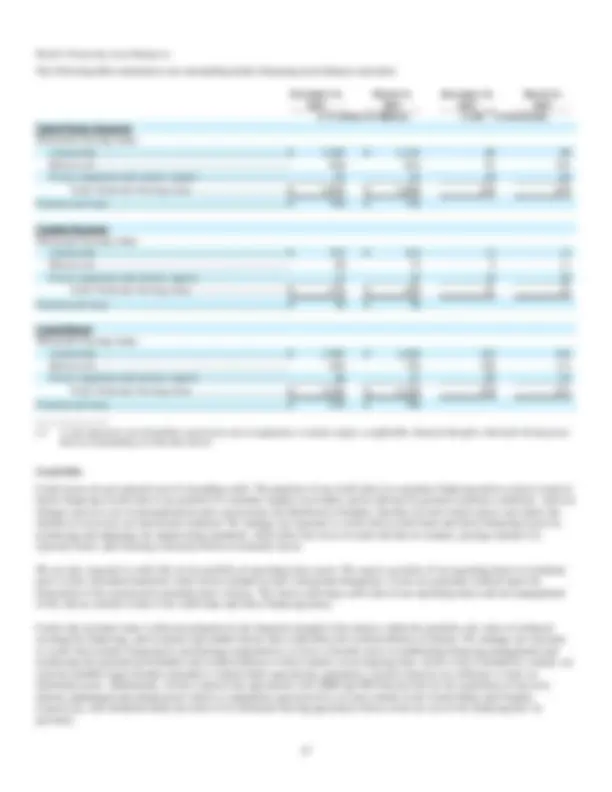

The following is a summary of the activity in the allowance for credit losses of finance receivables:

Three and nine months ended December 31, 2015 Lease Retail Dealer Total (U.S. dollars in millions) Beginning balance, October 1, 2015 .................................$ 2 $ 91 $ - $ 93 Provision............................................................................ 1 37 - 38 Charge-offs ........................................................................ (1 ) (54 ) - (55 ) Recoveries ......................................................................... - 18 - 18 Effect of translation adjustment ......................................... - (1 ) - (1 ) Ending balance, December 31, 2015 .................................$ 2 $ 91 $ - $ 93 Beginning balance, April 1, 2015 ......................................$ 2 $ 84 $ - $ 86 Provision............................................................................ 2 94 (1 ) 95 Charge-offs ........................................................................ (3 ) (139 ) - (142 ) Recoveries ......................................................................... 1 53 1 55 Effect of translation adjustment ......................................... - (1 ) - (1 ) Ending balance, December 31, 2015 .................................$ 2 $ 91 $ - $ 93 Allowance for credit losses – ending balance: Individually evaluated for impairment .........................$ - $ - $ - $ - Collectively evaluated for impairment ......................... 2 91 - 93 Finance receivables – ending balance: Individually evaluated for impairment .........................$ - $ - $ 1 $ 1 Collectively evaluated for impairment ......................... 1,048 30,629 4,151 35,

Three and nine months ended December 31, 2014 Lease Retail Dealer Total (U.S. dollars in millions) Beginning balance, October 1, 2014 ................................$. 3 $ 91 $ - $ 94 Provision............................................................................ 1 28 - 29 Charge-offs ........................................................................ (2 ) (55 ) - (57 ) Recoveries ......................................................................... 1 23 - 24 Effect of translation adjustment ......................................... - (1 ) - (1 ) Ending balance, December 31, 2014 .................................$ 3 $ 86 $ - $ 89 Beginning balance, April 1, 2014 ......................................$ 4 $ 95 $ 1 $ 100 Provision............................................................................ 2 69 - 71 Charge-offs ........................................................................ (4 ) (139 ) (1 ) (144 ) Recoveries ......................................................................... 1 62 - 63 Effect of translation adjustment ......................................... - (1 ) - (1 ) Ending balance, December 31, 2014 .................................$ 3 $ 86 $ - $ 89 Allowance for credit losses – ending balance: Individually evaluated for impairment .........................$ - $ - $ - $ - Collectively evaluated for impairment ......................... 3 86 - 89 Finance receivables – ending balance: Individually evaluated for impairment .........................$ - $ - $ 36 $ 36 Collectively evaluated for impairment ......................... 2,214 33,919 4,138 40,

Notes to Consolidated Financial Statements (Unaudited)

Credit Quality Indicators

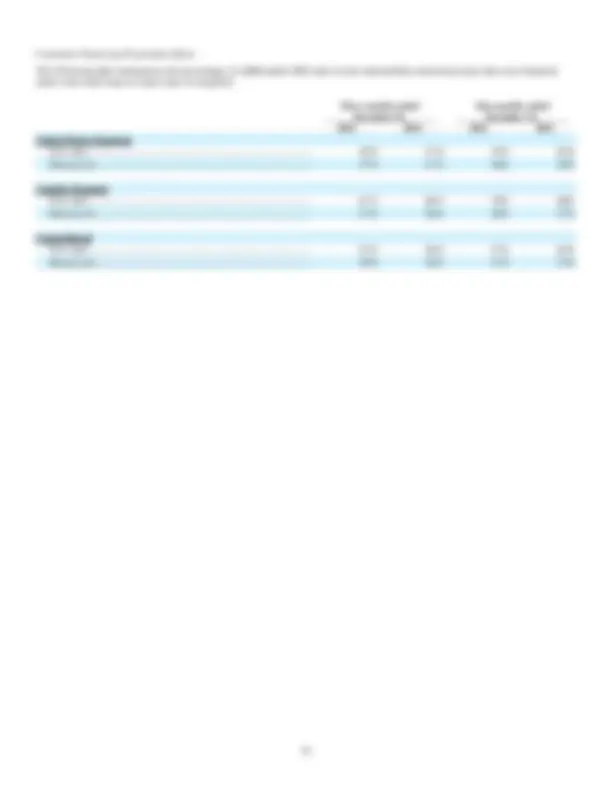

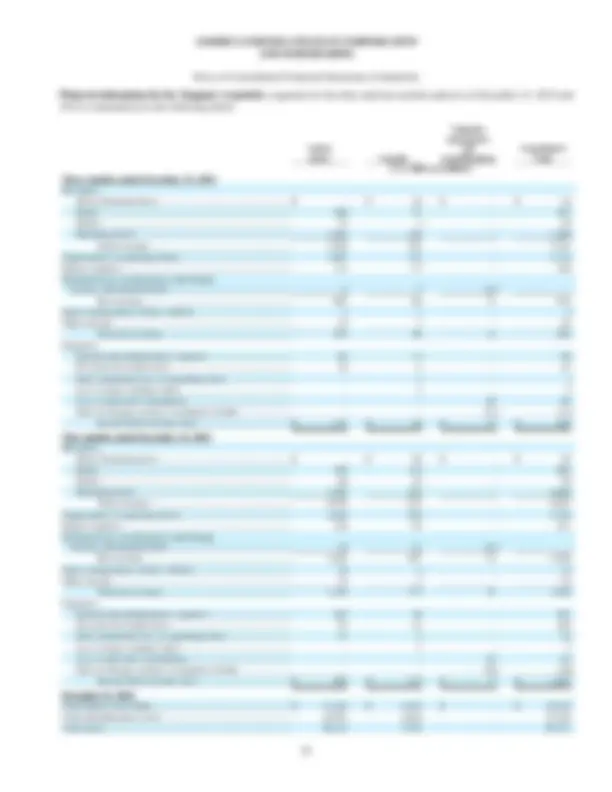

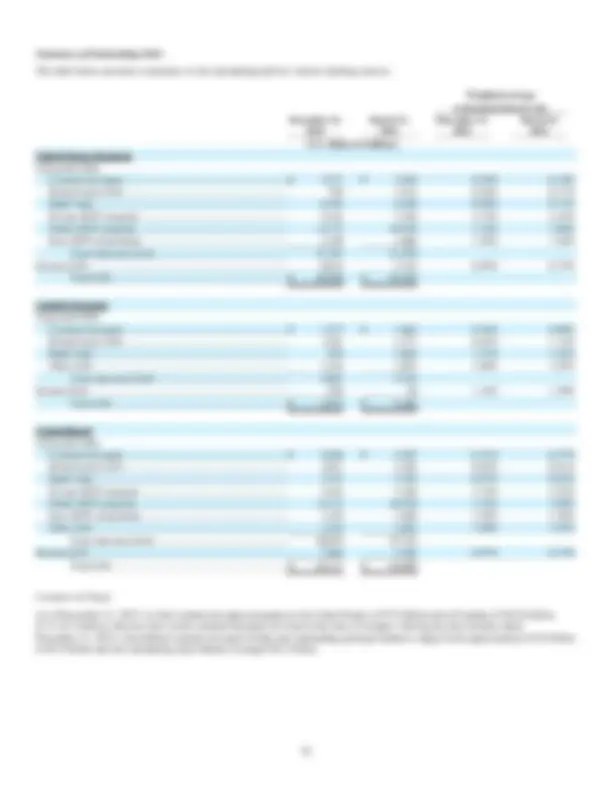

Retail Loan and Direct Financing Lease Portfolio Segments

The Company utilizes proprietary credit scoring systems to evaluate the credit risk of applicants for retail loans and leases. The scoring systems assign internal credit scores based on various factors including the applicant’s credit bureau information and contract terms. The internal credit score provides the primary basis for credit decisions when acquiring retail loan and lease contracts. Internal credit scores are determined only at the time of origination and are not reassessed during the life of the contract.

Subsequent to origination, collection experience provides a current indication of the credit quality of consumer finance receivables. The likelihood of accounts charging off becomes significantly higher once an account becomes 60 days delinquent. Accounts that are current or less than 60 days past due are considered to be performing. Accounts that are 60 days or more past due are considered to be nonperforming. The table below presents the Company’s portfolio of retail loans and direct financing leases by this credit quality indicator:

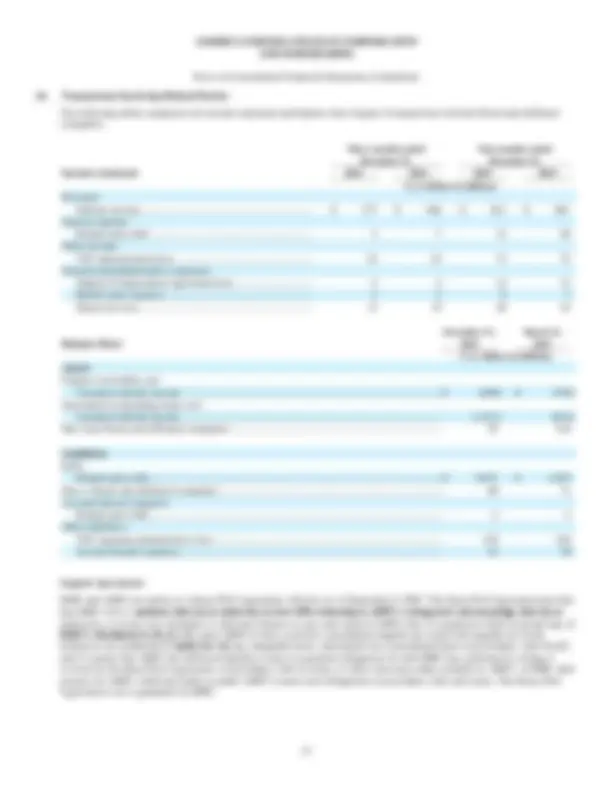

Retail Retail Direct

Total consumer Retail used and motorcycle financing finance new auto certified auto and other lease receivables (U.S. dollars in millions) December 31, 2015 Performing ..........................................$ 26,320 $ 3,171 $ 1,061 $ 1,046 $ 31, Nonperforming .................................... 53 16 8 2 79 Total ............................................$ 26,373 $ 3,187 $ 1,069 $ 1,048 $ 31,

March 31, 2015 Performing ..........................................$ 28,158 $ 3,280 $ 1,019 $ 1,813 $ 34, Nonperforming .................................... 23 8 4 2 37 Total ............................................$ 28,181 $ 3,288 $ 1,023 $ 1,815 $ 34,30 7

Dealer Loan Portfolio Segment

The Company utilizes an internal risk rating system to evaluate dealer credit risk. Dealerships are assigned an internal risk rating based on an assessment of their financial condition. Factors including liquidity, financial strength, management effectiveness, and operating efficiency are evaluated when assessing their financial condition. Financing limits and interest rates are determined from these risk ratings. Monitoring activities including financial reviews and inventory inspections are performed more frequently for dealerships with weaker risk ratings. The financial conditions of dealerships are reviewed and their risk ratings are updated at least annually.

The Company’s outstanding portfolio of dealer loans has been divided into two groups in the tables below. Group A includes the loans of dealerships with the strongest internal risk rating. Group B includes the loans of all remaining dealers. Although the likelihood of losses can be higher for dealerships in Group B, the overall risk of losses is not considered to be significant.

December 31, 2015 March 31, 2015 Wholesale Commercial Wholesale Commercial flooring loans Total flooring loans Total (U.S. dollars in millions) Group A ................ $ 2,174 $ 561 $ 2,735 $ 2,281 $ 564 $ 2, Group B ................ 1,151 266 1,417 1,177 234 1, Total ........ $ 3,325 $ 827 $ 4,152 $ 3,458 $ 798 $ 4,

Notes to Consolidated Financial Statements (Unaudited)

(3) Investment in Operating Leases

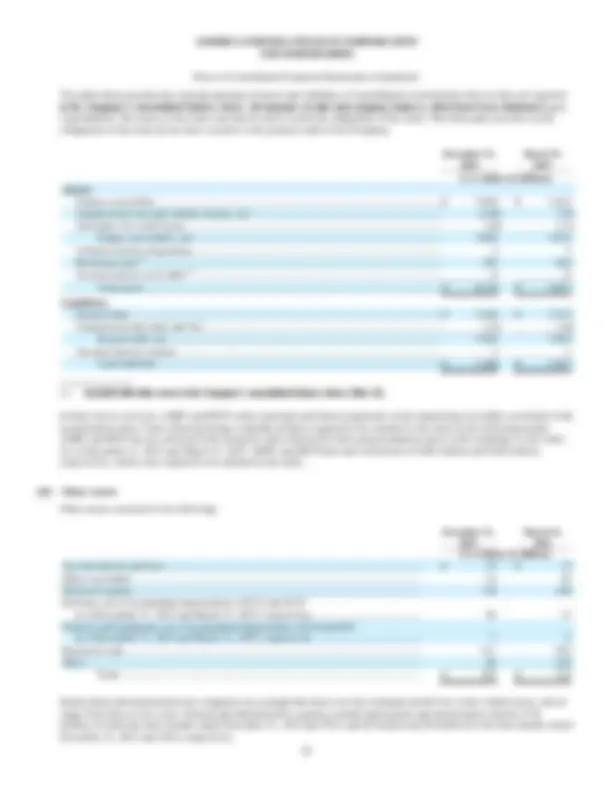

Investment in operating leases consisted of the following:

December 31, March 31, 2015 2015 (U.S. dollars in millions) Operating lease vehicles ...............................................................................................................$ 33,861 $ 30, Accumulated depreciation ............................................................................................................ (5,678 ) (5,070 ) Deferred dealer participation and IDC ......................................................................................... 109 98 Unearned subsidy income ............................................................................................................. (1,016 ) (819 ) Estimated early termination losses ............................................................................................... (56 ) (58 ) $ 27,220 $ 24,

The Company recognized $1 million and $11 million of estimated early termination losses due to lessee defaults for the three months ended December 31, 2015 and 2014, respectively. Actual net losses realized for the three months ended December 31, 2015 and 2014 totaled $14 million and $10 million, respectively. The Company recognized $30 million and $29 million of estimated early termination losses due to lessee defaults for the nine months ended December 31, 2015 and 2014, respectively. Actual net losses realized for the nine months ended December 31, 2015 and 2014 totaled $32 million and $26 million, respectively.

Included in the provision for credit losses for both the three months ended December 31, 2015 and 2014 are provisions related to past due receivables on operating leases in the amount of $5 million. Included in the provision for credit losses for both the nine months ended December 31, 2015 and 2014 are provisions related to past due receivables on operating leases in the amount of $14 million.

The Company did not recognize impairment losses due to declines in estimated residual values during the three and nine months ended December 31, 2015 and 2014.

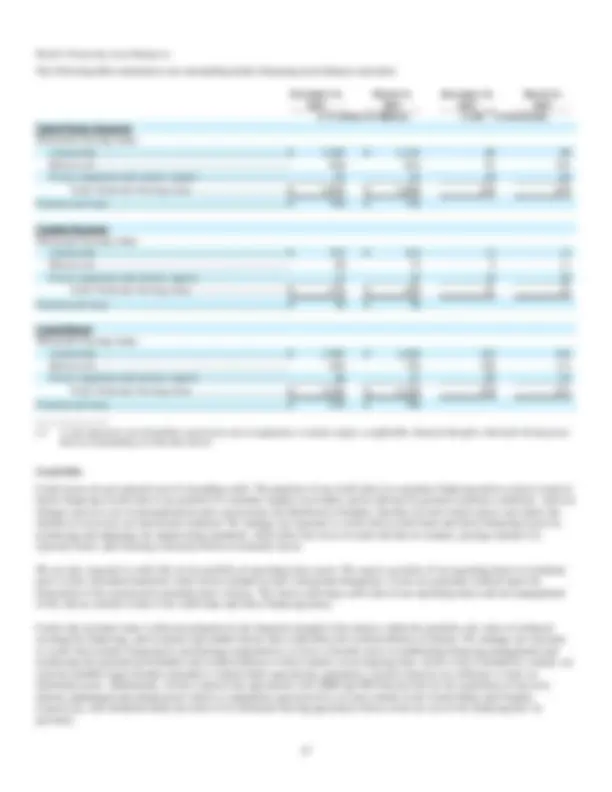

(4) Debt

The Company issues debt in various currencies with both floating and fixed interest rates. Outstanding debt, weighted average contractual interest rates and range of contractual interest rates were as follows:

Weighted average Contractual contractual interest rate interest rate ranges December 31, March 31, December 31, March 31, December 31, March 31, 2015 2015 2015 2015 2015 2015 (U.S. dollars in millions) Unsecured debt: Commercial paper ......... $ 5,048 $ 4,587 0.41 % 0.37 % 0.25 - 0.86% 0.15 - 1.33% Related party debt ......... 2,051 3,492 0.65 % 0.61 % 0.27 - 0.86% 0.16 - 1.30% Bank loans ..................... 7,247 7,292 0.97 % 0.84 % 0.73 - 1.57% 0.61 - 1.73% Private MTN program ... 5,442 7,458 2.75 % 2.45 % 0.78 - 7.63% 0.64 - 7.63% Public MTN program .... 14,173 10,938 1.35 % 1.09 % 0.28 - 2.63% 0.25 - 2.25% Euro MTN programme .. 1,339 1,866 1.58 % 1.30 % 0.82 - 2.23% 0.15 - 2.23% Other debt...................... 1,334 1,691 1.80 % 1.85 % 1.13 - 2.35% 1.40 - 2.35% Total unsecured debt .................... 36,634 37, Secured debt ....................... 7,483 7,365 0.97 % 0.74 % 0.48 - 1.56% 0.19 - 1.46% Total debt .............. $ 44,117 $ 44,

As of December 31, 2015, the outstanding principal balance of long-term debt with floating interest rates totaled $14.3 billion and long-term debt with fixed interest rates totaled $22.1 billion. As of March 31, 2015, the outstanding principal balance of long-term debt with floating interest rates totaled $12.6 billion and long-term debt with fixed interest rates totaled $21.0 billion.

Notes to Consolidated Financial Statements (Unaudited)

Secured Debt

The Company issues notes through secured financing transactions that are secured by assets held by the issuing securitization trust. The notes generally have fixed interest rates (a limited number of notes had floating interest rates). Repayment on the notes is dependent on the performance of the underlying receivables. Refer to Note 9 for additional information on the Company’s secured financing transactions.

Credit Agreements

Syndicated Bank Credit Facilities

AHFC maintains a $3.5 billion 364 day credit agreement, as amended, which expires on March 4, 2016, and a $3.5 billion five year credit agreement, as amended, which expires on March 7, 2020. At December 31, 2015, no amounts were outstanding or repaid under the AHFC credit agreements. AHFC intends to renew or replace the credit agreements prior to or on their respective expiration dates.

HCFI maintains a $1.2 billion credit agreement, as amended, which provides that HCFI may borrow up to $578 million on a one year and a five-year revolving basis. The one year tranche of the credit agreement expires on March 24, 2016 and the five year tranche of the credit agreement expires on March 24, 2020. At December 31, 2015, no amounts were outstanding or repaid under the HCFI credit agreement. HCFI intends to renew or replace the credit agreement prior to or on the expiration date of each respective tranche.

The credit agreements contain customary conditions to borrowing and customary restrictive covenants, including limitations on liens and limitations on mergers, consolidations and asset sales. The credit agreements also require AHFC and HCFI, respectively, to maintain a positive consolidated tangible net worth as defined in their respective credit agreements. The credit agreements, in addition to other customary events of default, include cross-default provisions and provisions for default if HMC does not maintain ownership, whether directly or indirectly, of at least 80% of the outstanding capital stock of AHFC or HCFI, as applicable. In addition, the AHFC and HCFI credit agreements contain provisions for default if HMC’s obligations under the HMC-AHFC Keep Well Agreement or the HMC-HCFI Keep Well Agreement, as applicable, become invalid, voidable, or unenforceable. All of these conditions, covenants and events of default are subject to important limitations and exceptions under the agreements governing the credit agreements. As of December 31, 2015, management believes that AHFC and HCFI were in compliance with all covenants contained in the respective credit agreements.

Other Credit Agreements

In September 2015, AHFC entered into other committed lines of credit to allow the Company access to an additional $1. billion in unsecured funding with multiple banks. The credit agreements contain customary conditions to borrowing and customary restrictive covenants, including limitations on liens and limitations on mergers, consolidations and asset sales and a requirement for AHFC to maintain a positive consolidated tangible net worth. There were no amounts outstanding as of December 31, 2015. These agreements expire in September 2016.

Notes to Consolidated Financial Statements (Unaudited)

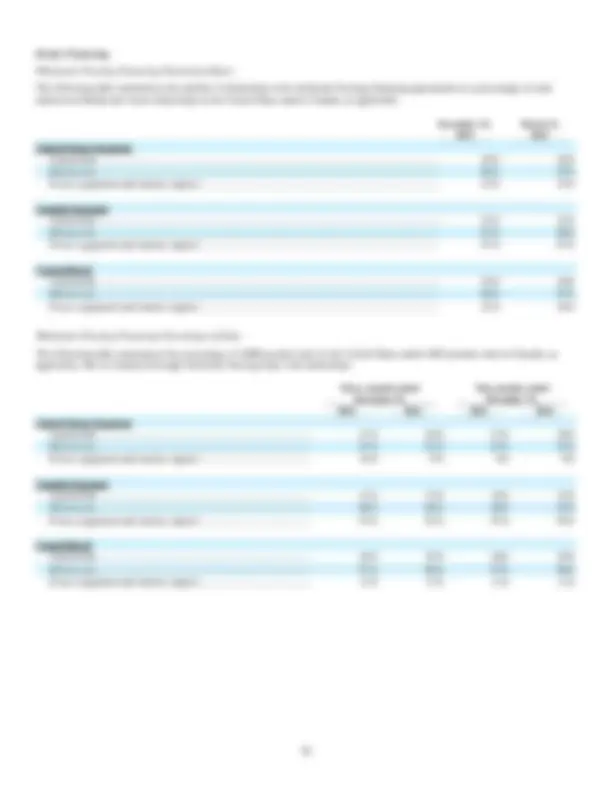

(5) Derivative Instruments

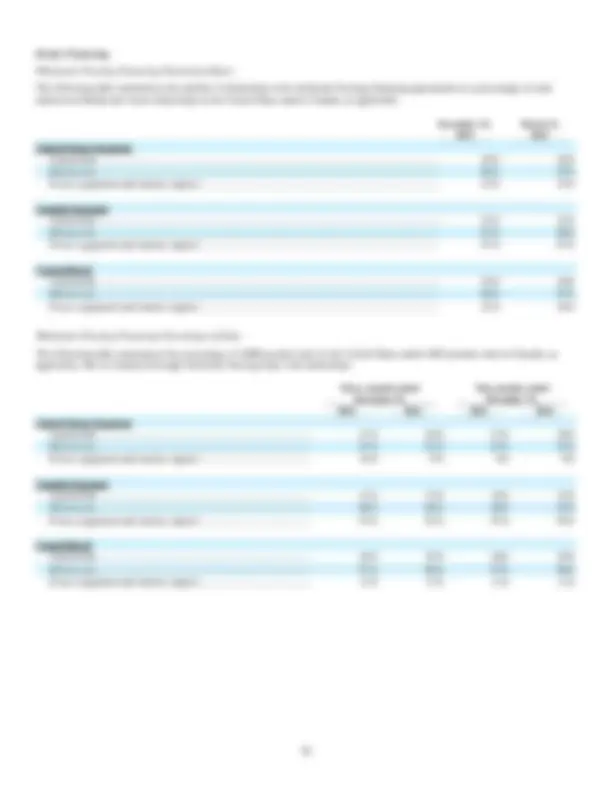

The notional balances and gross fair values of the Company’s derivatives are presented below. The derivative instruments are presented in the Company’s consolidated balance sheets on a gross basis by counterparty. Refer to Note 13 regarding the valuation of derivative instruments.

December 31, 2015 March 31, 2015 Notional Notional balances Assets Liabilities balances Assets Liabilities (U.S. dollars in millions) Interest rate swaps ................................$ 48,571 $ 210 $ 56 $ 49,216 $ 236 $ 115 Cross currency swaps ........................... 2,739 2 188 1,385 1 256 Gross derivative assets/liabilities .... 212 244 237 371 Counterparty netting adjustment .......... (74 ) (74 ) (97 ) (97 ) Net derivative assets/liabilities ........ $ 138 $ 170 $ 140 $ 274

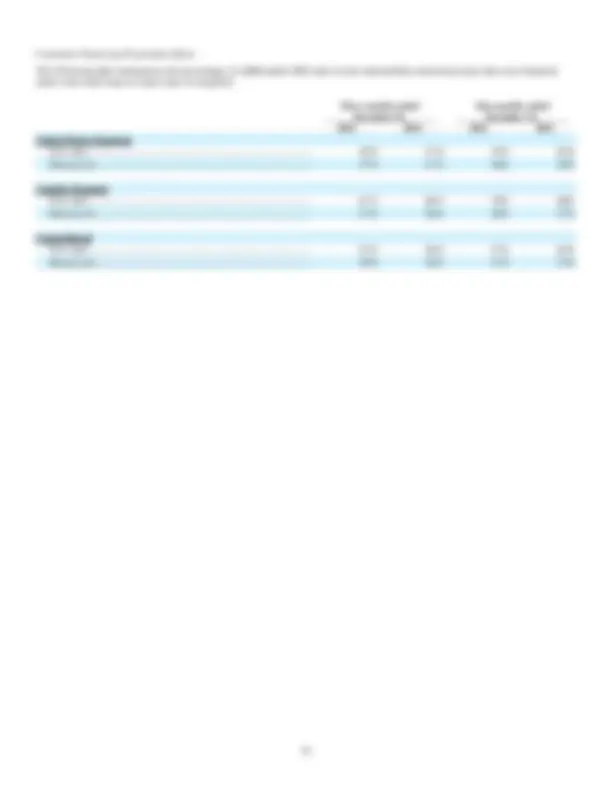

The income statement effect of derivative instruments is presented below. There were no derivative instruments designated as part of a hedge accounting relationship during the periods presented.

Three months ended Nine months ended December 31, December 31, 2015 2014 2015 2014 (U.S. dollars in millions) Interest rate swaps ..................................................................... $ 7 $ 7 $ (21 ) $ 20 Cross currency swaps ................................................................ (72 ) (68 ) (41 ) (213 ) Total loss on derivative instruments..................................... $ (65 ) $ (61 ) $ (62 ) $ (193 )

The fair value of derivative instruments is subject to the fluctuations in market interest rates and foreign currency exchange rates. Since the Company has elected not to apply hedge accounting, the volatility in the changes in fair value of these derivative instruments is recognized in earnings. All settlements of derivative instruments are recognized within cash flows from operating activities in the consolidated statements of cash flows.

These derivative instruments also contain an element of credit risk in the event the counterparties are unable to meet the terms of the agreements. However, the Company minimizes the risk exposure by limiting the counterparties to major financial institutions that meet established credit guidelines. In the event of default, all counterparties are subject to legally enforceable master netting agreements. The Company generally does not require or place collateral for these instruments under credit support agreements.

Notes to Consolidated Financial Statements (Unaudited)

HMC and HCFI are parties to a Keep Well Agreement effective as of September 26, 2005. This Keep Well Agreement provides that HMC will (1) maintain (directly or indirectly) at least 80% ownership in HCFI’s voting stock and not pledge (directly or indirectly), or in any way encumber or otherwise dispose of, any such stock of HCFI that it is required to hold (or permit any of HMC’s subsidiaries to do so), (2) cause HCFI to have a positive consolidated tangible net worth with tangible net worth defined as (a) stockholder’s equity less (b) any intangible assets, determined on a consolidated basis in accordance with generally accepted accounting principles in Canada, and (3) ensure that HCFI has sufficient liquidity to meet its payment obligations for debt HMC has confirmed in writing is covered by this Keep Well Agreement, in accordance with its terms, or where necessary make available to HCFI, or HMC shall procure for HCFI, sufficient funds to enable HCFI to meet such obligations in accordance with such terms. This Keep Well Agreement is not a guarantee by HMC.

Debt programs supported by the Keep Well Agreements consist of the Company’s commercial paper programs, Private MTN Program, Public MTN Program, Euro MTN Programme, and HCFI’s private placement debt. In connection with the above agreements, AHFC and HCFI have entered into separate Support Compensation Agreements, where each has agreed to pay HMC a quarterly fee based on the amount of outstanding debt that benefit from the Keep Well Agreements. Support Compensation Agreement fees are recognized in general and administrative expenses.

Incentive Programs

The Company receives subsidy payments from AHM and HCI, which supplement the revenues on financing products offered under incentive programs. Subsidy payments received on retail loans and leases are deferred and recognized as revenue over the term of the related contracts. The unearned balance is recognized as reductions to the carrying value of finance receivables and investment in operating leases. Subsidy payments on dealer loans are received as earned.

Related Party Debt

AHFC routinely issues short-term notes to AHM to fund AHFC’s general corporate operations. HCFI routinely issues short- term notes to HCI to fund HCFI’s general corporate operations. Interest rates are based on prevailing rates of debt with comparable terms. Refer to Note 4 for additional information.

Vehicle Service Contract (VSC) Administration

AHFC receives fees to perform administrative services for vehicle service contracts issued by AHM and its subsidiary. HCFI receives fees for marketing vehicle service contracts issued by HCI. Unearned VSC administration fees are included in other liabilities (Note 11). VSC administration income is recognized in other income (Note 12).

Shared Services

The Company shares certain common expenditures with AHM, HCI, and related parties including data processing services, software development, and facilities. The allocated costs for shared services are included in general and administrative expenses.

Benefit Plans

The Company participates in various employee benefit plans that are maintained by AHM and HCI. The allocated benefit plan expenses are included in general and administrative expenses.

Income taxes

The Company’s U.S. income taxes are recognized on a modified separate return basis pursuant to an intercompany income tax allocation agreement with AHM. Income tax related items are not included in the tables above. Refer to Note 7 for additional information.

Notes to Consolidated Financial Statements (Unaudited)

Other

The majority of the amounts due from the Parent and affiliated companies at December 31, 2015 and March 31, 2015 related to subsidies. The majority of the amounts due to the Parent and affiliated companies at December 31, 2015 and March 31, 2015 related to wholesale flooring invoices payable to the Parent. These receivable and payable accounts are non-interest-bearing and short-term in nature and are expected to be settled in the normal course of business.

(7) Income Taxes

The Company’s effective tax rate was 38.7% and 45.3% for the three months ended December 31, 2015 and 2014, respectively, and 35.8% and 38.2% for the nine months ended December 31, 2015 and 2014, respectively. The decrease in the effective tax rate for the three and nine months ended December 31, 2015 is due to the relative effect of retroactive U.S. tax law changes, enacted in December 2014 and December 2015, on AHFC’s share of qualified domestic production deduction allocated between the Parent and affiliated companies. Also, there were changes in certain state apportionment methods and tax rates which lowered the effective tax rate.

To date, the Company has not provided for federal income taxes on its share of the undistributed earnings of its foreign subsidiary, HCFI, that are intended to be indefinitely reinvested outside the United States. At December 31, 2015, $685 million of accumulated undistributed earnings of HCFI were deemed to be so reinvested. If these undistributed earnings as of December 31, 2015 were to be distributed, the tax liability associated with these indefinitely reinvested earnings would be $159 million. The Company does not expect to repatriate any undistributed earnings in the foreseeable future.

The Protecting Americans from Tax Hikes Act of 2015, signed into law on December 18, 2015, enacted the tax law that defers the imposition of U.S. taxes on certain foreign active financing income until that income is repatriated to the U.S. as a dividend. AHFC will no longer recognize tax on its share of such income to the extent it is indefinitely reinvested.

The changes in the unrecognized tax benefits for the nine months ended December 31, 2015 were not significant. The Company does not expect any material changes in the amounts of unrecognized tax benefits during the remainder of the fiscal year ending March 31, 2016.

As of December 31, 2015, the Company is subject to examination by U.S. federal and state tax jurisdictions for returns filed for the taxable years ended March 31, 2008 to 2015, with the exception of one state which is subject to examination for returns filed for the taxable years ended March 31, 2001 to 2015. The Company’s Canadian subsidiary, HCFI, is subject to examination for returns filed for the taxable years ended March 31, 2009 to 2015 federally, and returns filed for the taxable years ended March 31, 2008 to 2015 provincially. The Company believes appropriate provision has been made for all outstanding issues for all open years.

(8) Commitments and Contingencies

The Company leases certain premises and equipment on a long-term basis under noncancelable leases. Some of these leases require the Company to pay property taxes, insurance, and other expenses. Lease expense was approximately $3 million for both the three months ended December 31, 2015 and 2014, and approximately $8 million for both the nine months ended December 31, 2015 and 2014.

The Company extends commercial revolving lines of credit to dealerships to support their business activities including facilities refurbishment and general working capital requirements. The amounts borrowed are generally secured by the assets of the borrowing entity. The majority of the lines have annual renewal periods. Maximum commercial revolving lines of credit were $468 million and $476 million as of December 31, 2015 and March 31, 2015, respectively, with $259 million and $261 million used, respectively, as of those dates. The Company also has a commitment to lend a total of $82 million to finance the construction of auto dealerships, of which $56 million has been funded as of December 31, 2015.