Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Worksheet (name, title and date). ❖Record the balances for each General Ledger. Account (Trial Balance). (The first 2 columns order all accounts as debits ...

Typology: Exercises

1 / 19

This page cannot be seen from the preview

Don't miss anything!

The Accounting Cycle

First we have to summarize the General Ledger There are several goals in summarizing the General Ledger:

When does this work occur? End of the fiscal period or accounting period This is usually at the end of the calendar month, but smaller companies may do it less frequently

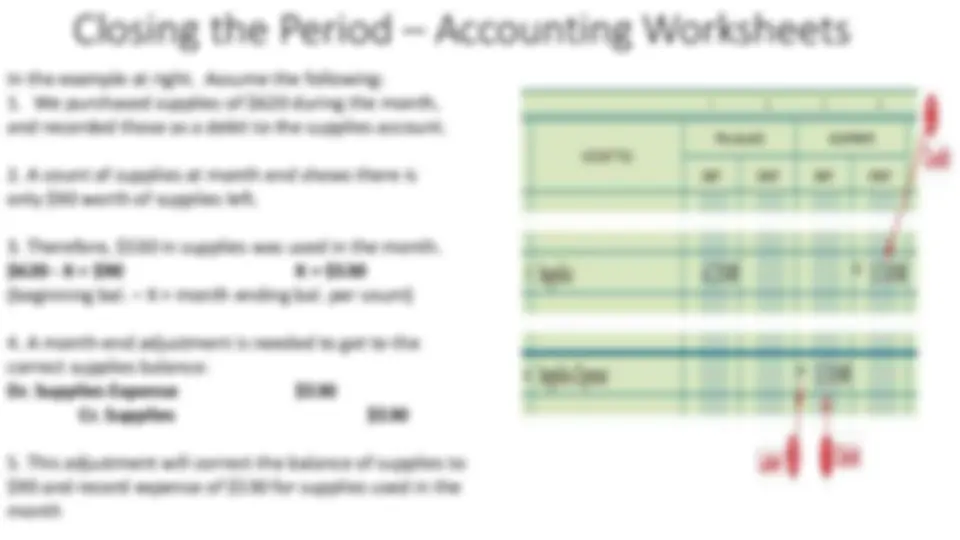

Make period end adjustments (2 columns to make adjustments to selected accounts) Remember: Expenses and income should appear in the period in which they occurred Certain accounts will not be accurate at month, without adjustment See the example for Supplies on the next page.

In the example at right. Assume the following:

Record Net Income or Loss: Notice a few things about what’s been done. After getting the initial totals (step #2) , a Net Income line is added to “settle up” the difference in the two sets of accounts, Balance Sheet and Income Statement (step #3/4). If done properly the new sets of totals for Balance Sheet and Income Statement will be equal (step #6).

The Income Statement There are 3 primary sections of the Income Statement: (Pay attention to how these are displayed.) The top section shows the amount of money taken in for the sale of products and services – Revenue/Sales The middle section shows Expenses incurred to earn those revenues/sales. (The book lists these alphabetically, but most companies list them by order of size or importance.)

Prepare the Trial Balance Columns:

What adjustments do we need and why? Supplies – we bought supplies during the period. What probably happened to some of those supplies (they were used up) Insurance – We bought insurance for the full year. What adjustment should we make (the insurance for the month is no longer of value, its been used up)

Closing out the Income Statement The point of the last step on the previous slide is to increase or decrease owner’s equity by Net Income/Loss – this is the amount we owe to the owner. During the month we record income and expense in their respective accounts; now we are summarizing and moving the net amount to Owner’s Equity.