Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The methods of estimating doubtful accounts expense and the arguments for and against the aging of accounts receivable, percentage of accounts receivable method, and percentage of sales method. It also provides examples and a summary of the methods. The document also discusses the correction in allowance for doubtful accounts and provides a sample problem.

Typology: Lecture notes

1 / 20

This page cannot be seen from the preview

Don't miss anything!

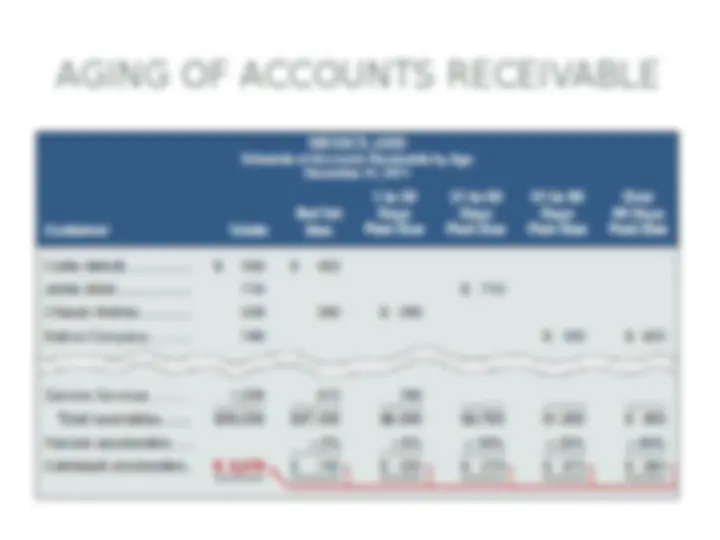

Balance % uncollectible Not due 1,000,000 2% 0-30 days 350,000 5% 31-60 days past due 100,000 15% 61-90 days past due 50,000 20% 91-120 days past due 30,000 50% 1,530, The allowance for doubtful accounts before adjustment is P50,000. Compute for the Allowance for Doubtful accounts and Doubtful accounts expense.

1. Compute the estimate of the **Allowance for Doubtful Accounts.

ABC Co. has an unadjusted balance of allowance for doubtful accounts before adjustment of P82,300. The accounts receivable is P2,500, at the end of the period. Previous periods have shown that 8% of the accounts receivable are uncollectible. Compute for the Allowance for Doubtful accounts and Doubtful accounts expense.

Bad debts expense is computed as follows: Current Period Sales × Bad Debt % = Estimated Bad Debts Expense P

ABC Co. has an unadjusted balance of allowance for doubtful accounts before adjustment of P82,300. The accounts receivable is P2,500,000 at the end of the period. Current month sales is P5,000,000. It is believed that 2% is uncollectible. Compute for the Allowance for Doubtful accounts and Doubtful accounts expense under the percent of sales method.

ABC Co. has an unadjusted balance of allowance for doubtful accounts before adjustment of P82,300. The accounts receivable is P2,500,000 at the end of the period. Current month sales is P5,000,000. It is believed that 2% is uncollectible. Compute for the Allowance for Doubtful accounts and Doubtful accounts expense under the percent of sales method. Allowance for Doubtful Accounts 82,300 Beg. Bal 100,000 DAE (5M X 2%) 182,300 ADA

CORRECTION IN ALLOWANCE FOR DOUBTFUL ACCOUNTS

ABC company uses the percent of sales method in recognizing the doubtful accounts per month. During the month of December, the company was able to generate P10,000,000 credit sales. The bad debt percentage used by the company for recording the expense is .6% of credit sales. The beginning balance of Allowance for doubtful account is P25,000. At the closing of the month, the accountant believed that such estimate for this month’s DAE is not accurate. Thus, an aging of AR was made and showed an amount of P85,. Prepare the necessary adjustment to correct the

DEBIT BALANCE IN ALLOWANCE ACCOUNT

At the beginning of June 2020, the company has a credit balance of P32,000 in its allowance for doubtful accounts. During the month, an account amounting to P64,000 was written off. The company prepared an entry recognizing doubtful accounts expense in the amount of P30,000. At the end of the month, the company discovered that the correct amount that should be presented for ADA is P26,000. What is the journal entry to adjust both the DAE and ADA for the month of June.Allowance for Doubtful Accounts 32,000 Beg. Bal Write-off 64,000 30,000 DAE recognized 28,000 ADJUSTMENT 26,000 Required allowance Doubtful Accounts 28,000. Allow. For Doubtful Accounts 28,000.