Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Accounts receivable and doubtful accounts problem activities

Typology: Exercises

1 / 6

This page cannot be seen from the preview

Don't miss anything!

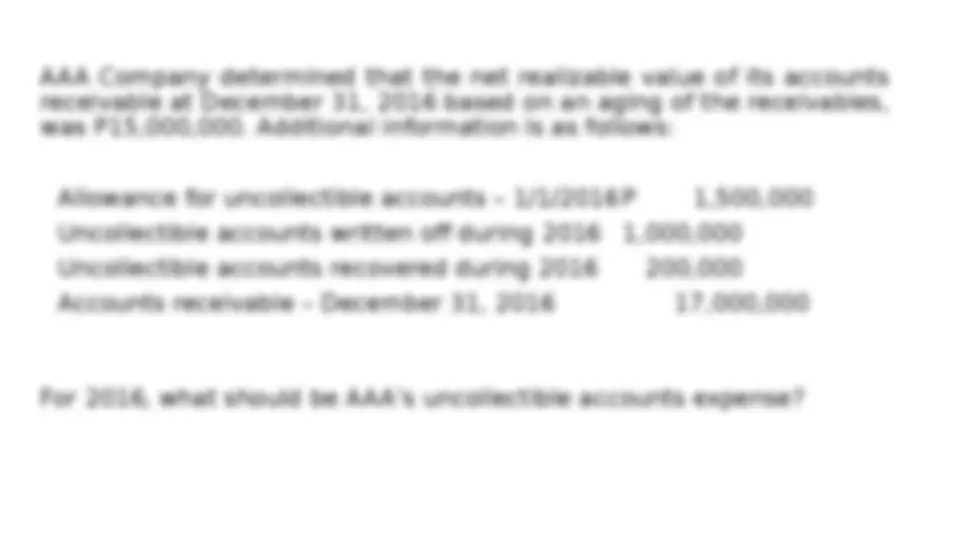

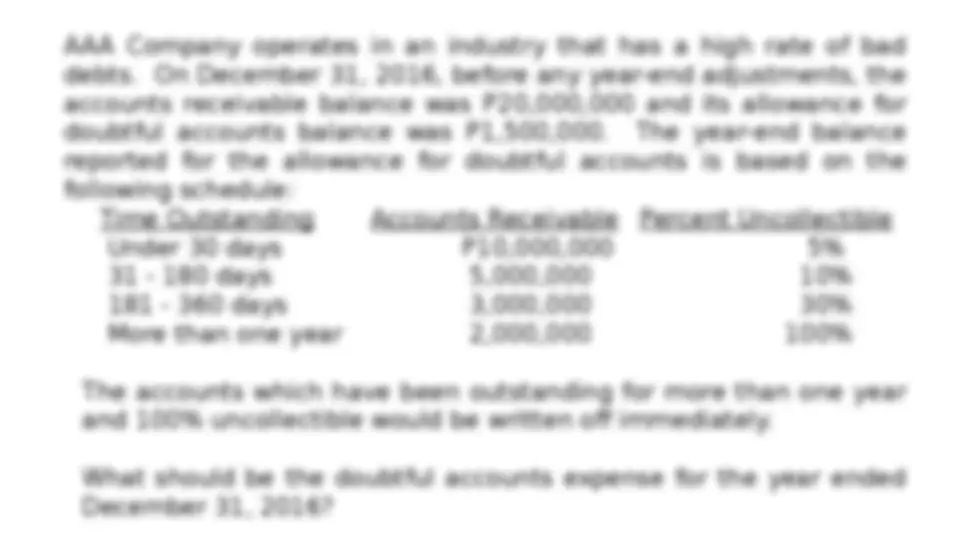

AAA Company operates in an industry that has a high rate of bad debts. On December 31, 2016, before any year-end adjustments, the accounts receivable balance was P20,000,000 and its allowance for doubtful accounts balance was P1,500,000. The year-end balance reported for the allowance for doubtful accounts is based on the following schedule: Time Outstanding Accounts Receivable Percent Uncollectible Under 30 days P10,000,000 5% 31 - 180 days 5,000,000 10% 181 - 360 days 3,000,000 30% More than one year 2,000,000 100% The accounts which have been outstanding for more than one year and 100% uncollectible would be written off immediately. What should be the doubtful accounts expense for the year ended December 31, 2016?

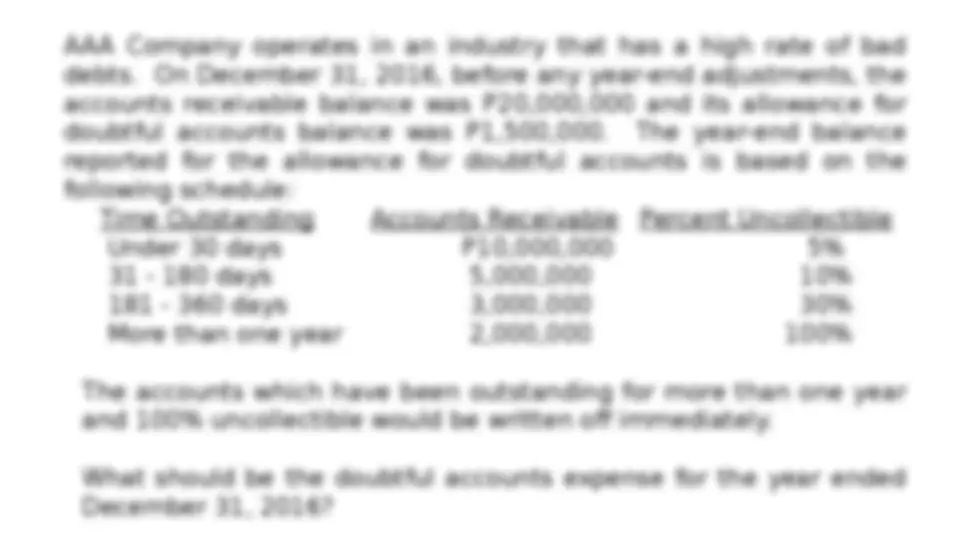

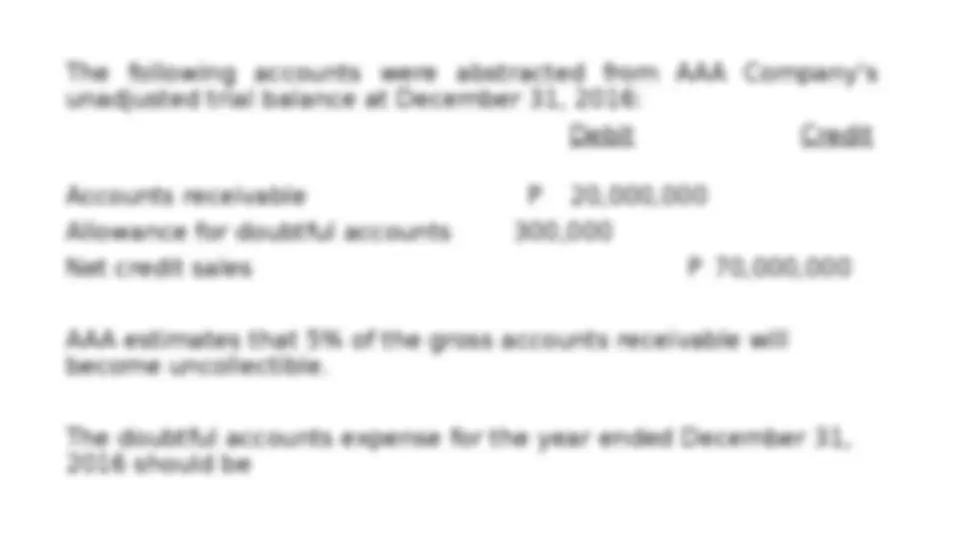

The following accounts were abstracted from AAA Company’s unadjusted trial balance at December 31, 2016: Debit Credit Accounts receivable P 20,000, Allowance for doubtful accounts 300, Net credit sales P 70,000, AAA estimates that 5% of the gross accounts receivable will become uncollectible. The doubtful accounts expense for the year ended December 31, 2016 should be